Form D-1 And Form Aq-1 - Instructions And Worksheet - Estimated Income Tax - 2014

ADVERTISEMENT

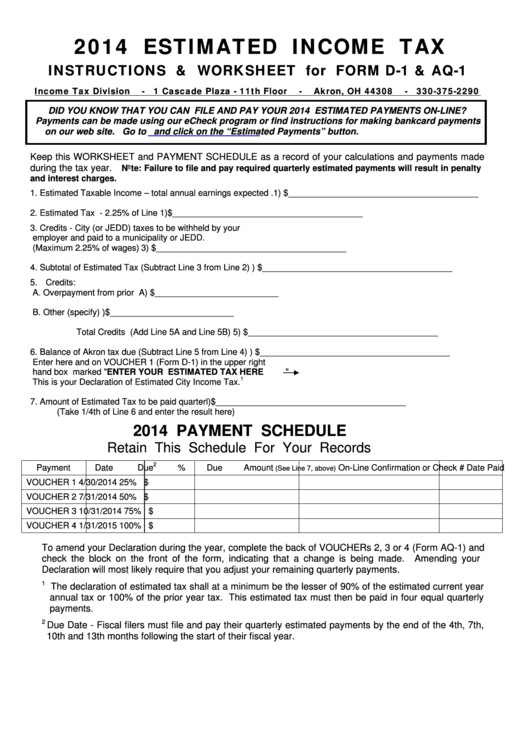

2014 ESTIMATED INCOME TAX

INSTRUCTIONS & WORKSHEET for FORM D-1 & AQ-1

Income Tax Division

- 1 Cascade Plaza - 11th Floor

-

Akron, OH 44308

- 330-375-2290

DID YOU KNOW THAT YOU CAN FILE AND PAY YOUR 2014 ESTIMATED PAYMENTS ON-LINE?

Payments can be made using our eCheck program or find instructions for making bankcard payments

on our web site. Go to

and click on the “Estimated Payments” button.

Keep this WORKSHEET and PAYMENT SCHEDULE as a record of your calculations and payments made

during the tax year.

Note: Failure to file and pay required quarterly estimated payments will result in penalty

and interest charges.

1. Estimated Taxable Income – total annual earnings expected . 1) $________________________________________

2. Estimated Tax - 2.25% of Line 1.............................................. 2) $________________________________________

3. Credits - City (or JEDD) taxes to be withheld by your

employer and paid to a municipality or JEDD.

(Maximum 2.25% of wages)...................................................... 3) $________________________________________

4. Subtotal of Estimated Tax (Subtract Line 3 from Line 2) .......... 4) $________________________________________

5. Credits:

A. Overpayment from prior year......................... A) $ __________________________

B. Other (specify) ............................................... B) $ __________________________

Total Credits (Add Line 5A and Line 5B) ............... 5) $________________________________________

6. Balance of Akron tax due (Subtract Line 5 from Line 4) ........... 6) $________________________________________

Enter here and on VOUCHER 1 (Form D-1) in the upper right

hand box marked "ENTER YOUR ESTIMATED TAX HERE

"

1

This is your Declaration of Estimated City Income Tax.

7. Amount of Estimated Tax to be paid quarterly.......................... 7) $________________________________________

(Take 1/4th of Line 6 and enter the result here)

2014 PAYMENT SCHEDULE

Retain This Schedule For Your Records

2

Payment

Date Due

% Due

Amount

On-Line Confirmation or Check #

Date Paid

(See Line 7, above)

VOUCHER 1

4/30/2014

25%

$

VOUCHER 2

7/31/2014

50%

$

VOUCHER 3

10/31/2014

75%

$

VOUCHER 4

1/31/2015

100%

$

To amend your Declaration during the year, complete the back of VOUCHERs 2, 3 or 4 (Form AQ-1) and

check the block on the front of the form, indicating that a change is being made.

Amending your

Declaration will most likely require that you adjust your remaining quarterly payments.

1

The declaration of estimated tax shall at a minimum be the lesser of 90% of the estimated current year

annual tax or 100% of the prior year tax. This estimated tax must then be paid in four equal quarterly

payments

.

2

Due Date - Fiscal filers must file and pay their quarterly estimated payments by the end of the 4th, 7th,

10th and 13th months following the start of their fiscal year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1