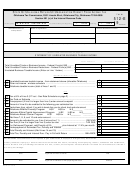

Form 990-Ez - Return Of Organization Exempt From Income Tax - 2012 Page 6

ADVERTISEMENT

efile GRAPHIC

p

rint - DO NOT PROCESS

As Filed Data -

DLN: 93492318021203

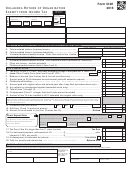

SCHEDULE A

Public Charity Status and Public Support

OMB No 1545-0047

(Form 990 or 990EZ)

2012

Complete if the organization is a section 501(c )(3) organization or a section

Department of the Treasury

4947( a)(1) nonexempt charitable trust.

Internal Revenue Service

Attach to Form 990 or Form 990-EZ .

See separate instructions.

Name of the organization

Employer identification number

Invisible Disabilities Association

1 83-0390659

Reason for Public Charity Status (All organizations must complete this part.) See instructions.

The organi zation is not a private foundation because it is (For lines 1 through 11, check only one box )

1

1

A church, convention of churches, or association of churches described in section 170 ( b)(1)(A)(i).

2

1

A school described in section 170 (b)(1)(A)(ii). (Attach Schedule E )

3

1

A hospital or a cooperative hospital service organization described in section 170(b)(1)(A)(iii).

4

1

A medical research organization operated in conjunction with a hospital described in section 170 (b)(1)(A)(iii). Enter the

hospital's name, city, and state

5

fl

An organization operated for the benefit of a college or university owned or operated by a governmental unit described in

section 170 ( b)(1)(A)(iv ). (Complete Part II )

6

fl

A federal, state, or local government or governmental unit described in section 170 ( b)(1)(A)(v).

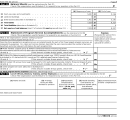

7

F

An organization that normally receives a substantial part of its support from a governmental unit or from the general public

described in section 170 ( b)(1)(A)(vi ). (Complete Part II )

8

1

A community trust described in section 170 ( b)(1)(A)(vi ) (Complete Part II )

9

1

An organization that normally receives (1) more than 331/3% of its support from contributions, membership fees, and gross

receipts from activities related to its exempt functions-subject to certain exceptions, and (2) no more than 331/3% of

its support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses

acquired by the organization after June 30, 1975 See section 509(a)(2). (Complete Part III )

10

fl

An organization organized and operated exclusively to test for public safety See section 509(a)(4).

11

1

An organization organized and operated exclusively for the benefit of, to perform the functions of, or to carry out the purposes of

one or more publicly supported organizations described in section 509 ( a)(1) or section 509(a )( 2) See section 509 ( a)(3). Check

the box that describes the type of supporting organization and complete lines Ile through 11 h

a

fl Type I

b

1 Type II

c

fl Type III - Functionally integrated

d

(- Type III - Non - functionally integrated

e

(-

By checking this box, I certify that the organization is not controlled directly or indirectly by one or more disqualified persons

other than foundation managers and other than one or more publicly supported organizations described in section 509(a)(1 ) or

section 509(a)(2)

f

If the organization received a written determination from the IRS that it is a Type I, Type II, orType III supporting organization,

check this box

(-

g

Since August 17, 2006, has the organization accepted any gift or contribution from any of the

following persons?

(i) A person who directly or indirectly controls , either alone or together with persons described in (ii)

Yes

No

and (iii) below, the governing body of the supported organization?

11g(i)

(ii) A family member of a person described in (i) above?

11g(ii)

(iii) A 35% controlled entity of a person described in (i) or (ii) above?

11g(iii)

h

Provide the following information about the supported organization(s)

(i) Name of

(ii) EIN

(iii) Type of

(iv) Is the

(v) Did you notify

(vi) Is the

(vii) Amount of

supported

organization

organization in

the organization

organization in

monetary

organization

(described on

col (i) listed in

in col (i) of your

col (i) organized

support

lines 1- 9 above

your governing

support?

in the U S ?

or IRC section

document?

(see

instructions))

Yes

No

Yes

No

Yes

No

Total

For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990EZ .

Cat No 11285F

ScheduleA(Form 990 or 990-EZ)2012

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15