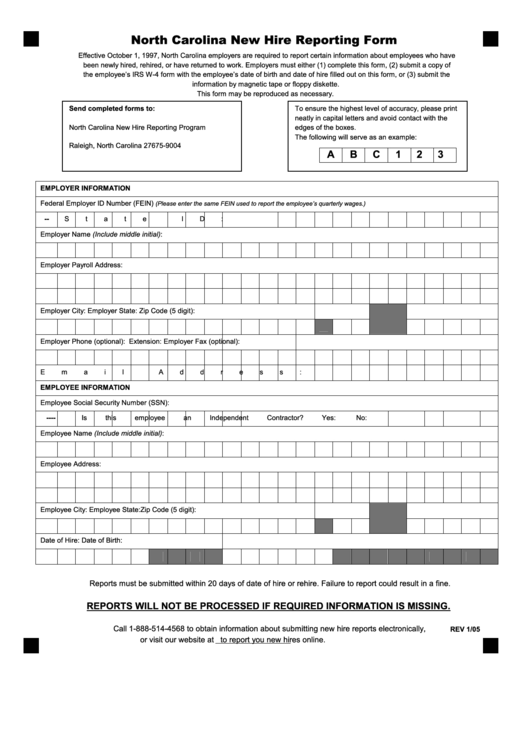

North Carolina New Hire Reporting Form

ADVERTISEMENT

North Carolina New Hire Reporting Form

Effective October 1, 1997, North Carolina employers are required to report certain information about employees who have

been newly hired, rehired, or have returned to work. Employers must either (1) complete this form, (2) submit a copy of

the employee’s IRS W-4 form with the employee’s date of birth and date of hire filled out on this form, or (3) submit the

information by magnetic tape or floppy diskette.

This form may be reproduced as necessary.

Send completed forms to:

To ensure the highest level of accuracy, please print

neatly in capital letters and avoid contact with the

North Carolina New Hire Reporting Program

edges of the boxes.

P.O. Box 900004

The following will serve as an example:

Raleigh, North Carolina 27675-9004

A

B

C

1

2

3

EMPLOYER INFORMATION

Federal Employer ID Number (FEIN)

(Please enter the same FEIN used to report the employee’s quarterly wages.)

--

State ID:

Employer Name (Include middle initial):

Employer Payroll Address:

Employer City:

Employer State:

Zip Code (5 digit):

Employer Phone (optional):

Extension:

Employer Fax (optional):

Email Address:

EMPLOYEE INFORMATION

Employee Social Security Number (SSN):

--

--

Is this employee an Independent Contractor?

Yes:

No:

Employee Name (Include middle initial):

Employee Address:

Employee City:

Employee State:

Zip Code (5 digit):

Date of Hire:

Date of Birth:

Reports must be submitted within 20 days of date of hire or rehire. Failure to report could result in a fine.

REPORTS WILL NOT BE PROCESSED IF REQUIRED INFORMATION IS MISSING.

Call 1-888-514-4568 to obtain information about submitting new hire reports electronically,

REV 1/05

or visit our website at to report you new hires online.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1