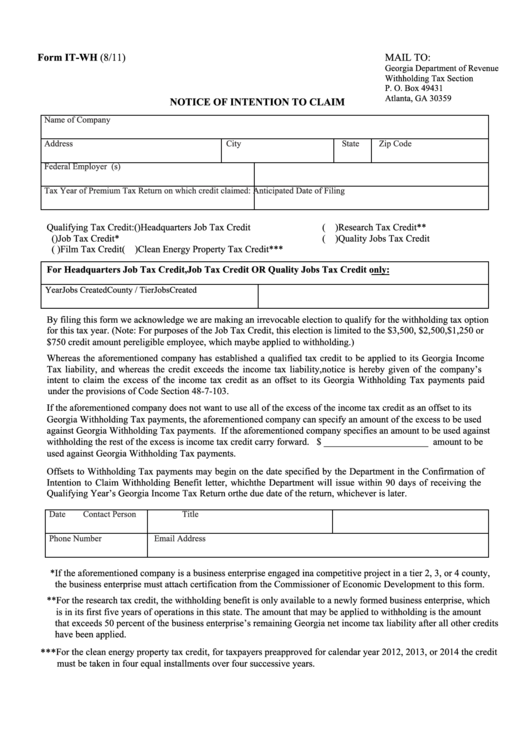

Form IT-WH (8/11)

MAIL TO:

Print

Clear

Georgia Department of Revenue

Withholding Tax Section

P. O. Box 49431

Atlanta, GA 30359

NOTICE OF INTENTION TO CLAIM

Name of Company

Address

City

State

Zip Code

Federal Employer I.D.

Georgia Withholding I.D. (s)

Tax Year of Premium Tax Return on which credit claimed:

Anticipated Date of Filing

Qualifying Tax Credit:

( ) Headquarters Job Tax Credit

( ) Research Tax Credit**

( ) Job Tax Credit*

( ) Quality Jobs Tax Credit

( ) Film Tax Credit

( ) Clean Energy Property Tax Credit***

For Headquarters Job Tax Credit, Job Tax Credit OR Quality Jobs Tax Credit only:

Year Jobs Created

County / Ti er Jobs Created

By filing this form we acknowledge we are making an irrevocable election to qualify for the withholding tax option

for this tax year. (Note: For purposes of the Job Tax Credit, this election is limited to the $3,500, $2,500, $1,250 or

$750 credit amount per eligible employee, which may be applied to withholding.)

Whereas the aforementioned company has established a qualified tax credit to be applied to its Georgia Income

Tax liability, and whereas the credit exceeds the income tax liability, notice is hereby given of the company’s

intent to claim the excess of the income tax credit as an offset to its Georgia Withholding Tax payments paid

under the provisions of Code Section 48-7-103.

If the aforementioned company does not want to use all of the excess of the income tax credit as an offset to its

Georgia Withholding Tax payments, the aforementioned company can specify an amount of the excess to be used

against Georgia Withholding Tax payments. If the aforementioned company specifies an amount to be used against

withholding the rest of the excess is income tax credit carry forward. $ ______________________ amount to be

used against Georgia Withholding Tax payments.

Offsets to Withholding Tax payments may begin on the date specified by the Department in the Confirmation of

Intention to Claim Withholding Benefit letter, which the Department will issue within 90 days of receiving the

Qualifying Year’s Georgia Income Tax Return or the due date of the return, whichever is later.

Date

Contact Person

Title

Phone Number

Email Address

*If the aforementioned company is a business enterprise engaged in a competitive project in a tier 2, 3, or 4 county,

the business enterprise must attach certification from the Commissioner of Economic Development to this form.

**For the research tax credit, the withholding benefit is only available to a newly formed business enterprise, which

is in its first five years of operations in this state. The amount that may be applied to withholding is the amount

that exceeds 50 percent of the business enterprise’s remaining Georgia net income tax liability after all other credits

have been applied.

***

For the clean energy property tax credit, for taxpayers preapproved for calendar year 2012, 2013, or 2014 the credit

must be taken in four equal installments over four successive years.

1

1