Form Cdi Fs-008 - Medi-Cal Managed Care Plan Insurance Tax Return - State Of California

ADVERTISEMENT

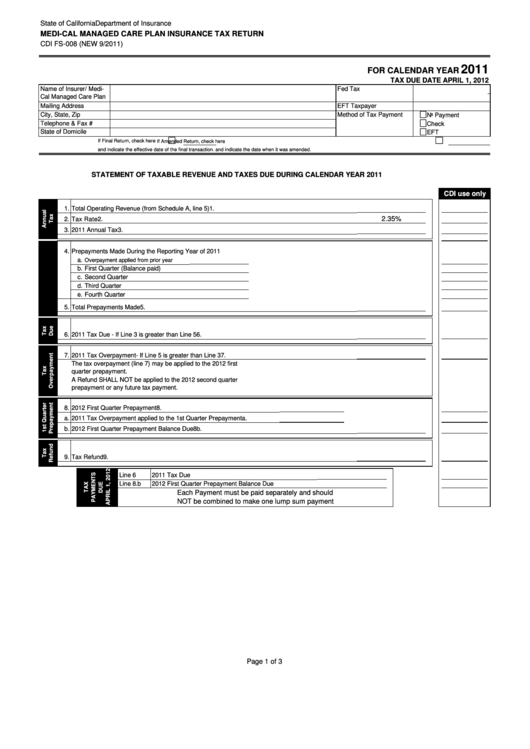

State of California

Department of Insurance

MEDI-CAL MANAGED CARE PLAN INSURANCE TAX RETURN

CDI FS-008 (NEW 9/2011)

2011

FOR CALENDAR YEAR

TAX DUE DATE APRIL 1, 2012

Name of Insurer/ Medi-

Fed Tax I.D. No.

CA Perm No.

Cal Managed Care Plan

Mailing Address

EFT Taxpayer I.D. No.

City, State, Zip

Method of Tax Payment

No Payment

Telephone & Fax #

Check

State of Domicile

EFT

If Final Return, check here

If Amended Return, check here

and indicate the effective date of the final transaction.

and indicate the date when it was amended.

STATEMENT OF TAXABLE REVENUE AND TAXES DUE DURING CALENDAR YEAR 2011

CDI use only

1.

Total Operating Revenue (from Schedule A, line 5)

1.

2.35%

2.

Tax Rate

2.

3.

2011 Annual Tax

3.

4.

Prepayments Made During the Reporting Year of 2011

a.

Overpayment applied from prior year

b.

First Quarter (Balance paid)

c.

Second Quarter

d.

Third Quarter

e.

Fourth Quarter

5.

Total Prepayments Made

5.

6.

2011 Tax Due - If Line 3 is greater than Line 5

6.

7.

2011 Tax Overpayment- If Line 5 is greater than Line 3

7.

The tax overpayment (line 7) may be applied to the 2012 first

quarter prepayment.

A Refund SHALL NOT be applied to the 2012 second quarter

prepayment or any future tax payment.

8.

2012 First Quarter Prepayment

8.

a.

2011 Tax Overpayment applied to the 1st Quarter Prepayment

a.

b.

2012 First Quarter Prepayment Balance Due

8b.

9.

Tax Refund

9.

Line 6

2011 Tax Due

Line 8.b

2012 First Quarter Prepayment Balance Due

Each Payment must be paid separately and should

NOT be combined to make one lump sum payment

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3