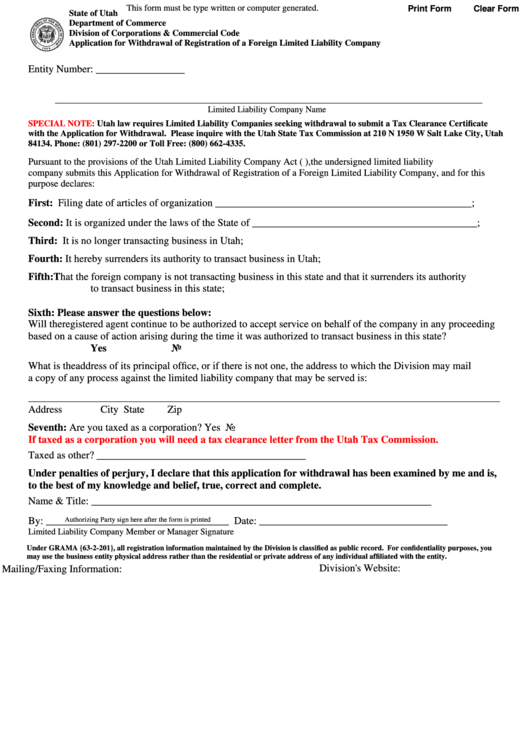

This form must be type written or computer generated.

Print Form

Clear Form

State of Utah

Department of Commerce

Division of Corporations & Commercial Code

Application for Withdrawal of Registration of a Foreign Limited Liability Company

Entity Number: _________________

__________________________________________________________________________________________________

Limited Liability Company Name

SPECIAL NOTE:

Utah law requires Limited Liability Companies seeking withdrawal to submit a Tax Clearance Certificate

with the Application for Withdrawal. Please inquire with the Utah State Tax Commission at 210 N 1950 W Salt Lake City, Utah

84134. Phone: (801) 297-2200 or Toll Free: (800) 662-4335.

Pursuant to the provisions of the Utah Limited Liability Company Act (U.C.A. 48-2c-1611), the undersigned limited liability

company submits this Application for Withdrawal of Registration of a Foreign Limited Liability Company, and for this

purpose declares:

First:

Filing date of articles of organization _________________________________________________;

Second:

It is organized under the laws of the State of ___________________________________________;

Third:

It is no longer transacting business in Utah;

Fourth:

It hereby surrenders its authority to transact business in Utah;

Fifth:

That the foreign company is not transacting business in this state and that it surrenders its authority

to transact business in this state;

Sixth:

Please answer the questions below:

Will the registered agent continue to be authorized to accept service on behalf of the company in any proceeding

based on a cause of action arising during the time it was authorized to transact business in this state?

Yes

No

What is the address of its principal office, or if there is not one, the address to which the Division may mail

a copy of any process against the limited liability company that may be served is:

____________________________________________________________________________

Address

City

State

Zip

Seventh:

Are you taxed as a corporation?

Yes

No

If taxed as a corporation you will need a tax clearance letter from the Utah Tax Commission.

Taxed as other? ________________________________________

Under penalties of perjury, I declare that this application for withdrawal has been examined by me and is,

to the best of my knowledge and belief, true, correct and complete.

Name & Title: _________________________________________________________________

By: ___________________________________

Authorizing Party sign here after the form is printed

Date: ____________________________________

Limited Liability Company Member or Manager Signature

Under GRAMA {63-2-201}, all registration information maintained by the Division is classified as public record. For confidentiality purposes, you

may use the business entity physical address rather than the residential or private address of any individual affiliated with the entity.

Division's Website:

Mailing/Faxing Information:

1

1