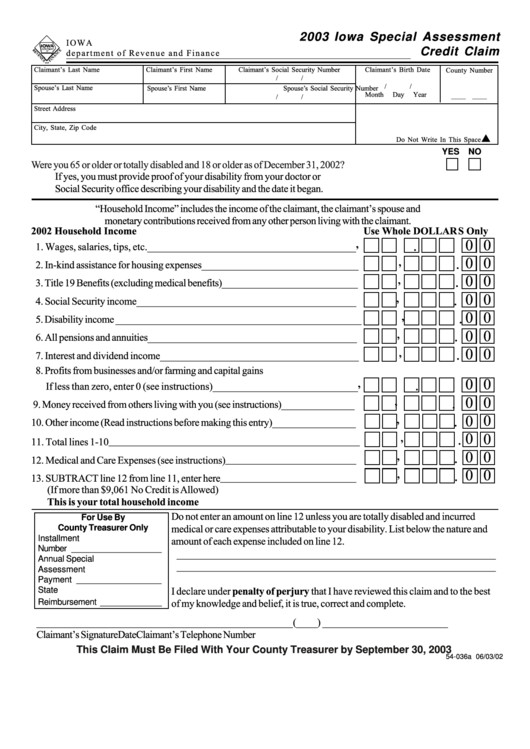

Form 54-036a - Iowa Special Assessment Credit Claim - 2003

ADVERTISEMENT

2003 Iowa Special Assessment

IOWA

Credit Claim

d e pa r t me n t o f R eve n u e a n d F i n a n c e

Claimant’s Last Name

Claimant’s First Name

Claimant’s Social Security Number

Claimant’s Birth Date

County Number

/

/

/

/

Spouse’s Last Name

Spouse’s First Name

Spouse’s Social Security Number

Month

Day

Year

____

____

/

/

Street Address

City, State, Zip Code

F

Do Not Write In This Space

YES NO

Were you 65 or older or totally disabled and 18 or older as of December 31, 2002?.............................

If yes, you must provide proof of your disability from your doctor or

Social Security office describing your disability and the date it began.

“Household Income” includes the income of the claimant, the claimant’s spouse and

monetary contributions received from any other person living with the claimant.

2002 Household Income

Use Whole DOLLAR S Only

0

0

,

1. Wages, salaries, tips, etc. ________________________________________

.

0

0

,

2. In-kind assistance for housing expenses ______________________________

.

0

0

,

3. Title 19 Benefits (excluding medical benefits) __________________________

.

0

0

,

4. Social Security income __________________________________________

.

0

0

,

5. Disability income _______________________________________________

.

0

0

,

6. All pensions and annuities ________________________________________

.

0

0

,

7. Interest and dividend income ______________________________________

.

8. Profits from businesses and/or farming and capital gains

0

0

,

If less than zero, enter 0 (see instructions) ____________________________

.

0

0

,

9. Money received from others living with you (see instructions) ______________

.

0

0

,

10. Other income (Read instructions before making this entry) ________________

.

0

0

,

11. Total lines 1-10 ________________________________________________

.

0

0

,

12. Medical and Care Expenses (see instructions) _________________________

.

0

0

,

13. SUBTRACT line 12 from line 11, enter here __________________________

.

(If more than $9,061 No Credit is Allowed)

This is your total household income

Do not enter an amount on line 12 unless you are totally disabled and incurred

For Use By

medical or care expenses attributable to your disability. List below the nature and

County Treasurer Only

Installment

amount of each expense included on line 12.

Number ___________________

_____________________________________________________________

Annual Special

_____________________________________________________________

Assessment

Payment __________________

I declare under penalty of perjury that I have reviewed this claim and to the best

State

of my knowledge and belief, it is true, correct and complete.

Reimbursement _____________

________________________________________

_________

( ____ ) ________________________

Claimant’s Signature

Date

Claimant’s Telephone Number

This Claim Must Be Filed With Your County Treasurer by September 30, 2003

54-036a 06/03/02

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1