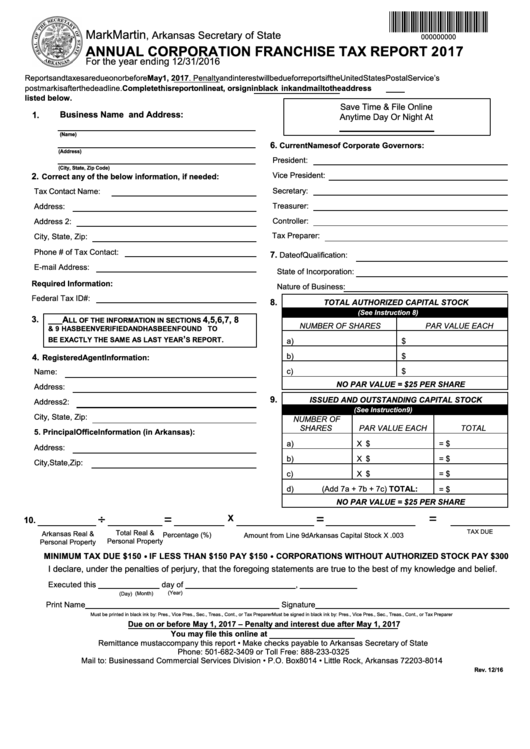

Mark Martin

, Arkansas Secretary of State

000000000

ANNUAL CORPORATION FRANCHISE TAX REPORT 2017

For the year ending 12/31/2016

Reports and taxes are due on or before May , 2017. Penalty and interest will be due for reports if the United States Postal Service’s

postmark is after the deadline. Complete this report online at , or sign in black ink and mail to the address

listed below.

Save Time & File Online

1.

Anytime Day Or Night At

.

Current Names of Corporate Governors:

President:

2.

Vice President:

Correct any of the below information, if needed:

Secretary:

Tax Contact Name:

Treasurer:

Address:

Controller:

Address 2:

Tax Preparer:

City, State, Zip:

Phone # of Tax Contact:

7

Date of Qualification:

E-mail Address:

State of Incorporation:

Required Information:

Nature of Business:

Federal Tax ID#:

.

TOTAL AUTHORIZED CAPITAL STOCK

(See Instruction 8)

3.

___ A

4, 5, 6, 7 8

LL OF THE INFORMATION IN SECTIONS

NUMBER OF SHARES

PAR VALUE EACH

HAS BEEN VERIFIED AND HAS BEEN FOUND TO

.

’

BE EXACTLY THE SAME AS LAST YEAR

S REPORT

a)

$

b)

$

4.

Registered Agent Information:

c)

$

Name:

NO PAR VALUE = $25 PER SHARE

Address:

.

ISSUED AND OUTSTANDING CAPITAL STOCK

Address 2:

(See Instruction 9)

City, State, Zip:

NUMBER OF

SHARES

PAR VALUE EACH

TOTAL

Principal Office Information (in Arkansas):

a)

X $

= $

Address:

b)

X $

= $

City, State, Zip:

c)

X $

= $

d)

(Add 7a + 7b + 7c) TOTAL:

= $

NO PAR VALUE = $25 PER SHARE

.

TAX DUE

MINIMUM TAX DUE $150 • IF LESS THAN $150 PAY $150 • CORPORATIONS WITHOUT AUTHORIZED STOCK PAY $300

I declare, under the penalties of perjury, that the foregoing statements are true to the best of my knowledge and belief.

Executed this ______________ day of _________________________, _____________

(Year)

(Month)

(Day)

Print Name____________________________________________ Signature____________________________________________

Must be printed in black ink by: Pres., Vice Pres., Sec., Treas., Cont., or Tax Preparer

Must be signed in black ink by: Pres., Vice Pres., Sec., Treas., Cont., or Tax Preparer

Due on or before May , 2017 – Penalty and interest due after May , 2017

You may file this online at

Remittance must accompany this report • Make checks payable to Arkansas Secretary of State

Phone: 501-682-3409 or Toll Free: 888-233-0325

Mail to: Business and Commercial Services Division • P.O. Box 8014 • Little Rock, Arkansas 72203-8014

Rev. 1 /1

1

1