F

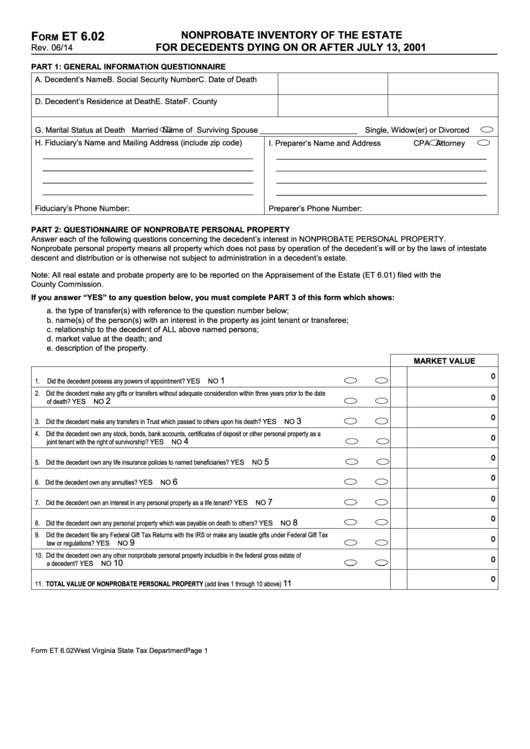

ET 6.02

nonprobAte inVentory of the estAte

orm

for DeceDents Dying on or After July 13, 2001

Rev. 06/14

pArt 1: generAl informAtion QuestionnAire

A. Decedent’s Name

B. Social Security Number

C. Date of Death

D. Decedent’s Residence at Death

E. State

F. County

G. Marital Status at Death Married

Name of Surviving Spouse

Single, Widow(er) or Divorced

_________________________

H. Fiduciary’s Name and Mailing Address (include zip code)

I. Preparer’s Name and Address

CPA

Attorney

________________________________________________

________________________________________________

________________________________________________

________________________________________________

________________________________________________

________________________________________________

________________________________________________

________________________________________________

Fiduciary’s Phone Number:

Preparer’s Phone Number:

pArt 2: QuestionnAire of nonprobAte personAl property

Answer each of the following questions concerning the decedent’s interest in NONPROBATE PERSONAL PROPERTY.

Nonprobate personal property means all property which does not pass by operation of the decedent’s will or by the laws of intestate

descent and distribution or is otherwise not subject to administration in a decedent’s estate.

Note: All real estate and probate property are to be reported on the Appraisement of the Estate (ET 6.01) filed with the

County Commission.

if you answer “yes” to any question below, you must complete pArt 3 of this form which shows:

a.

the type of transfer(s) with reference to the question number below;

b.

name(s) of the person(s) with an interest in the property as joint tenant or transferee;

c.

relationship to the decedent of ALL above named persons;

d.

market value at the death; and

e.

description of the property.

mArket VAlue

0

1

1.

Did the decedent possess any powers of appointment?...........................................................................................YES

NO

2. Did the decedent make any gifts or transfers without adequate consideration within three years prior to the date

0

2

of death?................................................................................................................................................................... YES

NO

0

3

3. Did the decedent make any transfers in Trust which passed to others upon his death?...........................................YES

NO

4. Did the decedent own any stock, bonds, bank accounts, certificates of deposit or other personal property as a

0

4

joint tenant with the right of survivorship?.................................................................................................................. YES

NO

0

5

5. Did the decedent own any life insurance policies to named beneficiaries?............................................................... YES

NO

0

6

6. Did the decedent own any annuities?.........................................................................................................................YES

NO

0

7

7. Did the decedent own an interest in any personal property as a life tenant?.............................................................YES

NO

0

8

8. Did the decedent own any personal property which was payable on death to others?.............................................YES

NO

9. Did the decedent file any Federal Gift Tax Returns with the IRS or make any taxable gifts under Federal Gift Tax

0

9

law or regulations?....................................................................................................................................................YES

NO

10. Did the decedent own any other nonprobate personal property includible in the federal gross estate of

0

10

a decedent?.............................................................................................................................................................. YES

NO

0

11

11. ToTal value of nonprobaTe personal properTy (add lines 1 through 10 above).......................................................................

Form ET 6.02

West Virginia State Tax Department

Page 1

1

1 2

2