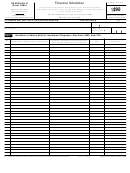

2

Schedule H (Form 5500) 2016

Page

1d

Employer-related investments:

(a) Beginning of Year

(b) End of Year

-123456789012345

-123456789012345

(1) Employer securities .................................................................................. 1d(1)

-123456789012345

-123456789012345

(2) Employer real property ............................................................................. 1d(2)

-123456789012345

-123456789012345

1e

1e

Buildings and other property used in plan operation .......................................

-123456789012345

-123456789012345

1f

1f

Total assets (add all amounts in lines 1a through 1e) .....................................

Liabilities

-123456789012345

-123456789012345

1g

1g

Benefit claims payable ....................................................................................

-123456789012345

-123456789012345

1h

1h

Operating payables ........................................................................................

-123456789012345

-123456789012345

1i

1i

Acquisition indebtedness ................................................................................

-123456789012345

-123456789012345

1j

1j

Other liabilities ................................................................................................

-123456789012345

-123456789012345

1k

1k

Total liabilities (add all amounts in lines 1g through1j) ....................................

Net Assets

-123456789012345

-123456789012345

1l

Net assets (subtract line 1k from line 1f) .........................................................

1l

Part II Income and Expense Statement

2

Plan income, expenses, and changes in net assets for the year. Include all income and expenses of the plan, including any trust(s) or separately maintained

fund(s) and any payments/receipts to/from insurance carriers. Round off amounts to the nearest dollar. MTIAs, CCTs, PSAs, and 103-12 IEs do not

complete lines 2a, 2b(1)(E), 2e, 2f, and 2g.

Income

(a) Amount

(b) Total

a

Contributions:

-123456789012345

(1) Received or receivable in cash from: (A) Employers ................................. 2a(1)(A)

-123456789012345

(B) Participants ....................................................................................... 2a(1)(B)

-123456789012345

(C) Others (including rollovers) ............................................................... 2a(1)(C)

-123456789012345

(2) Noncash contributions .............................................................................. 2a(2)

-123456789012345

(3) Total contributions. Add lines 2a(1)(A), (B), (C), and line 2a(2) ................. 2a(3)

b

Earnings on investments:

(1) Interest:

(A) Interest-bearing cash (including money market accounts and

-123456789012345

2b(1)(A)

certificates of deposit) .......................................................................

-123456789012345

(B) U.S. Government securities .............................................................. 2b(1)(B)

-123456789012345

(C) Corporate debt instruments ............................................................... 2b(1)(C)

-123456789012345

(D) Loans (other than to participants) ...................................................... 2b(1)(D)

-123456789012345

(E) Participant loans ............................................................................... 2b(1)(E)

-123456789012345

(F) Other ................................................................................................ 2b(1)(F)

-123456789012345

(G) Total interest. Add lines 2b(1)(A) through (F) .................................... 2b(1)(G)

-123456789012345

(2) Dividends: (A) Preferred stock .................................................................. 2b(2)(A)

-123456789012345

(B) Common stock .................................................................................. 2b(2)(B)

(C) Registered investment company shares (e.g. mutual funds) ............. 2b(2)(C)

-123456789012345

2b(2)(D)

(D) Total dividends. Add lines 2b(2)(A), (B), and (C)

-123456789012345

(3) Rents ........................................................................................................ 2b(3)

-123456789012345

(4) Net gain (loss) on sale of assets: (A) Aggregate proceeds....................... 2b(4)(A)

-123456789012345

(B) Aggregate carrying amount (see instructions) ................................... 2b(4)(B)

-123456789012345

(C) Subtract line 2b(4)(B) from line 2b(4)(A) and enter result ................. 2b(4)(C)

-123456789012345

(5) Unrealized appreciation (depreciation) of assets: (A) Real estate ........................ 2b(5)(A)

-123456789012345

(B) Other ................................................................................................ 2b(5)(B)

(C) Total unrealized appreciation of assets.

-123456789012345

2b(5)(C)

Add lines 2b(5)(A) and (B) ................................................................

1

1 2

2 3

3 4

4