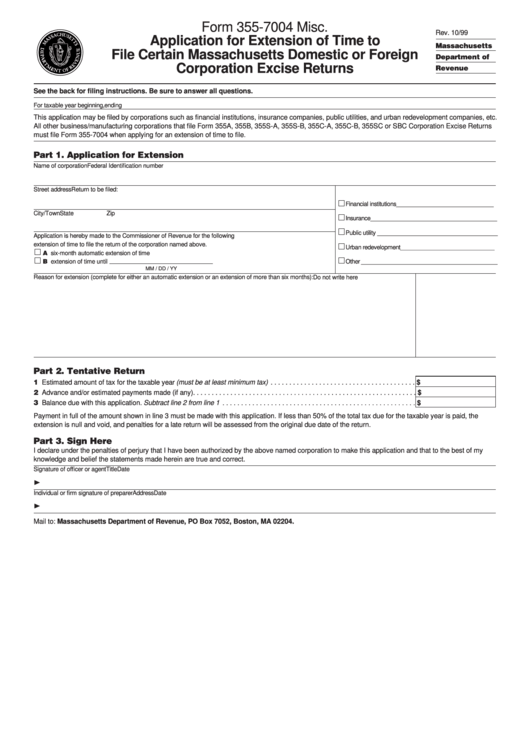

Form 355-7004 Misc. - Application For Extension Of Time To File Certain Massachusetts Domestic Or Foreign Corporation Excise Returns - 1999

ADVERTISEMENT

Form 355-7004 Misc.

Rev. 10/99

Application for Extension of Time to

Massachusetts

File Certain Massachusetts Domestic or Foreign

Department of

Corporation Excise Returns

Revenue

See the back for filing instructions. Be sure to answer all questions.

For taxable year beginning

, ending

This application may be filed by corporations such as financial institutions, insurance companies, public utilities, and urban redevelopment companies, etc.

All other business/manufacturing corporations that file Form 355A, 355B, 355S-A, 355S-B, 355C-A, 355C-B, 355SC or SBC Corporation Excise Returns

must file Form 355-7004 when applying for an extension of time to file.

Part 1. Application for Extension

Name of corporation

Federal Identification number

Street address

Return to be filed:

Financial institutions ______________________________

City/Town

State

Zip

Insurance_______________________________________

Public utility _____________________________________

Application is hereby made to the Commissioner of Revenue for the following

extension of time to file the return of the corporation named above.

Urban redevelopment _____________________________

A six-month automatic extension of time

B extension of time until

Other __________________________________________

MM / DD / YY

Reason for extension (complete for either an automatic extension or an extension of more than six months):

Do not write here

Part 2. Tentative Return

1 Estimated amount of tax for the taxable year (must be at least minimum tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2 Advance and/or estimated payments made (if any). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

3 Balance due with this application. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

Payment in full of the amount shown in line 3 must be made with this application. If less than 50% of the total tax due for the taxable year is paid, the

extension is null and void, and penalties for a late return will be assessed from the original due date of the return.

Part 3. Sign Here

I declare under the penalties of perjury that I have been authorized by the above named corporation to make this application and that to the best of my

knowledge and belief the statements made herein are true and correct.

Signature of officer or agent

Title

Date

¨

Individual or firm signature of preparer

Address

Date

¨

Mail to: Massachusetts Department of Revenue, PO Box 7052, Boston, MA 02204.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1