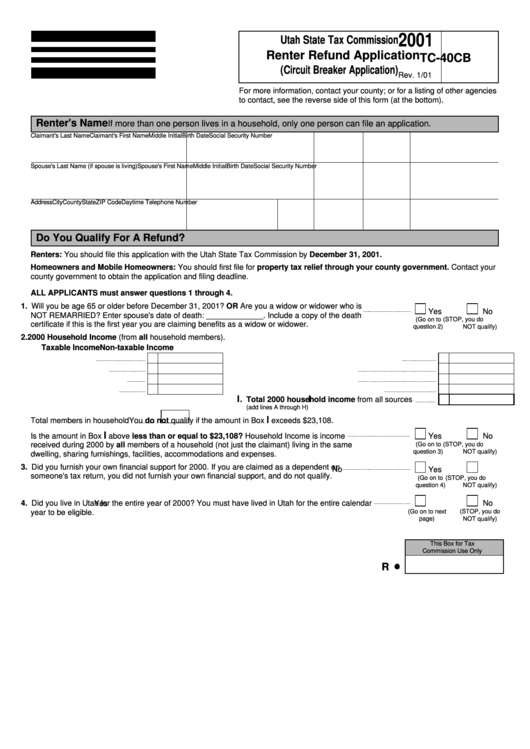

Form Tc-40cb - Renter Refund Application - 2001

ADVERTISEMENT

2001

Utah State Tax Commission

Renter Refund Application

TC-40CB

(Circuit Breaker Application)

Rev. 1/01

For more information, contact your county; or for a listing of other agencies

to contact, see the reverse side of this form (at the bottom).

Renter's Name

If more than one person lives in a household, only one person can file an application.

Claimant's Last Name

Claimant's First Name

Middle Initial

Birth Date

Social Security Number

Spouse's Last Name (if spouse is living)

Spouse's First Name

Middle Initial

Birth Date

Social Security Number

Address

City

County

State

ZIP Code

Daytime Telephone Number

Do You Qualify For A Refund?

Renters: You should file this application with the Utah State Tax Commission by December 31, 2001.

Homeowners and Mobile Homeowners: You should first file for property tax relief through your county government. Contact your

county government to obtain the application and filing deadline.

ALL APPLICANTS must answer questions 1 through 4.

1. Will you be age 65 or older before December 31, 2001? OR Are you a widow or widower who is

Yes

No

NOT REMARRIED? Enter spouse's date of death: _____________. Include a copy of the death

(Go on to

(STOP, you do

certificate if this is the first year you are claiming benefits as a widow or widower.

question 2)

NOT qualify)

2. 2000 Household Income (from all household members).

Taxable Income

Non-taxable Income

A. Wages/salaries

A

E. Social Security/other government programs

E

B. Pensions/annuities

B

F. Capital gains/pensions/annuities

F

C. Interest/dividends/trusts

C

G. Interest/dividends/trust income

G

D. Alimony/other income

D

H. Loss carryforwards/rental depreciation

H

I.

I

Total 2000 household income from all sources

(add lines A through H)

I

Total members in household

You do not qualify if the amount in Box

exceeds $23,108.

I

Is the amount in Box

above less than or equal to $23,108? Household Income is income

Yes

No

received during 2000 by all members of a household (not just the claimant) living in the same

(Go on to

(STOP, you do

question 3)

NOT qualify)

dwelling, sharing furnishings, facilities, accommodations and expenses.

3. Did you furnish your own financial support for 2000. If you are claimed as a dependent on

Yes

No

someone's tax return, you did not furnish your own financial support, and do not qualify.

(Go on to

(STOP, you do

question 4)

NOT qualify)

4. Did you live in Utah for the entire year of 2000? You must have lived in Utah for the entire calendar

No

Yes

year to be eligible.

(Go on to next

(STOP, you do

page)

NOT qualify)

This Box for Tax

Commission Use Only

R

40CB.FRM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2