4-

1

x

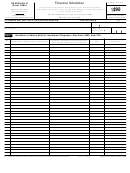

Schedule H (Form 5500) 2016

Page

Yes

No

Amount

c

Were any leases to which the plan was a party in default or classified during the year as

-123456789012345

uncollectible? (Attach Schedule G (Form 5500) Part II if “Yes” is checked.) ........................................

4c

d

Were there any nonexempt transactions with any party-in-interest? (Do not include transactions

reported on line 4a. Attach Schedule G (Form 5500) Part III if “Yes” is

-123456789012345

checked.) ...................................................................................................................................................

4d

e

-123456789012345

Was this plan covered by a fidelity bond?................................................................................................

4e

f

Did the plan have a loss, whether or not reimbursed by the plan’s fidelity bond, that was caused by

-123456789012345

fraud or dishonesty? ................................................................................................................................

4f

g

Did the plan hold any assets whose current value was neither readily determinable on an

established market nor set by an independent third party appraiser? ....................................................

-123456789012345

4g

h

Did the plan receive any noncash contributions whose value was neither readily

determinable on an established market nor set by an independent third party appraiser? ...................

-123456789012345

4h

i

Did the plan have assets held for investment? (Attach schedule(s) of assets if “Yes” is checked, and

see instructions for format requirements.) ...............................................................................................

4i

j

Were any plan transactions or series of transactions in excess of 5% of the current

value of plan assets? (Attach schedule of transactions if “Yes” is checked, and

see instructions for format requirements.) ...............................................................................................

4j

k

Were all the plan assets either distributed to participants or beneficiaries, transferred to another

plan, or brought under the control of the PBGC? ....................................................................................

4k

l

-123456789012345

Has the plan failed to provide any benefit when due under the plan? ....................................................

4l

m

If this is an individual account plan, was there a blackout period? (See instructions and 29 CFR

2520.101-3.) .............................................................................................................................................. 4m

n

If 4m was answered “Yes,” check the “Yes” box if you either provided the required notice or one of

the exceptions to providing the notice applied under 29 CFR 2520.101-3. ............................................

4n

o

Defined Benefit Plan or Money Purchase Pension Plan Only:

Were any distributions made during the plan year to an employee who attained age 62 and had not

4o

separated from service? ………………………………………………………………….............................

5a

Has a resolution to terminate the plan been adopted during the plan year or any prior plan year?

If “Yes,” enter the amount of any plan assets that reverted to the employer this year...........................

X

Yes

X

No

Amount:

-

5b

If, during this plan year, any assets or liabilities were transferred from this plan to another plan(s), identify the plan(s) to which assets or liabilities were

transferred. (See instructions.)

5b(1) Name of plan(s)

5b(2) EIN(s)

5b(3) PN(s)

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

123456789

123

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

123456789

123

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

123456789

123

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

123456789

123

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

5c

If the plan is a defined benefit plan, is it covered under the PBGC insurance program (See ERISA section 4021.)? ......

X

Yes

X

No

X

Not determined

If “Yes” is checked, enter the My PAA confirmation number from the PBGC premium filing for this plan year________________. (See instructions.)

Part V

Trust Information

6a

6b

Name of trust

Trust’s EIN

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

6c

6d

Name of trustee or custodian

Trustee’s or custodian’s telephone number

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

+12345678901234567890123456

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

ABCDEFGHI ABCDEFGHI ABCDEFGHI ABCDEFGHI

1

1 2

2 3

3 4

4