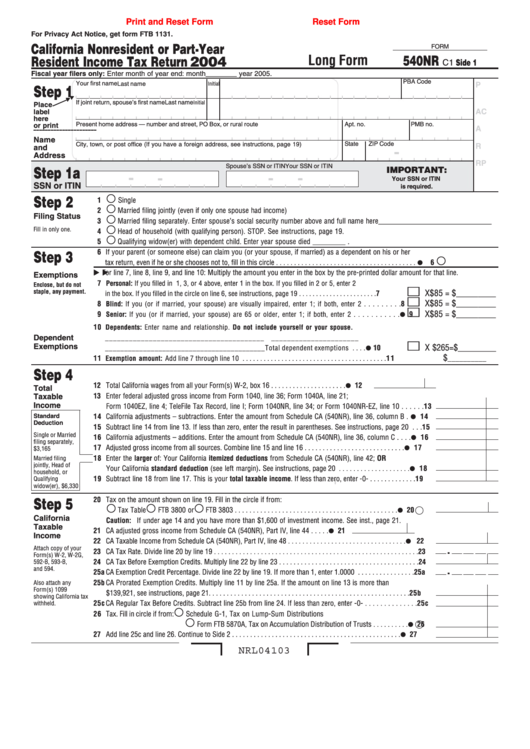

Print and Reset Form

Reset Form

For Privacy Act Notice, get form FTB 1131.

California Nonresident or Part-Year

FORM

Long Form

540NR

Resident Income Tax Return 2004

C1 Side 1

Fiscal year filers only: Enter month of year end: month________ year 2005.

PBA Code

Your first name

Initial

Last name

P

Step 1

If joint return, spouse’s first name

Last name

Initial

Place

AC

label

here

Present home address — number and street, PO Box, or rural route

Apt. no.

PMB no.

or print

___________

___________

___________

___________

___________

A

Name

City, town, or post office (If you have a foreign address, see instructions, page 19)

State

ZIP Code

R

and

-

Address

RP

Your SSN or ITIN

Spouse’s SSN or ITIN

IMPORTANT:

Step 1a

-

-

-

-

Your SSN or ITIN

SSN or ITIN

is required.

Step 2

1

Single

2

Married filing jointly (even if only one spouse had income)

Filing Status

3

Married filing separately. Enter spouse’s social security number above and full name here _______________________________

Fill in only one.

4

Head of household (with qualifying person). STOP. See instructions, page 19.

5

Qualifying widow(er) with dependent child. Enter year spouse died _________ .

6 If your parent (or someone else) can claim you (or your spouse, if married) as a dependent on his or her

Step 3

¼

tax return, even if he or she chooses not to, fill in this circle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the pre-printed dollar amount for that line.

Exemptions

7

Personal: If you filled in 1, 3, or 4 above, enter 1 in the box. If you filled in 2 or 5, enter 2

Enclose, but do not

staple, any payment.

X $85 = $_________

7

in the box. If you filled in the circle on line 6, see instructions, page 19 . . . . . . . . . . . . . . . . . . . . . . .

X $85 = $_________

8

8

Blind: If you (or if married, your spouse) are visually impaired, enter 1; if both, enter 2 . . . . . . . . .

¼

X $85 = $_________

9

Senior: If you (or if married, your spouse) are 65 or older, enter 1; if both, enter 2 . . . . . . . . . . .

9

10

Dependents: Enter name and relationship. Do not include yourself or your spouse.

Dependent

____________________

____________________

______________________

¼

Exemptions

X $265= $_________

_____________________

_____________________ Total dependent exemptions . . . .

10

$

11

1 1

__________

Exemption amount: Add line 7 through line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Step 4

¼

12 Total California wages from all your Form(s) W-2, box 16 . . . . . . . . . . . . . . . . . . . . .

12

Total

13 Enter federal adjusted gross income from Form 1040, line 36; Form 1040A, line 21;

Taxable

Income

Form 1040EZ, line 4; TeleFile Tax Record, line I; Form 1040NR, line 34; or Form 1040NR-EZ, line 10 . . . . . . 13

¼

Standard

14 California adjustments – subtractions. Enter the amount from Schedule CA (540NR), line 36, column B .

14

Deduction

15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses. See instructions, page 20 . . . 15

¼

Single or Married

16 California adjustments – additions. Enter the amount from Schedule CA (540NR), line 36, column C . . . .

16

filing separately,

¼

17 Adjusted gross income from all sources. Combine line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

$3,165

18 Enter the larger of: Your California itemized deductions from Schedule CA (540NR), line 42; OR

Married filing

¼

jointly, Head of

Your California standard deduction (see left margin). See instructions, page 20 . . . . . . . . . . . . . . . . . . . .

18

household, or

19 Subtract line 18 from line 17. This is your total taxable income. If less than zero, enter -0- . . . . . . . . . . . . . 19

Qualifying

widow(er), $6,330

20 Tax on the amount shown on line 19. Fill in the circle if from:

Step 5

¼

Tax Table

FTB 3800 or

FTB 3803 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20

California

Caution: If under age 14 and you have more than $1,600 of investment income. See inst., page 21.

Taxable

¼

21 CA adjusted gross income from Schedule CA (540NR), Part IV, line 44 . . . . .

21

Income

¼

22 CA Taxable Income from Schedule CA (540NR), Part IV, line 48 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

Attach copy of your

.

23 CA Tax Rate. Divide line 20 by line 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Form(s) W-2, W-2G,

24 CA Tax Before Exemption Credits. Multiply line 22 by line 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

592-B, 593-B,

and 594.

25a CA Exemption Credit Percentage. Divide line 22 by line 19. If more than 1, enter 1.0000 . . . . . . . . . . . . . . . . 25a

.

25b CA Prorated Exemption Credits. Multiply line 11 by line 25a. If the amount on line 13 is more than

Also attach any

Form(s) 1099

$139,921, see instructions, page 21. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25b

showing California tax

25c CA Regular Tax Before Credits. Subtract line 25b from line 24. If less than zero, enter -0- . . . . . . . . . . . . . . 25c

withheld.

26 Tax. Fill in circle if from:

Schedule G-1, Tax on Lump-Sum Distributions

¼

Form FTB 5870A, Tax on Accumulation Distribution of Trusts . . . . . . . . . .

26

¼

27 Add line 25c and line 26. Continue to Side 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27

NRL04103

1

1 2

2