Form Boe-260-A - Certificate And Affidavit For Exemption Of Certain Aircraft Claim For Exemption From Property Taxes Under Section 2 Of Article Xiii Of The Constitution Of The State Of California And Section 217.1 Of The Revenue And Taxation Code

ADVERTISEMENT

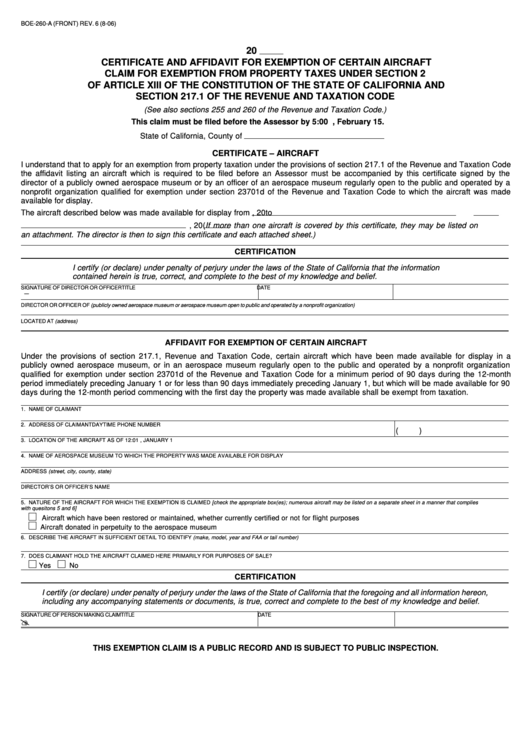

BOE-260-A (FRONT) REV. 6 (8-06)

20

CERTIFICATE AND AFFIDAVIT FOR EXEMPTION OF CERTAIN AIRCRAFT

CLAIM FOR EXEMPTION FROM PROPERTY TAXES UNDER SECTION 2

OF ARTICLE XIII OF THE CONSTITUTION OF THE STATE OF CALIFORNIA AND

SECTION 217.1 OF THE REVENUE AND TAXATION CODE

(See also sections 255 and 260 of the Revenue and Taxation Code.)

This claim must be filed before the Assessor by 5:00 p.m., February 15.

State of California, County of

CERTIFICATE – AIRCRAFT

I understand that to apply for an exemption from property taxation under the provisions of section 217.1 of the Revenue and Taxation Code

the affidavit listing an aircraft which is required to be filed before an Assessor must be accompanied by this certificate signed by the

director of a publicly owned aerospace museum or by an officer of an aerospace museum regularly open to the public and operated by a

nonprofit organization qualified for exemption under section 23701d of the Revenue and Taxation Code to which the aircraft was made

available for display.

The aircraft described below was made available for display from

, 20

to

, 20

(If more than one aircraft is covered by this certificate, they may be listed on

an attachment. The director is then to sign this certificate and each attached sheet.)

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the information

contained herein is true, correct, and complete to the best of my knowledge and belief.

SIGNATURE OF DIRECTOR OR OFFICER

TITLE

DATE

-

DIRECTOR OR OFFICER OF (publicly owned aerospace museum or aerospace museum open to public and operated by a nonprofit organization)

LOCATED AT (address)

AFFIDAVIT FOR EXEMPTION OF CERTAIN AIRCRAFT

Under the provisions of section 217.1, Revenue and Taxation Code, certain aircraft which have been made available for display in a

publicly owned aerospace museum, or in an aerospace museum regularly open to the public and operated by a nonprofit organization

qualified for exemption under section 23701d of the Revenue and Taxation Code for a minimum period of 90 days during the 12-month

period immediately preceding January 1 or for less than 90 days immediately preceding January 1, but which will be made available for 90

days during the 12-month period commencing with the first day the property was made available shall be exempt from taxation.

1. NAME OF CLAIMANT

2. ADDRESS OF CLAIMANT

DAYTIME PHONE NUMBER

(

)

3. LOCATION OF THE AIRCRAFT AS OF 12:01 A.M., JANUARY 1

4. NAME OF AEROSPACE MUSEUM TO WHICH THE PROPERTY WAS MADE AVAILABLE FOR DISPLAY

ADDRESS (street, city, county, state)

DIRECTOR’S OR OFFICER’S NAME

5. NATURE OF THE AIRCRAFT FOR WHICH THE EXEMPTION IS CLAIMED [check the appropriate box(es); numerous aircraft may be listed on a separate sheet in a manner that complies

with quesitons 5 and 6]

Aircraft which have been restored or maintained, whether currently certified or not for flight purposes

Aircraft donated in perpetuity to the aerospace museum

6. DESCRIBE THE AIRCRAFT IN SUFFICIENT DETAIL TO IDENTIFY (make, model, year and FAA or tail number)

7. DOES CLAIMANT HOLD THE AIRCRAFT CLAIMED HERE PRIMARILY FOR PURPOSES OF SALE?

Yes

No

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon,

including any accompanying statements or documents, is true, correct and complete to the best of my knowledge and belief.

SIGNATURE OF PERSON MAKING CLAIM

TITLE

DATE

?

THIS EXEMPTION CLAIM IS A PUBLIC RECORD AND IS SUBJECT TO PUBLIC INSPECTION.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2