Form 314 - Annual Premium Tax Statement - Hawaii Department Of Commerce - 2008

ADVERTISEMENT

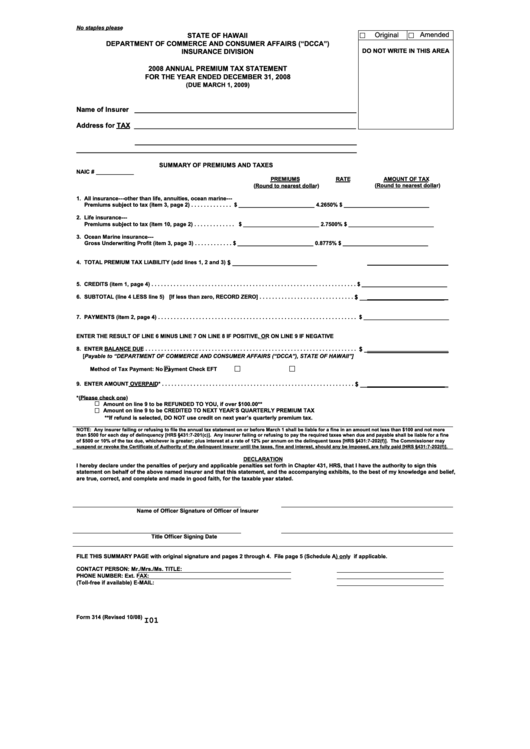

No staples please

Original

Amended

STATE OF HAWAII

DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS (“DCCA”)

DO NOT WRITE IN THIS AREA

INSURANCE DIVISION

2008 ANNUAL PREMIUM TAX STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2008

(DUE MARCH 1, 2009)

Name of Insurer _________________________________________________________

Address for TAX _________________________________________________________

_________________________________________________________

________________________________________________________________________

SUMMARY OF PREMIUMS AND TAXES

NAIC # ____________

PREMIUMS

RATE

AMOUNT OF TAX

(Round to nearest dollar)

(Round to nearest dollar)

1. All insurance---other than life, annuities, ocean marine---

Premiums subject to tax (item 3, page 2) . . . . . . . . . . . . .

$ ________________________

4.2650%

$ ___________________________

2. Life insurance---

Premiums subject to tax (item 10, page 2) . . . . . . . . . . . . .

$ ________________________

2.7500%

$ ___________________________

3. Ocean Marine insurance---

Gross Underwriting Profit (item 3, page 3) . . . . . . . . . . . .

$ ________________________

0.8775%

$ ___________________________

4. TOTAL PREMIUM TAX LIABILITY (add lines 1, 2 and 3)

$ ________________________

5. CREDITS (item 1, page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________________________

6. SUBTOTAL (line 4 LESS line 5) [If less than zero, RECORD ZERO] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ________________________

7. PAYMENTS (item 2, page 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ___________________________

ENTER THE RESULT OF LINE 6 MINUS LINE 7 ON LINE 8 IF POSITIVE, OR ON LINE 9 IF NEGATIVE

8. ENTER BALANCE DUE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ________________________

[Payable to “DEPARTMENT OF COMMERCE AND CONSUMER AFFAIRS (“DCCA”), STATE OF HAWAII”]

Method of Tax Payment:

No Payment

Check

EFT

9. ENTER AMOUNT OVERPAID* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$ ________________________

*(Please check one)

Amount on line 9 to be REFUNDED TO YOU, if over $100.00**

Amount on line 9 to be CREDITED TO NEXT YEAR’S QUARTERLY PREMIUM TAX

**If refund is selected, DO NOT use credit on next year’s quarterly premium tax.

NOTE: Any insurer failing or refusing to file the annual tax statement on or before March 1 shall be liable for a fine in an amount not less than $100 and not more

than $500 for each day of delinquency [HRS §431:7-201(c)]. Any insurer failing or refusing to pay the required taxes when due and payable shall be liable for a fine

of $500 or 10% of the tax due, whichever is greater; plus interest at a rate of 12% per annum on the delinquent taxes [HRS §431:7-202(f)]. The Commissioner may

suspend or revoke the Certificate of Authority of the delinquent insurer until the taxes, fine and interest, should any be imposed, are fully paid [HRS §431:7-202(f)].

DECLARATION

I hereby declare under the penalties of perjury and applicable penalties set forth in Chapter 431, HRS, that I have the authority to sign this

statement on behalf of the above named insurer and that this statement, and the accompanying exhibits, to the best of my knowledge and belief,

are true, correct, and complete and made in good faith, for the taxable year stated.

Name of Officer

Signature of Officer of Insurer

Title

Officer Signing Date

FILE THIS SUMMARY PAGE with original signature and pages 2 through 4. File page 5 (Schedule A) only if applicable.

CONTACT PERSON:

Mr./Mrs./Ms.

TITLE:

PHONE NUMBER:

Ext.

FAX:

(Toll-free if available)

E-MAIL:

I01

Form 314 (Revised 10/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5