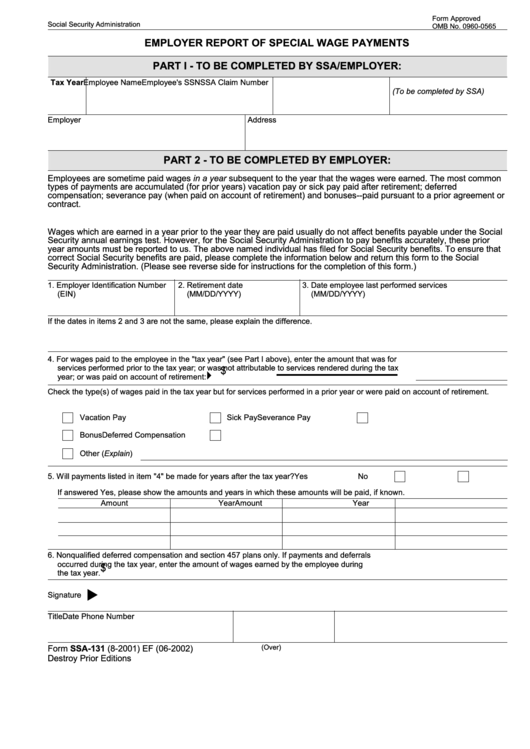

Form Approved

Social Security Administration

OMB No. 0960-0565

EMPLOYER REPORT OF SPECIAL WAGE PAYMENTS

PART I - TO BE COMPLETED BY SSA/EMPLOYER:

Tax Year Employee Name

Employee's SSN

SSA Claim Number

(To be completed by SSA)

Employer

Address

PART 2 - TO BE COMPLETED BY EMPLOYER:

Employees are sometime paid wages in a year subsequent to the year that the wages were earned. The most common

types of payments are accumulated (for prior years) vacation pay or sick pay paid after retirement; deferred

compensation; severance pay (when paid on account of retirement) and bonuses--paid pursuant to a prior agreement or

contract.

Wages which are earned in a year prior to the year they are paid usually do not affect benefits payable under the Social

Security annual earnings test. However, for the Social Security Administration to pay benefits accurately, these prior

year amounts must be reported to us. The above named individual has filed for Social Security benefits. To ensure that

correct Social Security benefits are paid, please complete the information below and return this form to the Social

Security Administration. (Please see reverse side for instructions for the completion of this form.)

1. Employer Identification Number

2. Retirement date

3. Date employee last performed services

(EIN)

(MM/DD/YYYY)

(MM/DD/YYYY)

If the dates in items 2 and 3 are not the same, please explain the difference.

4. For wages paid to the employee in the "tax year" (see Part I above), enter the amount that was for

services performed prior to the tax year; or was not attributable to services rendered during the tax

$

}

year; or was paid on account of retirement:

Check the type(s) of wages paid in the tax year but for services performed in a prior year or were paid on account of retirement.

Vacation Pay

Sick Pay

Severance Pay

Bonus

Deferred Compensation

Other (Explain)

5. Will payments listed in item "4" be made for years after the tax year?

Yes

No

If answered Yes, please show the amounts and years in which these amounts will be paid, if known.

Amount

Year

Amount

Year

6. Nonqualified deferred compensation and section 457 plans only. If payments and deferrals

occurred during the tax year, enter the amount of wages earned by the employee during

$

the tax year.

u

Signature

Title

Date

Phone Number

Form SSA-131 (8-2001) EF (06-2002)

(Over)

Destroy Prior Editions

1

1 2

2