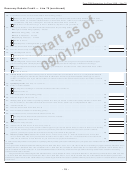

Instructions For Form 1040 - Draft Worksheet(S) And Tables - 2008 Page 28

ADVERTISEMENT

2008 Earned Income Credit (EIC) Table – Continued

(Caution. This is not a tax table.)

And your filing status is –

And your filing status is –

Single, head of household, Married filing jointly and

Single, head of household, Married filing jointly and

If the amount you

If the amount you

or qualifying widow(er)

you have –

or qualifying widow(er)

you have –

are looking up from

are looking up from

and you have –

and you have –

the worksheet is –

the worksheet is –

No

One

Two

No

One

Two

No

One

Two

No

One

Two

children

child

children children

child

children

children

child

children children

child

children

Your credit is –

Your credit is –

Your credit is –

Your credit is –

At least But less than

At least But less than

38,000

38,050

0

0

131

0

0

763

40,000

40,050

0

0

0

0

0

341

38,050

38,100

0

0

120

0

0

752

40,050

40,100

0

0

0

0

0

331

38,100

38,150

0

0

110

0

0

742

40,100

40,150

0

0

0

0

0

320

38,150

38,200

0

0

99

0

0

731

40,150

40,200

0

0

0

0

0

310

38,200

38,250

0

0

89

0

0

720

40,200

40,250

0

0

0

0

0

299

38,250

38,300

0

0

78

0

0

710

40,250

40,300

0

0

0

0

0

289

38,300

38,350

0

0

68

0

0

699

40,300

40,350

0

0

0

0

0

278

38,350

38,400

0

0

57

0

0

689

40,350

40,400

0

0

0

0

0

268

38,400

38,450

0

0

47

0

0

678

40,400

40,450

0

0

0

0

0

257

38,450

38,500

0

0

36

0

0

668

40,450

40,500

0

0

0

0

0

247

38,500

38,550

0

0

25

0

0

657

40,500

40,550

0

0

0

0

0

236

38,550

38,600

0

0

15

0

0

647

40,550

40,600

0

0

0

0

0

226

38,600

38,650

0

0

*

0

0

636

40,600

40,650

0

0

0

0

0

215

38,650

38,700

0

0

0

0

0

626

40,650

40,700

0

0

0

0

0

204

38,700

38,750

0

0

0

0

0

615

40,700

40,750

0

0

0

0

0

194

38,750

38,800

0

0

0

0

0

605

40,750

40,800

0

0

0

0

0

183

38,800

38,850

0

0

0

0

0

594

40,800

40,850

0

0

0

0

0

173

38,850

38,900

0

0

0

0

0

584

40,850

40,900

0

0

0

0

0

162

38,900

38,950

0

0

0

0

0

573

40,900

40,950

0

0

0

0

0

152

38,950

39,000

0

0

0

0

0

563

40,950

41,000

0

0

0

0

0

141

39,000

39,050

0

0

0

0

0

552

41,000

41,050

0

0

0

0

0

131

39,050

39,100

0

0

0

0

0

541

41,050

41,100

0

0

0

0

0

120

39,100

39,150

0

0

0

0

0

531

41,100

41,150

0

0

0

0

0

110

39,150

39,200

0

0

0

0

0

520

41,150

41,200

0

0

0

0

0

99

39,200

39,250

0

0

0

0

0

510

41,200

41,250

0

0

0

0

0

89

39,250

39,300

0

0

0

0

0

499

41,250

41,300

0

0

0

0

0

78

39,300

39,350

0

0

0

0

0

489

41,300

41,350

0

0

0

0

0

68

39,350

39,400

0

0

0

0

0

478

41,350

41,400

0

0

0

0

0

57

39,400

39,450

0

0

0

0

0

468

41,400

41,450

0

0

0

0

0

47

39,450

39,500

0

0

0

0

0

457

41,450

41,500

0

0

0

0

0

36

39,500

39,550

0

0

0

0

0

447

41,500

41,550

0

0

0

0

0

25

39,550

39,600

0

0

0

0

0

436

41,550

41,600

0

0

0

0

0

15

39,600

39,650

0

0

0

0

0

426

41,600

41,646

0

0

0

0

0

5

39,650

39,700

0

0

0

0

0

415

39,700

39,750

0

0

0

0

0

405

39,750

39,800

0

0

0

0

0

394

39,800

39,850

0

0

0

0

0

383

39,850

39,900

0

0

0

0

0

373

39,900

39,950

0

0

0

0

0

362

39,950

40,000

0

0

0

0

0

352

*If the amount you are looking up from the worksheet is at least $38,600 but less than $38,646, your credit is $5. Otherwise, you can not take the credit.

- 27 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42