General Instructions - Form 11oocr 9507

ADVERTISEMENT

+STOP. If the business is an S Corporation with non-

1100s. If a Sole Proprietor/Partnership/S Corporation

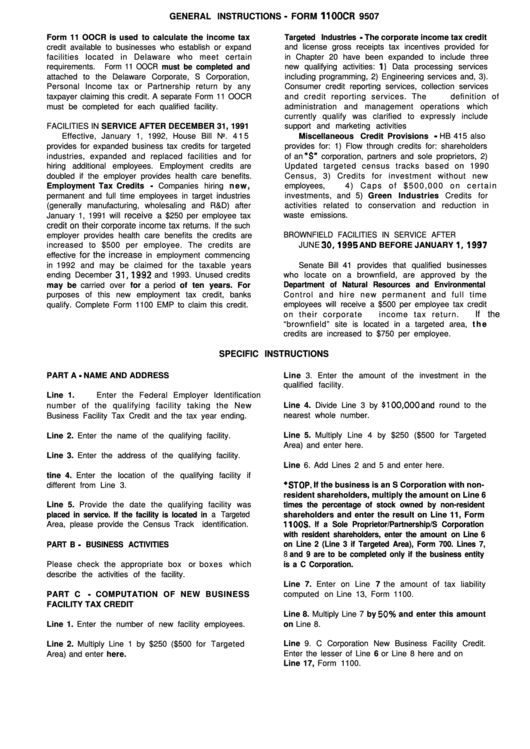

GENERAL INSTRUCTIONS - FORM 1 1OOCR 9507

Form 11 OOCR is used to calculate the income tax

Targeted Industries - The corporate income tax credit

credit available to businesses who establish or expand

and license gross receipts tax incentives provided for

facilities located in Delaware who meet certain

in Chapter 20 have been expanded to include three

requirements.

Form 11 OOCR must be completed and

new qualifying activities: 1) Data processing services

including programming, 2) Engineering services and, 3).

attached to the Delaware Corporate, S Corporation,

Personal Income tax or Partnership return by any

Consumer credit reporting services, collection services

taxpayer claiming this credit. A separate Form 11 OOCR

and credit reporting services. The

definition of

administration and management operations which

must be completed for each qualified facility.

currently qualify was clarified to expressly include

FACILITIES IN SERVICE AFTER DECEMBER 31, 1991

support and marketing activities

Effective, January 1, 1992, House Bill No. 4 1 5

Miscellaneous Credit Provisions - HB 415 also

provides for: 1) Flow through credits for: shareholders

provides for expanded business tax credits for targeted

of an "S" corporation, partners and sole proprietors, 2)

industries, expanded and replaced facilities and for

hiring additional employees. Employment credits are

Updated targeted census tracks based on 1990

doubled if the employer provides health care benefits.

Census, 3) Credits for investment without new

Employment Tax Credits - Companies hiring n e w ,

employees,

4 ) C a p s o f $ 5 0 0 , 0 0 0 o n c e r t a i n

permanent and full time employees in target industries

investments, and 5) Green Industries Credits for

(generally manufacturing, wholesaling and R&D) after

activities related to conservation and reduction in

receive

January 1, 1991 will

a $250 per employee tax

waste emissions.

credit on their corporate income tax returns.

If the such

BROWNFIELD FACILITIES IN SERVICE AFTER

employer provides health care benefits the credits are

JUNE 30,1995 AND BEFORE JANUARY 1,1997

increased to $500 per employee. The credits are

for the increase

effective

in employment commencing

Senate Bill 41 provides that qualified businesses

in 1992 and may be claimed for the taxable years

ending December 31,1992 and 1993. Unused credits

who locate on a brownfield, are approved by the

may be carried over for a period of ten years. For

Department of Natural Resources and Environmental

Control and hire new permanent and full time

purposes of this new employment tax credit, banks

qualify. Complete Form 1100 EMP to claim this credit.

employees will receive a $500 per employee tax credit

If the

on their corporate

income tax return.

“brownfield” site is located in a targeted area, t h e

credits are increased to $750 per employee.

SPECIFIC INSTRUCTIONS

PART A - NAME AND ADDRESS

Line 3. Enter the amount of the investment in the

qualified facility.

Line 1.

Enter the Federal Employer Identification

Line 4. Divide Line 3 by $lOO,OOOand

round to the

number of the qualifying facility taking the New

nearest whole number.

Business Facility Tax Credit and the tax year ending.

Line 5. Multiply Line 4 by $250 ($500 for Targeted

Line 2. Enter the name of the qualifying facility.

Area) and enter here.

Line 3. Enter the address of the qualifying facility.

Line 6. Add Lines 2 and 5 and enter here.

tine 4. Enter the location of the qualifying facility if

different from Line 3.

resident shareholders, multiply the amount on Line 6

Line 5. Provide the date the qualifying facility was

times the percentage of stock owned by non-resident

placed in service. If the facility is located in a Targeted

shareholders and enter the result on Line 11, Form

Area, please provide the Census Track identification.

with resident shareholders, enter the amount on Line 6

PART B - BUSINESS ACTIVITIES

on Line 2 (Line 3 if Targeted Area), Form 700. Lines 7,

8 and 9 are to be completed only if the business entity

Please check the appropriate box or boxes which

is a C Corporation.

describe the activities of the facility.

Line 7. Enter on Line 7 the amount of tax liability

PART C - COMPUTATION OF NEW BUSINESS

computed on Line 13, Form 1100.

FACILITY TAX CREDIT

Line 8. Multiply Line 7 by 50°h and enter this amount

Line 1. Enter the number of new facility employees.

on Line 8.

Line 9. C Corporation New Business Facility Credit.

Line 2. Multiply Line 1 by $250 ($500 for Targeted

Enter the lesser of Line 6 or Line 8 here and on

Area) and enter here.

Line 17, Form 1100.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1