Form Tc-941r - Utah Annual Mineral Production Withholding Reconciliation - Utah State Tax Commission

ADVERTISEMENT

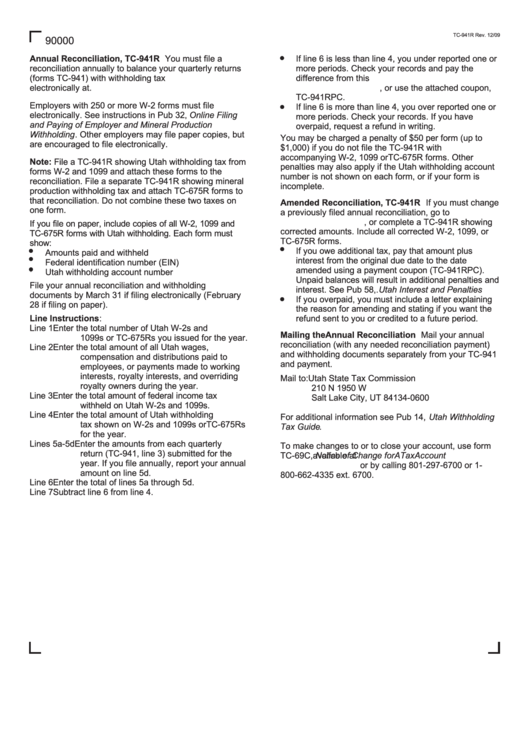

TC-941R Rev. 12/09

90000

Annual Reconciliation, TC-941R

You must file a

If line 6 is less than line 4, you under reported one or

reconciliation annually to balance your quarterly returns

more periods. Check your records and pay the

(forms TC-941) with withholding tax paid. You may file

difference from this line. You may pay online at

electronically at

taxexpress.utah.gov

.

taxexpress.utah.gov

, or use the attached coupon,

TC-941RPC.

Employers with 250 or more W-2 forms must file

If line 6 is more than line 4, you over reported one or

electronically. See instructions in Pub 32,

Online Filing

more periods. Check your records. If you have

and Paying of Employer and Mineral Production

overpaid, request a refund in writing.

Withholding

. Other employers may file paper copies, but

You may be charged a penalty of $50 per form (up to

are encouraged to file electronically.

$1,000) if you do not file the TC-941R with

accompanying W-2, 1099 or TC-675R forms. Other

Note:

File a TC-941R showing Utah withholding tax from

penalties may also apply if the Utah withholding account

forms W-2 and 1099 and attach these forms to the

number is not shown on each form, or if your form is

reconciliation. File a separate TC-941R showing mineral

incomplete.

production withholding tax and attach TC-675R forms to

that reconciliation. Do not combine these two taxes on

If you must change

Amended Reconciliation, TC-941R

one form.

a previously filed annual reconciliation, go to

taxexpress.utah.gov

, or complete a TC-941R showing

If you file on paper, include copies of all W-2, 1099 and

corrected amounts. Include all corrected W-2, 1099, or

TC-675R forms with Utah withholding. Each form must

TC-675R forms.

show:

If you owe additional tax, pay that amount plus

Amounts paid and withheld

interest from the original due date to the date

Federal identification number (EIN)

amended using a payment coupon (TC-941RPC).

Utah withholding account number

Unpaid balances will result in additional penalties and

File your annual reconciliation and withholding

interest. See Pub 58,

Utah Interest and Penalties

.

documents by March 31 if filing electronically (February

If you overpaid, you must include a letter explaining

28 if filing on paper).

the reason for amending and stating if you want the

Line Instructions

:

refund sent to you or credited to a future period.

Line 1

Enter the total number of Utah W-2s and

Mailing the Annual Reconciliation

Mail your annual

1099s or TC-675Rs you issued for the year.

reconciliation (with any needed reconciliation payment)

Line 2

Enter the total amount of all Utah wages,

and withholding documents separately from your TC-941

compensation and distributions paid to

and payment.

employees, or payments made to working

interests, royalty interests, and overriding

Mail to: Utah State Tax Commission

royalty owners during the year.

210 N 1950 W

Line 3

Enter the total amount of federal income tax

Salt Lake City, UT 84134-0600

withheld on Utah W-2s and 1099s.

Line 4

Enter the total amount of Utah withholding

For additional information see Pub 14,

Utah Withholding

tax shown on W-2s and 1099s or TC-675Rs

Tax Guide

.

for the year.

Lines 5a-5d Enter the amounts from each quarterly

To make changes to or to close your account, use form

return (TC-941, line 3) submitted for the

TC-69C,

Notice of Change for A Tax Account

available at

year. If you file annually, report your annual

or by calling 801-297-6700 or 1-

tax.utah.gov/forms

amount on line 5d.

800-662-4335 ext. 6700.

Line 6

Enter the total of lines 5a through 5d.

Line 7

Subtract line 6 from line 4.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1