Reset Form

Print Form

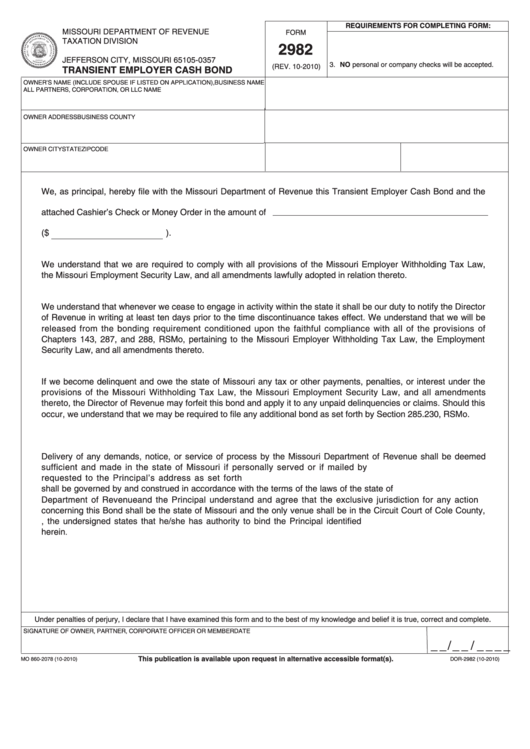

REQUIREMENTS FOR COMPLETING FORM:

MISSOURI DEPARTMENT OF REVENUE

FORM

TAXATION DIVISION

1. Form must be properly completed.

2982

P.O. BOX 357

2. Signed by applicant.

JEFFERSON CITY, MISSOURI 65105-0357

3. NO personal or company checks will be accepted.

(REV. 10-2010)

TRANSIENT EMPLOYER CASH BOND

OWNER’S NAME (INCLUDE SPOUSE IF LISTED ON APPLICATION),

BUSINESS NAME

ALL PARTNERS, CORPORATION, OR LLC NAME

OWNER ADDRESS

BUSINESS COUNTY

OWNER CITY

STATE

ZIP CODE

We, as principal, hereby file with the Missouri Department of Revenue this Transient Employer Cash Bond and the

attached Cashier’s Check or Money Order in the amount of

($

).

We understand that we are required to comply with all provisions of the Missouri Employer Withholding Tax Law,

the Missouri Employment Security Law, and all amendments lawfully adopted in relation thereto.

We understand that whenever we cease to engage in activity within the state it shall be our duty to notify the Director

of Revenue in writing at least ten days prior to the time discontinuance takes effect. We understand that we will be

released from the bonding requirement conditioned upon the faithful compliance with all of the provisions of

Chapters 143, 287, and 288, RSMo, pertaining to the Missouri Employer Withholding Tax Law, the Employment

Security Law, and all amendments thereto.

If we become delinquent and owe the state of Missouri any tax or other payments, penalties, or interest under the

provisions of the Missouri Withholding Tax Law, the Missouri Employment Security Law, and all amendments

thereto, the Director of Revenue may forfeit this bond and apply it to any unpaid delinquencies or claims. Should this

occur, we understand that we may be required to file any additional bond as set forth by Section 285.230, RSMo.

Delivery of any demands, notice, or service of process by the Missouri Department of Revenue shall be deemed

sufficient and made in the state of Missouri if personally served or if mailed by U.S. mail with return receipt

requested to the Principal’s address as set forth above. This Bond and any legal action pertaining thereto

shall be governed by and construed in accordance with the terms of the laws of the state of Missouri. The Missouri

Department of Revenue and the Principal understand and agree that the exclusive jurisdiction for any action

concerning this Bond shall be the state of Missouri and the only venue shall be in the Circuit Court of Cole County,

Missouri. By signing this Bond, the undersigned states that he/she has authority to bind the Principal identified

herein

.

.

Under penalties of perjury, I declare that I have examined this form and to the best of my knowledge and belief it is true, correct and complete

SIGNATURE OF OWNER, PARTNER, CORPORATE OFFICER OR MEMBER

DATE

_ _ /_ _ /_ _ _ _

This publication is available upon request in alternative accessible format(s).

MO 860-2078 (10-2010)

DOR-2982 (10-2010)

1

1