Instructions For Wisconsin Form 1x - Wisconsin Department Of Revenue - 2010

ADVERTISEMENT

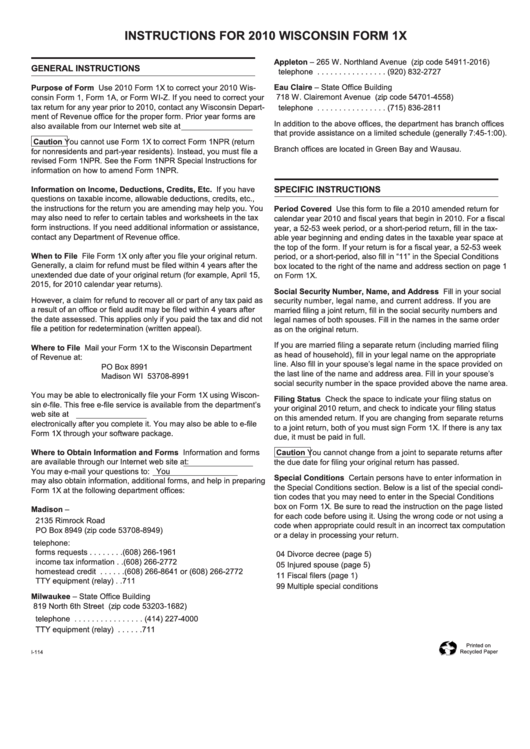

INSTRUCTIONS FOR 2010 WISCONSIN FORM 1X

Appleton – 265 W. Northland Avenue (zip code 54911‑2016)

GENERAL INSTRUCTIONS

telephone . . . . . . . . . . . . . . . . (920) 832‑2727

Eau Claire – State Office Building

Purpose of Form Use 2010 Form 1X to correct your 2010 Wis‑

718 W. Clairemont Avenue (zip code 54701‑4558)

consin Form 1, Form 1A, or Form WI‑Z. If you need to correct your

tax return for any year prior to 2010, contact any Wisconsin Depart‑

telephone . . . . . . . . . . . . . . . . (715) 836‑2811

ment of Revenue office for the proper form. Prior year forms are

In addition to the above offices, the department has branch offices

also available from our Internet web site at

that provide assistance on a limited schedule (generally 7:45‑1:00).

Caution You cannot use Form 1X to correct Form 1NPR (return

Branch offices are located in Green Bay and Wausau.

for nonresidents and part‑year residents). Instead, you must file a

revised Form 1NPR. See the Form 1NPR Special Instructions for

information on how to amend Form 1NPR.

Information on Income, Deductions, Credits, Etc. If you have

SPECIFIC INSTRUCTIONS

questions on taxable income, allowable deductions, credits, etc.,

the instructions for the return you are amending may help you. You

Period Covered Use this form to file a 2010 amended return for

may also need to refer to certain tables and worksheets in the tax

calendar year 2010 and fiscal years that begin in 2010. For a fiscal

form instructions. If you need additional information or assistance,

year, a 52‑53 week period, or a short‑period return, fill in the tax‑

contact any Department of Revenue office.

able year beginning and ending dates in the taxable year space at

the top of the form. If your return is for a fiscal year, a 52‑53 week

When to File File Form 1X only after you file your original return.

period, or a short‑period, also fill in “11” in the Special Conditions

Generally, a claim for refund must be filed within 4 years after the

box located to the right of the name and address section on page 1

unextended due date of your original return (for example, April 15,

on Form 1X.

2015, for 2010 calendar year returns).

Social Security Number, Name, and Address Fill in your social

However, a claim for refund to recover all or part of any tax paid as

security number, legal name, and current address. If you are

a result of an office or field audit may be filed within 4 years after

married filing a joint return, fill in the social security numbers and

the date assessed. This applies only if you paid the tax and did not

legal names of both spouses. Fill in the names in the same order

file a petition for redetermination (written appeal).

as on the original return.

If you are married filing a separate return (including married filing

Where to File Mail your Form 1X to the Wisconsin Department

as head of household), fill in your legal name on the appropriate

of Revenue at:

line. Also fill in your spouse’s legal name in the space provided on

PO Box 8991

the last line of the name and address area. Fill in your spouse’s

Madison WI 53708‑8991

social security number in the space provided above the name area.

You may be able to electronically file your Form 1X using Wiscon‑

Filing Status Check the space to indicate your filing status on

e

sin

‑file. This free e‑file service is available from the department’s

your original 2010 return, and check to indicate your filing status

web site at Your form can be submitted

on this amended return. If you are changing from separate returns

electronically after you complete it. You may also be able to e‑file

to a joint return, both of you must sign Form 1X. If there is any tax

Form 1X through your software package.

due, it must be paid in full.

Where to Obtain Information and Forms Information and forms

Caution You cannot change from a joint to separate returns after

are available through our Internet web site at:

the due date for filing your original return has passed.

You may e‑mail your questions to: income@revenue.wi.gov. You

Special Conditions Certain persons have to enter information in

may also obtain information, additional forms, and help in preparing

the Special Conditions section. Below is a list of the special condi‑

Form 1X at the following department offices:

tion codes that you may need to enter in the Special Conditions

box on Form 1X. Be sure to read the instruction on the page listed

Madison –

for each code before using it. Using the wrong code or not using a

2135 Rimrock Road

code when appropriate could result in an incorrect tax computation

PO Box 8949 (zip code 53708‑8949)

or a delay in processing your return.

telephone:

forms requests . . . . . . . . (608) 266‑1961

04 Divorce decree (page 5)

income tax information . . (608) 266‑2772

05 Injured spouse (page 5)

homestead credit . . . . . . (608) 266‑8641 or (608) 266‑2772

11 Fiscal filers (page 1)

TTY equipment (relay) . . 711

99 Multiple special conditions

Milwaukee – State Office Building

819 North 6th Street (zip code 53203‑1682)

telephone . . . . . . . . . . . . . . . . (414) 227‑4000

TTY equipment (relay) . . . . . . 711

Printed on

Recycled Paper

I‑114

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16