Farm Business Operating Agreement

ADVERTISEMENT

C4-43

November 2014

Farm Business Operating Agreement

A

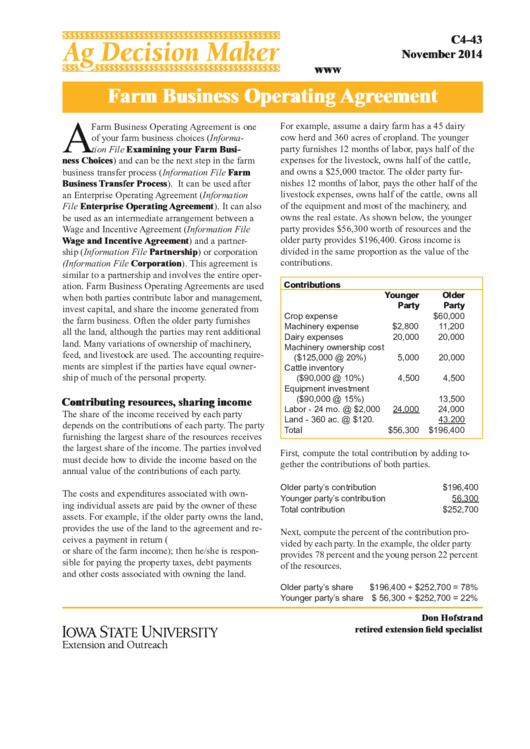

For example, assume a dairy farm has a 45 dairy

Farm Business Operating Agreement is one

cow herd and 360 acres of cropland. The younger

of your farm business choices (Informa-

party furnishes 12 months of labor, pays half of the

tion File Examining your Farm Busi-

expenses for the livestock, owns half of the cattle,

ness Choices) and can be the next step in the farm

and owns a $25,000 tractor. The older party fur-

business transfer process (Information File Farm

nishes 12 months of labor, pays the other half of the

Business Transfer Process). It can be used after

livestock expenses, owns half of the cattle, owns all

an Enterprise Operating Agreement (Information

of the equipment and most of the machinery, and

File Enterprise Operating Agreement). It can also

owns the real estate. As shown below, the younger

be used as an intermediate arrangement between a

party provides $56,300 worth of resources and the

Wage and Incentive Agreement (Information File

older party provides $196,400. Gross income is

Wage and Incentive Agreement) and a partner-

divided in the same proportion as the value of the

ship (Information File Partnership) or corporation

contributions.

(Information File Corporation). This agreement is

similar to a partnership and involves the entire oper-

Contributions

ation. Farm Business Operating Agreements are used

Younger

Older

when both parties contribute labor and management,

Party

Party

invest capital, and share the income generated from

Crop expense

$60,000

the farm business. Often the older party furnishes

Machinery expense

$2,800

11,200

all the land, although the parties may rent additional

Dairy expenses

20,000

20,000

land. Many variations of ownership of machinery,

Machinery ownership cost

feed, and livestock are used. The accounting require-

($125,000 @ 20%)

5,000

20,000

ments are simplest if the parties have equal owner-

Cattle inventory

ship of much of the personal property.

($90,000 @ 10%)

4,500

4,500

Equipment investment

($90,000 @ 15%)

13,500

Contributing resources, sharing income

Labor - 24 mo. @ $2,000

24,000

24,000

The share of the income received by each party

Land - 360 ac. @ $120.

43.200

depends on the contributions of each party. The party

Total

$56,300

$196,400

furnishing the largest share of the resources receives

the largest share of the income. The parties involved

First, compute the total contribution by adding to-

must decide how to divide the income based on the

gether the contributions of both parties.

annual value of the contributions of each party.

Older party’s contribution

$196,400

The costs and expenditures associated with own-

Younger party’s contribution

56,300

ing individual assets are paid by the owner of these

Total contribution

$252,700

assets. For example, if the older party owns the land,

provides the use of the land to the agreement and re-

Next, compute the percent of the contribution pro-

ceives a payment in return (i.e. cash rent equivalent

vided by each party. In the example, the older party

or share of the farm income); then he/she is respon-

provides 78 percent and the young person 22 percent

sible for paying the property taxes, debt payments

of the resources.

and other costs associated with owning the land.

Older party’s share

$196,400 ÷ $252,700 = 78%

Younger party’s share $ 56,300 ÷ $252,700 = 22%

Don Hofstrand

retired extension fi eld specialist

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2