th

19 East 34

Street

New York, NY 10016

(212) 592-1800

(800) 223-6602

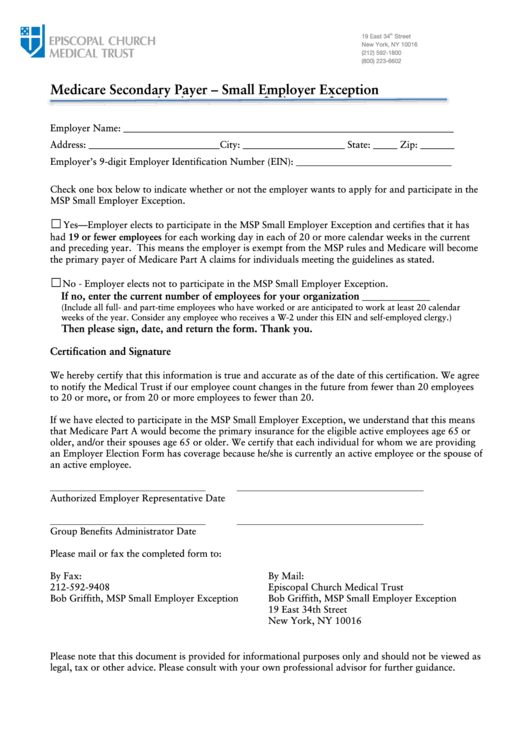

Medicare Secondary Payer – Small Employer Exception

Employer Name: ____________________________________________________________________

Address: ___________________________City: _____________________ State: _____ Zip: _______

Employer’s 9-digit Employer Identification Number (EIN): ________________________________

Check one box below to indicate whether or not the employer wants to apply for and participate in the

MSP Small Employer Exception.

Yes—Employer elects to participate in the MSP Small Employer Exception and certifies that it has

☐

had 19 or fewer employees for each working day in each of 20 or more calendar weeks in the current

and preceding year. This means the employer is exempt from the MSP rules and Medicare will become

the primary payer of Medicare Part A claims for individuals meeting the guidelines as stated.

No - Employer elects not to participate in the MSP Small Employer Exception.

☐

If no, enter the current number of employees for your organization

______________

(Include all full- and part-time employees who have worked or are anticipated to work at least 20 calendar

weeks of the year. Consider any employee who receives a W-2 under this EIN and self-employed clergy.)

Then please sign, date, and return the form. Thank you.

Certification and Signature

We hereby certify that this information is true and accurate as of the date of this certification. We agree

to notify the Medical Trust if our employee count changes in the future from fewer than 20 employees

to 20 or more, or from 20 or more employees to fewer than 20.

If we have elected to participate in the MSP Small Employer Exception, we understand that this means

that Medicare Part A would become the primary insurance for the eligible active employees age 65 or

older, and/or their spouses age 65 or older. We certify that each individual for whom we are providing

an Employer Election Form has coverage because he/she is currently an active employee or the spouse of

an active employee.

Authorized Employer Representative

Date

Group Benefits Administrator

Date

Please mail or fax the completed form to:

By Fax:

By Mail:

Episcopal Church Medical Trust

212-592-9408

Bob Griffith, MSP Small Employer Exception

Bob Griffith, MSP Small Employer Exception

19 East 34th Street

New York, NY 10016

Please note that this document is provided for informational purposes only and should not be viewed as

legal, tax or other advice. Please consult with your own professional advisor for further guidance.

1

1