Schedule Wv/mitc-1 - Credit For Manufacturing Investment (For Periods After January 1, 2015)

ADVERTISEMENT

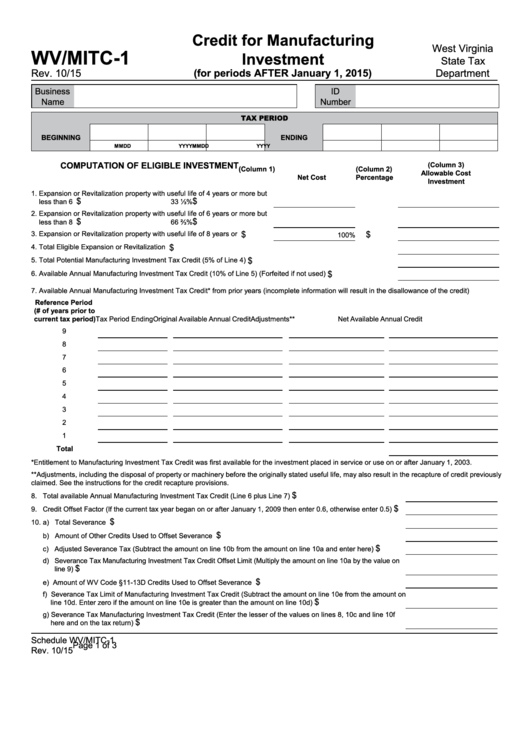

Credit for Manufacturing

West Virginia

WV/MITC-1

Investment

State Tax

Rev. 10/15

(for periods AFTER January 1, 2015)

Department

Business

ID

Name

Number

Tax period

BEgInnIng

EnDIng

MM

DD

YYYY

MM

DD

YYYY

CoMpuTATIon oF ElIgIBlE InVEsTMEnT

(Column 3)

(Column 1)

(Column 2)

Allowable Cost

net Cost

percentage

Investment

1. Expansion or Revitalization property with useful life of 4 years or more but

$

$

less than 6 years............................................................................................

33 ⅓%

2. Expansion or Revitalization property with useful life of 6 years or more but

$

$

less than 8 years............................................................................................

66 ⅔%

$

$

3. Expansion or Revitalization property with useful life of 8 years or more.......

100%

$

4. Total Eligible Expansion or Revitalization Investment....................................................................................................

$

5. Total Potential Manufacturing Investment Tax Credit (5% of Line 4).............................................................................

$

6. Available Annual Manufacturing Investment Tax Credit (10% of Line 5) (Forfeited if not used)....................................

7. Available Annual Manufacturing Investment Tax Credit* from prior years (incomplete information will result in the disallowance of the credit)

Reference period

(# of years prior to

current tax period)

Tax Period Ending

Original Available Annual Credit

Adjustments**

Net Available Annual Credit

9

8

7

6

5

4

3

2

1

Total

*Entitlement to Manufacturing Investment Tax Credit was first available for the investment placed in service or use on or after January 1, 2003.

**Adjustments, including the disposal of property or machinery before the originally stated useful life, may also result in the recapture of credit previously

claimed. See the instructions for the credit recapture provisions.

$

8. Total available Annual Manufacturing Investment Tax Credit (Line 6 plus Line 7)............................................................

$

9. Credit Offset Factor (If the current tax year began on or after January 1, 2009 then enter 0.6, otherwise enter 0.5)......

$

10. a) Total Severance Tax...................................................................................................................................................

$

b) Amount of Other Credits Used to Offset Severance Tax............................................................................................

$

c) Adjusted Severance Tax (Subtract the amount on line 10b from the amount on line 10a and enter here).................

d) Severance Tax Manufacturing Investment Tax Credit Offset Limit (Multiply the amount on line 10a by the value on

$

line 9)................................................................................................................................................................................

$

e) Amount of WV Code §11-13D Credits Used to Offset Severance Tax........................................................................

f) Severance Tax Limit of Manufacturing Investment Tax Credit (Subtract the amount on line 10e from the amount on

$

line 10d. Enter zero if the amount on line 10e is greater than the amount on line 10d)...............................................

g) Severance Tax Manufacturing Investment Tax Credit (Enter the lesser of the values on lines 8, 10c and line 10f

$

here and on the tax return)...........................................................................................................................................

Schedule WV/MITC-1

Page 1 of 3

Rev. 10/15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3