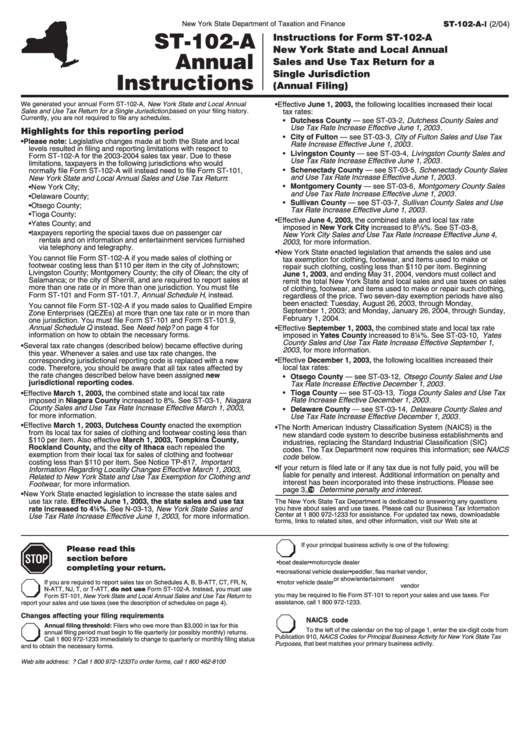

Instructions For Form St-102-A New York State And Local Annual Sales And Use Tax Return For A Single Jurisdiction

ADVERTISEMENT

New York State Department of Taxation and Finance

ST-102-A-I (2/04)

ST-102-A

Instructions for Form ST-102-A

New York State and Local Annual

Annual

Sales and Use Tax Return for a

Single Jurisdiction

Instructions

(Annual Filing)

• Effective June 1, 2003, the following localities increased their local

We generated your annual Form ST-102-A, New York State and Local Annual

Sales and Use Tax Return for a Single Jurisdiction, based on your filing history.

tax rates:

Currently, you are not required to file any schedules.

• Dutchess County — see ST-03-2, Dutchess County Sales and

Use Tax Rate Increase Effective June 1, 2003 .

Highlights for this reporting period

• City of Fulton — see ST-03-3, City of Fulton Sales and Use Tax

• Please note: Legislative changes made at both the State and local

Rate Increase Effective June 1, 2003 .

levels resulted in filing and reporting limitations with respect to

• Livingston County — see ST-03-4, Livingston County Sales and

Form ST-102-A for the 2003-2004 sales tax year. Due to these

Use Tax Rate Increase Effective June 1, 2003 .

limitations, taxpayers in the following jurisdictions who would

• Schenectady County — see ST-03-5, Schenectady County Sales

normally file Form ST-102-A will instead need to file Form ST-101,

and Use Tax Rate Increase Effective June 1, 2003 .

New York State and Local Annual Sales and Use Tax Return :

• Montgomery County — see ST-03-6, Montgomery County Sales

• New York City;

and Use Tax Rate Increase Effective June 1, 2003 .

• Delaware County;

• Sullivan County — see ST-03-7, Sullivan County Sales and Use

• Otsego County;

Tax Rate Increase Effective June 1, 2003 .

• Tioga County;

• Effective June 4, 2003, the combined state and local tax rate

• Yates County; and

5

imposed in New York City increased to 8

/

%. See ST-03-8,

8

• taxpayers reporting the special taxes due on passenger car

New York City Sales and Use Tax Rate Increase Effective June 4,

rentals and on information and entertainment services furnished

2003, for more information.

via telephony and telegraphy.

• New York State enacted legislation that amends the sales and use

You cannot file Form ST-102-A if you made sales of clothing or

tax exemption for clothing, footwear, and items used to make or

footwear costing less than $110 per item in the city of Johnstown;

repair such clothing, costing less than $110 per item. Beginning

Livingston County; Montgomery County; the city of Olean; the city of

June 1, 2003, and ending May 31, 2004, vendors must collect and

Salamanca; or the city of Sherrill, and are required to report sales at

remit the total New York State and local sales and use taxes on sales

more than one rate or in more than one jurisdiction. You must file

of clothing, footwear, and items used to make or repair such clothing,

Form ST-101 and Form ST-101.7, Annual Schedule H , instead.

regardless of the price. Two seven-day exemption periods have also

been enacted: Tuesday, August 26, 2003, through Monday,

You cannot file Form ST-102-A if you made sales to Qualified Empire

September 1, 2003; and Monday, January 26, 2004, through Sunday,

Zone Enterprises (QEZEs) at more than one tax rate or in more than

February 1, 2004.

one jurisdiction. You must file Form ST-101 and Form ST-101.9,

Annual Schedule Q instead. See Need help? on page 4 for

• Effective September 1, 2003, the combined state and local tax rate

information on how to obtain the necessary forms.

imposed in Yates County increased to 8¼%. See ST-03-10, Yates

County Sales and Use Tax Rate Increase Effective September 1,

• Several tax rate changes (described below) became effective during

2003 , for more information.

this year. Whenever a sales and use tax rate changes, the

• Effective December 1, 2003, the following localities increased their

corresponding jurisdictional reporting code is replaced with a new

local tax rates:

code. Therefore, you should be aware that all tax rates affected by

the rate changes described below have been assigned new

• Otsego County — see ST-03-12, Otsego County Sales and Use

jurisdictional reporting codes.

Tax Rate Increase Effective December 1, 2003 .

• Tioga County — see ST-03-13, Tioga County Sales and Use Tax

• Effective March 1, 2003, the combined state and local tax rate

imposed in Niagara County increased to 8%. See ST-03-1, Niagara

Rate Increase Effective December 1, 2003 .

County Sales and Use Tax Rate Increase Effective March 1, 2003,

• Delaware County — see ST-03-14, Delaware County Sales and

for more information.

Use Tax Rate Increase Effective December 1, 2003 .

• Effective March 1, 2003, Dutchess County enacted the exemption

• The North American Industry Classification System (NAICS) is the

from its local tax for sales of clothing and footwear costing less than

new standard code system to describe business establishments and

$110 per item. Also effective March 1, 2003, Tompkins County,

industries, replacing the Standard Industrial Classification (SIC)

Rockland County, and the city of Ithaca each repealed the

codes. The Tax Department now requires this information; see NAICS

exemption from their local tax for sales of clothing and footwear

code below.

costing less than $110 per item. See Notice TP-817, Important

• If your return is filed late or if any tax due is not fully paid, you will be

Information Regarding Locality Changes Effective March 1, 2003,

liable for penalty and interest. Additional information on penalty and

Related to New York State and Use Tax Exemption for Clothing and

interest has been incorporated into these instructions. Please see

Footwear , for more information.

page 3, , Determine penalty and interest.

• New York State enacted legislation to increase the state sales and

use tax rate. Effective June 1, 2003, the state sales and use tax

The New York State Tax Department is dedicated to answering any questions

rate increased to 4¼%. See N-03-13, New York State Sales and

you have about sales and use taxes. Please call our Business Tax Information

Center at 1 800 972-1233 for assistance. For updated tax news, downloadable

Use Tax Rate Increase Effective June 1, 2003, for more information.

forms, links to related sites, and other information, visit our Web site at

If your principal business activity is one of the following:

Please read this

section before

• boat dealer

• motorcycle dealer

completing your return.

• recreational vehicle dealer

• peddler, flea market vendor,

or show/entertainment

If you are required to report sales tax on Schedules A, B, B-ATT, CT, FR, N,

• motor vehicle dealer

vendor

N-ATT, NJ, T, or T-ATT, do not use Form ST-102-A. Instead, you must use

you may be required to file Form ST-101 to report your sales and use taxes. For

Form ST-101, New York State and Local Annual Sales and Use Tax Return to

assistance, call 1 800 972-1233.

report your sales and use taxes (see the description of schedules on page 4).

Changes affecting your filing requirements

NAICS code

Annual filing threshold: Filers who owe more than $3,000 in tax for this

To the left of the calendar on the top of page 1, enter the six-digit code from

annual filing period must begin to file quarterly (or possibly monthly) returns.

Publication 910, NAICS Codes for Principal Business Activity for New York State Tax

Call 1 800 972-1233 immediately to change to quarterly or monthly filing status

Purposes, that best matches your primary business activity.

and to obtain the necessary forms.

Web site address:

Need help? Call 1 800 972-1233

To order forms, call 1 800 462-8100

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13