Instructions For Form 480.80 - Fiduciary Income Tax Return (Estate Or Trust)

ADVERTISEMENT

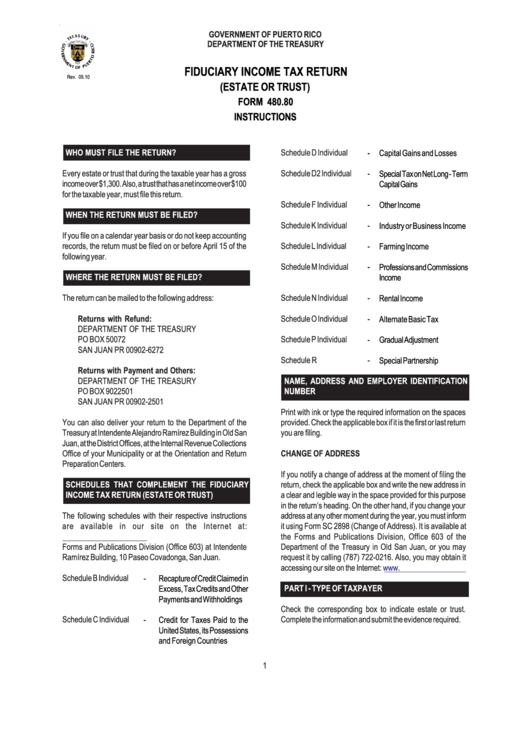

GOVERNMENT OF PUERTO RICO

DEPARTMENT OF THE TREASURY

FIDUCIARY INCOME TAX RETURN

Rev. 05.10

(ESTATE OR TRUST)

FORM 480.80

INSTRUCTIONS

WHO MUST FILE THE RETURN?

Schedule D Individual

-

Capital Gains and Losses

Every estate or trust that during the taxable year has a gross

Schedule D2 Individual

-

Special Tax on Net Long - Term

income over $1,300. Also, a trust that has a net income over $100

Capital Gains

for the taxable year, must file this return.

Schedule F Individual

-

Other Income

WHEN THE RETURN MUST BE FILED?

Schedule K Individual

-

Industry or Business Income

If you file on a calendar year basis or do not keep accounting

records, the return must be filed on or before April 15 of the

Schedule L Individual

-

Farming Income

following year.

Schedule M Individual

-

Professions and Commissions

WHERE THE RETURN MUST BE FILED?

Income

The return can be mailed to the following address:

Schedule N Individual

-

Rental Income

Returns with Refund:

Schedule O Individual

-

Alternate Basic Tax

DEPARTMENT OF THE TREASURY

PO BOX 50072

Schedule P Individual

-

Gradual Adjustment

SAN JUAN PR 00902-6272

Schedule R

-

Special Partnership

Returns with Payment and Others:

DEPARTMENT OF THE TREASURY

NAME, ADDRESS AND EMPLOYER IDENTIFICATION

PO BOX 9022501

NUMBER

SAN JUAN PR 00902-2501

Print with ink or type the required information on the spaces

You can also deliver your return to the Department of the

provided. Check the applicable box if it is the first or last return

Treasury at Intendente Alejandro Ramírez Building in Old San

you are filing.

Juan, at the District Offices, at the Internal Revenue Collections

Office of your Municipality or at the Orientation and Return

CHANGE OF ADDRESS

Preparation Centers.

If you notify a change of address at the moment of filing the

SCHEDULES THAT COMPLEMENT THE FIDUCIARY

return, check the applicable box and write the new address in

INCOME TAX RETURN (ESTATE OR TRUST)

a clear and legible way in the space provided for this purpose

in the return’s heading. On the other hand, if you change your

The following schedules with their respective instructions

address at any other moment during the year, you must inform

are available in our site on the Internet at:

it using Form SC 2898 (Change of Address). It is available at

. They are also available at the

the Forms and Publications Division, Office 603 of the

Forms and Publications Division (Office 603) at Intendente

Department of the Treasury in Old San Juan, or you may

Ramírez Building, 10 Paseo Covadonga, San Juan.

request it by calling (787) 722-0216. Also, you may obtain it

accessing our site on the Internet: .

Schedule B Individual

-

Recapture of Credit Claimed in

PART I - TYPE OF TAXPAYER

Excess, Tax Credits and Other

Payments and Withholdings

Check the corresponding box to indicate estate or trust.

Schedule C Individual

Complete the information and submit the evidence required.

-

Credit for Taxes Paid to the

United States, its Possessions

and Foreign Countries

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4