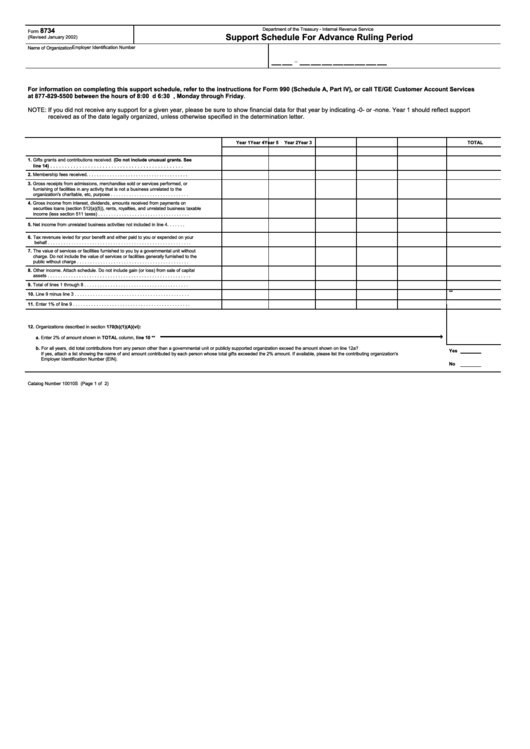

8734

Department of the Treasury - Internal Revenue Service

Form

Support Schedule For Advance Ruling Period

(Revised January 2002)

Employer Identification Number

Name of Organization

_

For information on completing this support schedule, refer to the instructions for Form 990 (Schedule A, Part IV), or call TE/GE Customer Account Services

at 877-829-5500 between the hours of 8:00 a.m. and 6:30 p.m. Eastern Time, Monday through Friday.

NOTE: If you did not receive any support for a given year, please be sure to show financial data for that year by indicating -0- or -none. Year 1 should reflect support

received as of the date legally organized, unless otherwise specified in the determination letter.

Year 1

Year 2

Year 3

Year 4

Year 5

TOTAL

1. Gifts grants and contributions received. (Do not include unusual grants. See

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

line 14)

2. Membership fees received. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Gross receipts from admissions, merchandise sold or services performed, or

furnishing of facilities in any activity that is not a business unrelated to the

organization's charitable, etc, purpose . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Gross income from interest, dividends, amounts received from payments on

securities loans (section 512(a)(5)), rents, royalties, and unrelated business taxable

income (less section 511 taxes) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Net income from unrelated business activities not included in line 4. . . . . . .

6. Tax revenues levied for your benefit and either paid to you or expended on your

behalf . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. The value of services or facilities furnished to you by a governmental unit without

charge. Do not include the value of services or facilities generally furnished to the

public without charge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Other income. Attach schedule. Do not include gain (or loss) from sale of capital

assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Total of lines 1 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

**

10. Line 9 minus line 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11. Enter 1% of line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Organizations described in section 170(b)(1)(A)(vi):

Ú

a. Enter 2% of amount shown in TOTAL column, line 10 **

b. For all years, did total contributions from any person other than a governmental unit or publicly supported organization exceed the amount shown on line 12a?

Yes

If yes, attach a list showing the name of and amount contributed by each person whose total gifts exceeded the 2% amount. If available, please list the contributing organization's

Employer Identification Number (EIN).

No

Catalog Number 10010S (Page 1 of 2)

1

1 2

2