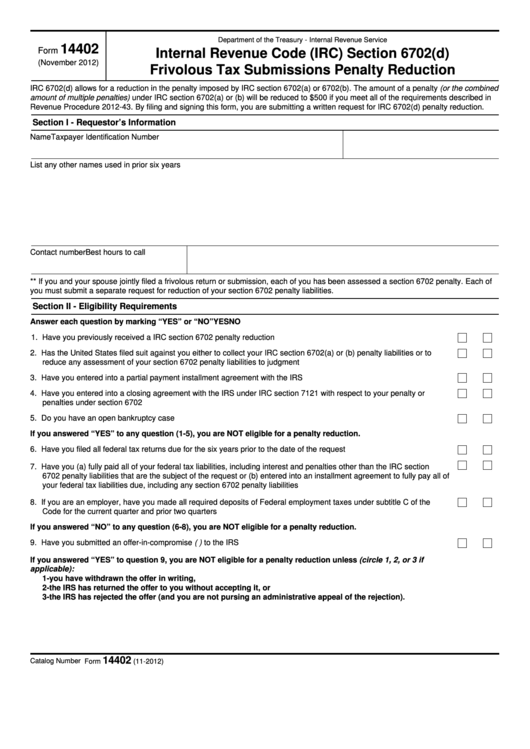

Department of the Treasury - Internal Revenue Service

14402

Form

Internal Revenue Code (IRC) Section 6702(d)

(November 2012)

Frivolous Tax Submissions Penalty Reduction

IRC 6702(d) allows for a reduction in the penalty imposed by IRC section 6702(a) or 6702(b). The amount of a penalty (or the combined

amount of multiple penalties) under IRC section 6702(a) or (b) will be reduced to $500 if you meet all of the requirements described in

Revenue Procedure 2012-43. By filing and signing this form, you are submitting a written request for IRC 6702(d) penalty reduction.

Section I - Requestor’s Information

Name

Taxpayer Identification Number

List any other names used in prior six years

Contact number

Best hours to call

** If you and your spouse jointly filed a frivolous return or submission, each of you has been assessed a section 6702 penalty. Each of

you must submit a separate request for reduction of your section 6702 penalty liabilities.

Section II - Eligibility Requirements

Answer each question by marking “YES” or “NO”

YES

NO

1. Have you previously received a IRC section 6702 penalty reduction

2. Has the United States filed suit against you either to collect your IRC section 6702(a) or (b) penalty liabilities or to

reduce any assessment of your section 6702 penalty liabilities to judgment

3. Have you entered into a partial payment installment agreement with the IRS

4. Have you entered into a closing agreement with the IRS under IRC section 7121 with respect to your penalty or

penalties under section 6702

5. Do you have an open bankruptcy case

If you answered “YES” to any question (1-5), you are NOT eligible for a penalty reduction.

6. Have you filed all federal tax returns due for the six years prior to the date of the request

7. Have you (a) fully paid all of your federal tax liabilities, including interest and penalties other than the IRC section

6702 penalty liabilities that are the subject of the request or (b) entered into an installment agreement to fully pay all of

your federal tax liabilities due, including any section 6702 penalty liabilities

8. If you are an employer, have you made all required deposits of Federal employment taxes under subtitle C of the

Code for the current quarter and prior two quarters

If you answered “NO” to any question (6-8), you are NOT eligible for a penalty reduction.

9. Have you submitted an offer-in-compromise (i.e. Form 656) to the IRS

If you answered “YES” to question 9, you are NOT eligible for a penalty reduction unless (circle 1, 2, or 3 if

applicable):

1-you have withdrawn the offer in writing,

2-the IRS has returned the offer to you without accepting it, or

3-the IRS has rejected the offer (and you are not pursing an administrative appeal of the rejection).

14402

Catalog Number 59694G

Form

(11-2012)

1

1 2

2 3

3 4

4