RESET FORM

UIA 1027

Authorized by

(Rev. 05-16)

MCL 421.1, et seq.

State of Michigan

BUSINESS TRANSFEROR’S NOTICE

DEPARTMENT OF TALENT AND ECONOMIC DEVELOPMENT

TALENT INVESTMENT AGENCY

TO TRANSFEREE OF UNEMPLOYMENT

Unemployment Insurance

TAX LIABILITY AND RATE

Roger Curtis

Wanda M. Stokes

Director

Director

Regardless of any agreement between the parties to the transfer,

• cumulative benefit charges for the most recent five years,

the Michigan Employment Security (MES) Act provides that

• a listing of all individuals currently employed by the

when a business is sold (or otherwise transferred), the buyer

transferor, and

(or other transferee) of the business may be liable to pay the

• a listing of all employees separated from employment with

unpaid unemployment taxes and interest, and may receive the

the transferor in the most recent 12 months.

unemployment tax rate, penalty, and the benefit charges of the

This obligation extends to the transferor’s real estate broker,

seller (or other transferor).*

other agent, or attorney.

The law requires the transferor of a business, or the transferor’s real

The information submitted on this form must be current as of the

estate broker or other agent or attorney, to complete and deliver

date it is signed. However, this form may be given to a prospective

this form to the transferee of the business. Section 15(g) of the

transferee within 90 days of the date it was signed; the form must

MES Act requires the seller (or other transferee) of the business at

be delivered to the prospective transferee not less than two calendar

least two calendar days (not including Saturday, Sunday, or legal

days before the transferor’s acceptance of the offer.

holiday) before the transferor’s acceptance of the transferee’s offer

Failure of the business transferor or transferor’s agent to provide

to acquire the business to disclose:

correct information is a misdemeanor, punishable by up to 90 days

• the transferee’s outstanding unemployment tax liability,

imprisonment and/or fine of up to $2,500.00. Civil liability for

• unreported unemployment tax liability,

consecutive damages may also apply, as well as other remedies

• the tax payments,

provided by law.

• tax rates,

*In general, a person or business that acquires the organization, trade, business, or 75percent or more of the assets of a business will be liable for

unemployment taxes and interest due the Unemployment Insurance (UI) from the seller (or other transferor) of the business at the time of the transfer,

up to the reasonable value of the business minus any secured interest in assets.

1.

Provide a list of the names, addresses, and Social Security numbers of all your employees as of the date you or your agent or attorney

signs this form. This will give the transferee the potential number of individuals for whom unemployment tax must be paid, and of

the potential number of claimants for unemployment benefits.

2.

Provide a list of the names, addresses, and Social Security numbers of all your employees separated from employment for any

reason in the most recent 12 months prior to the date this form is signed. This will give the transferee the potential current charges

to their account.

3.

(a) What is the amount of unemployment taxes you have reported to the Unemployment Insurance (UI) as owing, but have not yet

paid? ____________________________

(b) What is the interest you owe the UI on this account? __________________________

4.

(a) Which quarterly unemployment tax reports (give calendar quarters and calendar years) are unfiled with the UI? (Ex: 1/2016)

(b) How much do you owe in unemployment taxes for these unfiled quarters? (The UI may assess interest and penalties on

this amount. Interest accrues at 1.0 percent per month, not to exceed 50percent.) _______________________

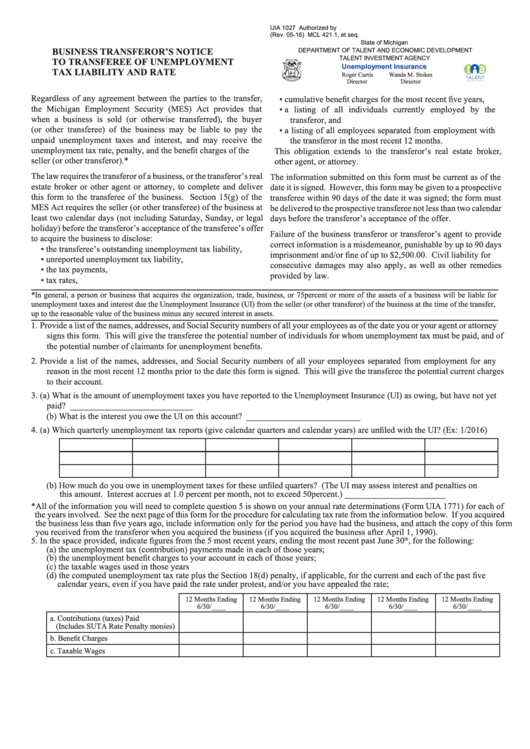

*All of the information you will need to complete question 5 is shown on your annual rate determinations (Form UIA 1771) for each of

the years involved. See the next page of this form for the procedure for calculating tax rate from the information below. If you acquired

the business less than five years ago, include information only for the period you have had the business, and attach the copy of this form

you received from the transferor when you acquired the business (if you acquired the business after April 1, 1990).

5.

In the space provided, indicate figures from the 5 most recent years, ending the most recent past June 30

, for the following:

th

(a) the unemployment tax (contribution) payments made in each of those years;

(b) the unemployment benefit charges to your account in each of those years;

(c) the taxable wages used in those years

(d) the computed unemployment tax rate plus the Section 18(d) penalty, if applicable, for the current and each of the past five

calendar years, even if you have paid the rate under protest, and/or you have appealed the rate;

12 Months Ending

12 Months Ending

12 Months Ending

12 Months Ending

12 Months Ending

6/30/____

6/30/____

6/30/____

6/30/____

6/30/____

a. Contributions (taxes) Paid

(Includes SUTA Rate Penalty monies)

b. Benefit Charges

c. Taxable Wages

1

1 2

2