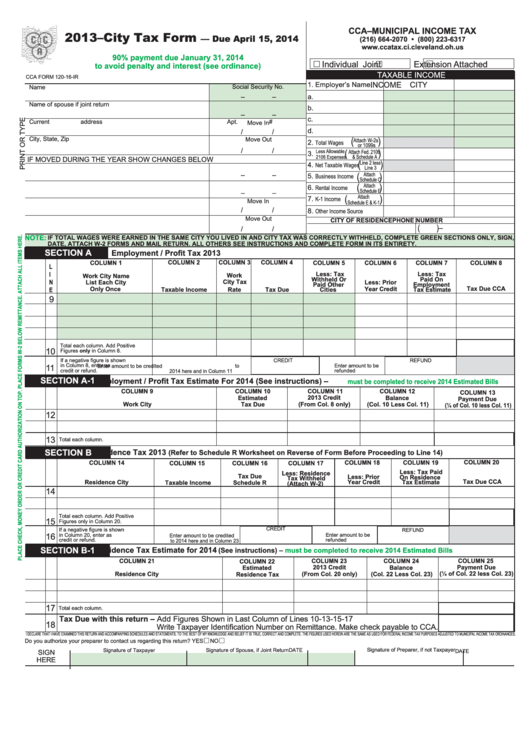

Cca Form 120-16-Ir - City Tax Form - Cleveland - 2013

ADVERTISEMENT

CCA–MUNICIPAL INCOME TAX

2013–City Tax Form

‡

— Due April 15, 2014

ZZZFFDWD[FLFOHYHODQGRKXV

SD\PHQW GXH -DQXDU\

WR DYRLG SHQDOW\ DQG LQWHUHVW

VHH RUGLQDQFH

Individual

Joint

Extension Attached

TAXABLE INCOME

CCA FORM 120-16-IR

1. Employer’s Name

CITY

INCOME

Social Security No.

Name

–

–

a.

Name of spouse if joint return

b.

–

–

c.

Current address

Apt. #

Move In

d.

/

/

City, State, Zip

Move Out

(

)

Attach W-2s

2.

Total Wages

or 1099s

/

/

Less Allowable

(

)

Attach Fed. 2106

3.

2106 Expenses

& Schedule A

IF MOVED DURING THE YEAR SHOW CHANGES BELOW

(

Line 2 less

)

4.

Net Taxable Wages

Line 3

–

–

Attach

(

)

5.

Business Income

Schedule C

(

Attach

)

6.

Rental Income

Schedule E

–

–

Attach

(

)

7.

K-1 Income

Move In

Schedule E & K-1

/

/

8.

Other Income Source

Move Out

CITY OF RESIDENCE

PHONE NUMBER

(

)

–

/

/

NOTE:

IF TOTAL WAGES WERE EARNED IN THE SAME CITY YOU LIVED IN AND CITY TAX WAS CORRECTLY WITHHELD, COMPLETE GREEN SECTIONS ONLY, SIGN,

DATE, ATTACH W-2 FORMS AND MAIL RETURN. ALL OTHERS SEE INSTRUCTIONS AND COMPLETE FORM IN ITS ENTIRETY.

SECTION A

(PSOR\PHQW 3UR¿W 7D[

COLUMN 2

COLUMN 3

COLUMN 4

COLUMN 1

COLUMN 5

COLUMN 6

COLUMN 7

&2/801

L

I

/HVV

7D[

/HVV

7D[

:RUN

:RUN &LW\ 1DPH

:LWKKHOG 2U

3DLG 2Q

N

&LW\ 7D[

/LVW (DFK &LW\

/HVV

3ULRU

3DLG 2WKHU

(PSOR\PHQW

2QO\ 2QFH

<HDU &UHGLW

7D[ 'XH &&$

E

7D[DEOH ,QFRPH

Rate

7D[ 'XH

Cities

7D[ (VWLPDWH

9

Total each column. Add Positive

Figures RQO\ in Column 8.

10

,I D QHJDWLYH ¿JXUH LV VKRZQ

CREDIT

REFUND

in Column 8, enter as

Enter amount to be credited to

Enter amount to be

11

credit or refund.

refunded

2014 here and in Column 11

SECTION A-1

(PSOR\PHQW 3UR¿W 7D[ (VWLPDWH )RU

6HH LQVWUXFWLRQV

±

PXVW EH FRPSOHWHG WR UHFHLYH (VWLPDWHG %LOOV

COLUMN 9

COLUMN 11

COLUMN 10

COLUMN 12

COLUMN 13

(VWLPDWHG

&UHGLW

%DODQFH

3D\PHQW 'XH

:RUN &LW\

7D[ 'XH

)URP &RO RQO\

&RO /HVV &RO

ó RI &RO OHVV &RO

12

13

Total each column.

SECTION B

5HVLGHQFH 7D[

5HIHU WR 6FKHGXOH 5 :RUNVKHHW RQ 5HYHUVH RI )RUP %HIRUH 3URFHHGLQJ WR /LQH

COLUMN 20

COLUMN 14

&2/801

COLUMN 19

COLUMN 15

COLUMN 16

COLUMN 17

/HVV

7D[ 3DLG

/HVV

5HVLGHQFH

7D[ 'XH

/HVV

3ULRU

2Q 5HVLGHQFH

7D[ :LWKKHOG

<HDU &UHGLW

7D[ 'XH &&$

5HVLGHQFH &LW\

7D[ (VWLPDWH

7D[DEOH ,QFRPH

6FKHGXOH 5

$WWDFK :

14

Total each column. Add Positive

15

Figures only in Column 20.

CREDIT

,I D QHJDWLYH ¿JXUH LV VKRZQ

REFUND

in Column 20, enter as

Enter amount to be

16

Enter amount to be credited

credit or refund.

refunded

to 2014 here and in Column 23

SECTION B-1

5HVLGHQFH 7D[ (VWLPDWH IRU

6HH LQVWUXFWLRQV

±

PXVW EH FRPSOHWHG WR UHFHLYH (VWLPDWHG %LOOV

COLUMN 21

COLUMN 23

COLUMN 24

COLUMN 25

COLUMN 22

&UHGLW

%DODQFH

3D\PHQW 'XH

(VWLPDWHG

5HVLGHQFH &LW\

)URP &RO RQO\

ó RI &RO OHVV &RO

5HVLGHQFH 7D[

&RO /HVV &RO

17

Total each column.

7D[ 'XH ZLWK WKLV UHWXUQ ± Add Figures Shown in Last Column of Lines 10-13-15-17

18

:ULWH 7D[SD\HU ,GHQWL¿FDWLRQ 1XPEHU RQ 5HPLWWDQFH 0DNH FKHFN SD\DEOH WR &&$

I DECLARE THAT I HAVE EXAMINED THIS RETURN AND ACCOMPANYING SCHEDULES AND STATEMENTS. TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE. THE FIGURES USED HEREIN ARE THE SAME AS USED FOR FEDERAL INCOME TAX PURPOSES ADJUSTED TO MUNICIPAL INCOME TAX ORDINANCES.

#

#

Do you authorize your preparer to contact us regarding this return? YES

NO

Signature of Preparer, if not Taxpayer

Signature of Taxpayer

Signature of Spouse, if Joint Return

DATE

DATE

SIGN

HERE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2