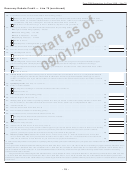

Instructions For Form 1040 - Draft Worksheet(S) And Tables - 2008 Page 27

ADVERTISEMENT

2008 Earned Income Credit (EIC) Table – Continued

(Caution. This is not a tax table.)

And your filing status is –

And your filing status is –

Single, head of household, Married filing jointly and

Single, head of household, Married filing jointly and

If the amount you

If the amount you

or qualifying widow(er)

you have –

or qualifying widow(er)

you have –

are looking up from

are looking up from

and you have –

and you have –

the worksheet is –

the worksheet is –

No

One

Two

No

One

Two

No

One

Two

No

One

Two

children

child

children children

child

children

children

child

children children

child

children

At least But less than

Your credit is –

Your credit is –

At least But less than

Your credit is –

Your credit is –

33,000

33,050

0

155

1,184

0

634

1,816

35,500

35,550

0

0

657

0

235

1,289

33,050

33,100

0

147

1,173

0

626

1,805

35,550

35,600

0

0

647

0

227

1,279

33,100

33,150

0

139

1,163

0

618

1,795

35,600

35,650

0

0

636

0

219

1,268

33,150

33,200

0

131

1,152

0

610

1,784

35,650

35,700

0

0

626

0

211

1,257

33,200

33,250

0

123

1,142

0

602

1,773

35,700

35,750

0

0

615

0

203

1,247

33,250

33,300

0

115

1,131

0

595

1,763

35,750

35,800

0

0

605

0

195

1,236

33,300

33,350

0

107

1,121

0

587

1,752

35,800

35,850

0

0

594

0

187

1,226

33,350

33,400

0

99

1,110

0

579

1,742

35,850

35,900

0

0

584

0

179

1,215

33,400

33,450

0

91

1,100

0

571

1,731

35,900

35,950

0

0

573

0

171

1,205

33,450

33,500

0

83

1,089

0

563

1,721

35,950

36,000

0

0

563

0

163

1,194

33,500

33,550

0

75

1,078

0

555

1,710

36,000

36,050

0

0

552

0

155

1,184

33,550

33,600

0

67

1,068

0

547

1,700

36,050

36,100

0

0

541

0

147

1,173

33,600

33,650

0

59

1,057

0

539

1,689

36,100

36,150

0

0

531

0

139

1,163

33,650

33,700

0

51

1,047

0

531

1,679

36,150

36,200

0

0

520

0

131

1,152

33,700

33,750

0

43

1,036

0

523

1,668

36,200

36,250

0

0

510

0

123

1,142

33,750

33,800

0

35

1,026

0

515

1,658

36,250

36,300

0

0

499

0

115

1,131

33,800

33,850

0

27

1,015

0

507

1,647

36,300

36,350

0

0

489

0

107

1,121

33,850

33,900

0

19

1,005

0

499

1,637

36,350

36,400

0

0

478

0

99

1,110

33,900

33,950

0

11

994

0

491

1,626

36,400

36,450

0

0

468

0

91

1,100

33,950

34,000

0

*

984

0

483

1,616

36,450

36,500

0

0

457

0

83

1,089

34,000

34,050

0

0

973

0

475

1,605

36,500

36,550

0

0

447

0

75

1,078

34,050

34,100

0

0

963

0

467

1,594

36,550

36,600

0

0

436

0

67

1,068

34,100

34,150

0

0

952

0

459

1,584

36,600

36,650

0

0

426

0

59

1,057

34,150

34,200

0

0

942

0

451

1,573

36,650

36,700

0

0

415

0

51

1,047

34,200

34,250

0

0

931

0

443

1,563

36,700

36,750

0

0

405

0

43

1,036

34,250

34,300

0

0

921

0

435

1,552

36,750

36,800

0

0

394

0

35

1,026

34,300

34,350

0

0

910

0

427

1,542

36,800

36,850

0

0

383

0

27

1,015

34,350

34,400

0

0

899

0

419

1,531

36,850

36,900

0

0

373

0

19

1,005

34,400

34,450

0

0

889

0

411

1,521

36,900

36,950

0

0

362

0

11

994

34,450

34,500

0

0

878

0

403

1,510

36,950

37,000

0

0

352

0

*

984

34,500

34,550

0

0

868

0

395

1,500

37,000

37,050

0

0

341

0

0

973

34,550

34,600

0

0

857

0

387

1,489

37,050

37,100

0

0

331

0

0

963

34,600

34,650

0

0

847

0

379

1,479

37,100

37,150

0

0

320

0

0

952

34,650

34,700

0

0

836

0

371

1,468

37,150

37,200

0

0

310

0

0

942

34,700

34,750

0

0

826

0

363

1,458

37,200

37,250

0

0

299

0

0

931

34,750

34,800

0

0

815

0

355

1,447

37,250

37,300

0

0

289

0

0

921

34,800

34,850

0

0

805

0

347

1,436

37,300

37,350

0

0

278

0

0

910

34,850

34,900

0

0

794

0

339

1,426

37,350

37,400

0

0

268

0

0

899

34,900

34,950

0

0

784

0

331

1,415

37,400

37,450

0

0

257

0

0

889

34,950

35,000

0

0

773

0

323

1,405

37,450

37,500

0

0

247

0

0

878

35,000

35,050

0

0

763

0

315

1,394

37,500

37,550

0

0

236

0

0

868

35,050

35,100

0

0

752

0

307

1,384

37,550

37,600

0

0

226

0

0

857

35,100

35,150

0

0

742

0

299

1,373

37,600

37,650

0

0

215

0

0

847

35,150

35,200

0

0

731

0

291

1,363

37,650

37,700

0

0

204

0

0

836

35,200

35,250

0

0

720

0

283

1,352

37,700

37,750

0

0

194

0

0

826

35,250

35,300

0

0

710

0

275

1,342

37,750

37,800

0

0

183

0

0

815

35,300

35,350

0

0

699

0

267

1,331

37,800

37,850

0

0

173

0

0

805

35,350

35,400

0

0

689

0

259

1,321

37,850

37,900

0

0

162

0

0

794

35,400

35,450

0

0

678

0

251

1,310

37,900

37,950

0

0

152

0

0

784

35,450

35,500

0

0

668

0

243

1,300

37,950

38,000

0

0

141

0

0

773

*If the amount you are looking up from the worksheet is at least $33,950 ($36,950 if married filing jointly) but less than $33,995 ($36,995 if married filing jointly),

your credit is $4. Otherwise, you cannot take the credit.

(Continued on page 27)

- 26 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42