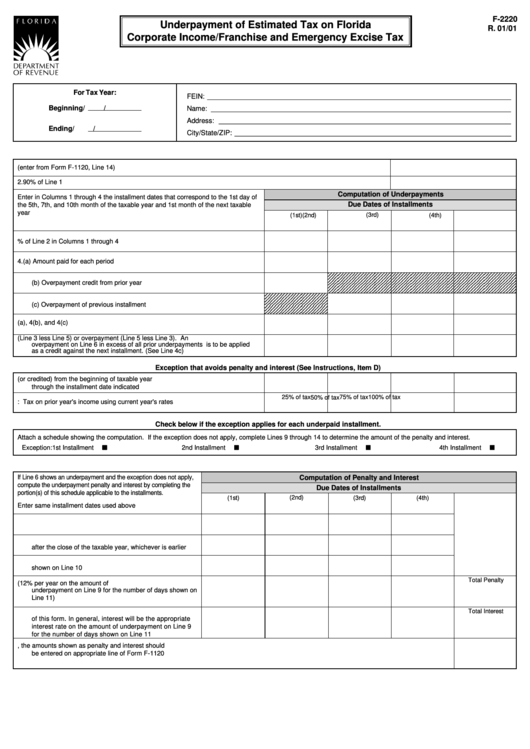

Form F-2220 - Underpayment Of Estimated Tax On Florida Corporate Income/franchise And Emergency Excise Tax - 2001

ADVERTISEMENT

F-2220

Underpayment of Estimated Tax on Florida

R. 01/01

Corporate Income/Franchise and Emergency Excise Tax

For Tax Year:

FEIN: ______________________________________________________________________________

Beginning

/

/

Name: _____________________________________________________________________________

Address: ___________________________________________________________________________

Ending

/

/

City/State/ZIP: _______________________________________________________________________

1.

Total income/franchise and emergency excise tax due for the year (enter from Form F-1120, Line 14)

2.

90% of Line 1

Computation of Underpayments

Enter in Columns 1 through 4 the installment dates that correspond to the 1st day of

Due Dates of Installments

the 5th, 7th, and 10th month of the taxable year and 1st month of the next taxable

year

(1st)

(2nd)

(3rd)

(4th)

3.

Enter 25% of Line 2 in Columns 1 through 4

4.

(a) Amount paid for each period

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

(b) Overpayment credit from prior year

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

(c) Overpayment of previous installment

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2

5.

Total of Lines 4(a), 4(b), and 4(c)

6.

Underpayment (Line 3 less Line 5) or overpayment (Line 5 less Line 3). An

overpayment on Line 6 in excess of all prior underpayments is to be applied

as a credit against the next installment. (See Line 4c)

Exception that avoids penalty and interest (See Instructions, Item D)

7.

Total cumulative amount paid (or credited) from the beginning of taxable year

through the installment date indicated

25% of tax

75% of tax

100% of tax

50% of tax

8.

Exception: Tax on prior year's income using current year's rates

Check below if the exception applies for each underpaid installment.

Attach a schedule showing the computation. If the exception does not apply, complete Lines 9 through 14 to determine the amount of the penalty and interest.

Exception:

1st Installment

2nd Installment

3rd Installment

4th Installment

If Line 6 shows an underpayment and the exception does not apply,

Computation of Penalty and Interest

compute the underpayment penalty and interest by completing the

Due Dates of Installments

portion(s) of this schedule applicable to the installments.

(2nd)

(1st)

(3rd)

(4th)

Enter same installment dates used above

9.

Amount of underpayment from Line 6

10. Enter the date of payment or the 1st day of the 4th month

after the close of the taxable year, whichever is earlier

11. Number of days from due date of installment to the dates

shown on Line 10

Total Penalty

12. Penalty on underpayment (12% per year on the amount of

underpayment on Line 9 for the number of days shown on

Line 11)

13. Interest on underpayment. See Instruction E on the back

Total Interest

of this form. In general, interest will be the appropriate

interest rate on the amount of underpayment on Line 9

for the number of days shown on Line 11

14. Total of amounts shown on Lines 12 and 13. If this Form F-2220 is being filed with your return, the amounts shown as penalty and interest should

be entered on appropriate line of Form F-1120

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1