Instructions For Form 1040 - Draft Worksheet(S) And Tables - 2008 Page 3

ADVERTISEMENT

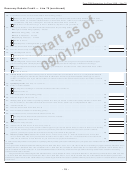

State and Local Income Tax Refund Worksheet—Line 10

Keep for Your Records

Before you begin:

Be sure you have read the Exception above to see if you can use this worksheet instead of

Pub. 525 to figure if any of your refund is taxable.

1. Enter the income tax refund from Form(s) 1099-G (or similar statement). But do not enter more than

the amount of your state and local income taxes shown on your 2007 Schedule A, line 5 . . . . . . . . . . . 1.

2. Enter your total allowable itemized deductions from your 2007 Schedule A, line 29

2.

Note.

If the filing status on your 2007 Form 1040 was married filing separately and

your spouse itemized deductions in 2007, skip lines 3, 4, and 5, and enter the amount

from line 2 on line 6.

3. Enter the amount shown below for the filing status claimed on your

2007 Form 1040.

•

Single or married filing separately — $5,350

}

•

Married filing jointly or qualifying widow(er) —

$10,700

. . 3.

•

Head of household — $7,850

4. Did you fill in line 39a on your 2007 Form 1040?

}

No. Enter -0-.

Yes. Multiply the number in the box on line 39a of your

2007 Form 1040 by $1,050 ($1,300 if your 2007 filing

status was single or head of household).

4.

5. Add lines 3 and 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.

6. Is the amount on line 5 less than the amount on line 2?

No.

None of your refund is taxable.

STOP

Yes. Subtract line 5 from line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6.

7. Taxable part of your refund. Enter the smaller of line 1 or line 6 here and on Form 1040, line 10 . . . 7.

- 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42