Reset Form

Print and Reset Form

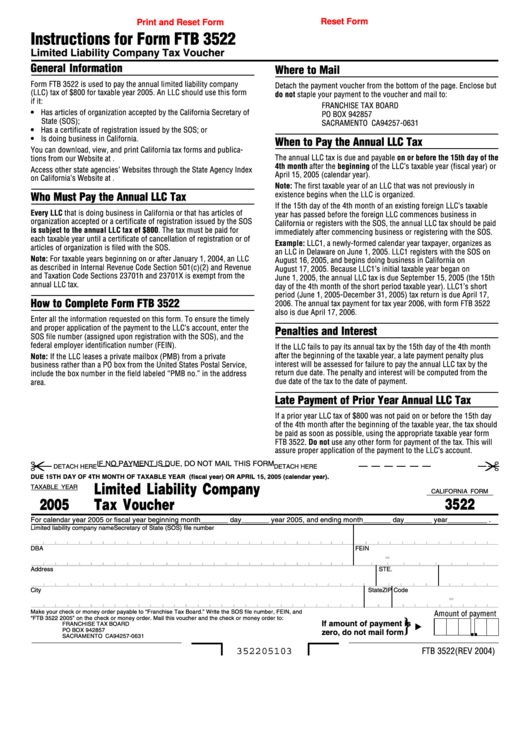

Instructions for Form FTB 3522

Limited Liability Company Tax Voucher

General Information

Where to Mail

Form FTB 3522 is used to pay the annual limited liability company

Detach the payment voucher from the bottom of the page. Enclose but

(LLC) tax of $800 for taxable year 2005. An LLC should use this form

do not staple your payment to the voucher and mail to:

if it:

FRANCHISE TAX BOARD

• Has articles of organization accepted by the California Secretary of

PO BOX 942857

State (SOS);

SACRAMENTO CA 94257-0631

• Has a certificate of registration issued by the SOS; or

• Is doing business in California.

When to Pay the Annual LLC Tax

You can download, view, and print California tax forms and publica-

The annual LLC tax is due and payable on or before the 15th day of the

tions from our Website at

4th month after the beginning of the LLC’s taxable year (fiscal year) or

Access other state agencies’ Websites through the State Agency Index

April 15, 2005 (calendar year).

on California’s Website at

Note: The first taxable year of an LLC that was not previously in

existence begins when the LLC is organized.

Who Must Pay the Annual LLC Tax

If the 15th day of the 4th month of an existing foreign LLC’s taxable

Every LLC that is doing business in California or that has articles of

year has passed before the foreign LLC commences business in

organization accepted or a certificate of registration issued by the SOS

California or registers with the SOS, the annual LLC tax should be paid

is subject to the annual LLC tax of $800. The tax must be paid for

immediately after commencing business or registering with the SOS.

each taxable year until a certificate of cancellation of registration or of

Example: LLC1, a newly-formed calendar year taxpayer, organizes as

articles of organization is filed with the SOS.

an LLC in Delaware on June 1, 2005. LLC1 registers with the SOS on

Note: For taxable years beginning on or after January 1, 2004, an LLC

August 16, 2005, and begins doing business in California on

as described in Internal Revenue Code Section 501(c)(2) and Revenue

August 17, 2005. Because LLC1’s initial taxable year began on

and Taxation Code Sections 23701h and 23701X is exempt from the

June 1, 2005, the annual LLC tax is due September 15, 2005 (the 15th

annual LLC tax.

day of the 4th month of the short period taxable year). LLC1’s short

period (June 1, 2005-December 31, 2005) tax return is due April 17,

How to Complete Form FTB 3522

2006. The annual tax payment for tax year 2006, with form FTB 3522

also is due April 17, 2006.

Enter all the information requested on this form. To ensure the timely

and proper application of the payment to the LLC’s account, enter the

Penalties and Interest

SOS file number (assigned upon registration with the SOS), and the

federal employer identification number (FEIN).

If the LLC fails to pay its annual tax by the 15th day of the 4th month

after the beginning of the taxable year, a late payment penalty plus

Note: If the LLC leases a private mailbox (PMB) from a private

interest will be assessed for failure to pay the annual LLC tax by the

business rather than a PO box from the United States Postal Service,

return due date. The penalty and interest will be computed from the

include the box number in the field labeled “PMB no.” in the address

due date of the tax to the date of payment.

area.

Late Payment of Prior Year Annual LLC Tax

If a prior year LLC tax of $800 was not paid on or before the 15th day

of the 4th month after the beginning of the taxable year, the tax should

be paid as soon as possible, using the appropriate taxable year form

FTB 3522. Do not use any other form for payment of the tax. This will

assure proper application of the payment to the LLC’s account.

¤

§

IF NO PAYMENT IS DUE, DO NOT MAIL THIS FORM

DETACH HERE

DETACH HERE

DUE 15TH DAY OF 4TH MONTH OF TAXABLE YEAR (fiscal year) OR APRIL 15, 2005 (calendar year).

Limited Liability Company

TAXABLE YEAR

CALIFORNIA FORM

2005

Tax Voucher

3522

For calendar year 2005 or fiscal year beginning month_______ day_______ year 2005, and ending month_______ day_______ year__________ .

Limited liability company name

Secretary of State (SOS) file number

DBA

FEIN

-

Address

STE. no.

PMB no.

City

State

ZIP Code

-

Make your check or money order payable to “Franchise Tax Board.” Write the SOS file number, FEIN, and

Amount of payment

“FTB 3522 2005” on the check or money order. Mail this voucher and the check or money order to:

}

If amount of payment is

FRANCHISE TAX BOARD

PO BOX 942857

. . . . .

zero, do not mail form

SACRAMENTO CA 94257-0631

352205103

FTB 3522 (REV 2004)

1

1