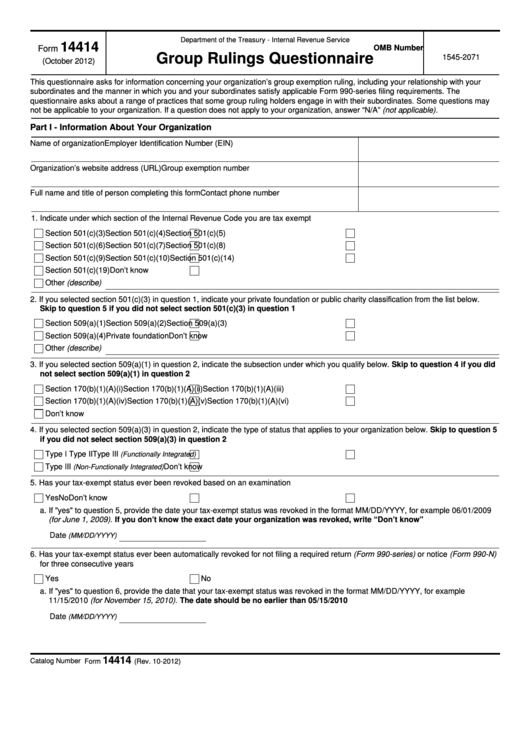

Department of the Treasury - Internal Revenue Service

14414

OMB Number

Form

Group Rulings Questionnaire

1545-2071

(October 2012)

This questionnaire asks for information concerning your organization’s group exemption ruling, including your relationship with your

subordinates and the manner in which you and your subordinates satisfy applicable Form 990-series filing requirements. The

questionnaire asks about a range of practices that some group ruling holders engage in with their subordinates. Some questions may

not be applicable to your organization. If a question does not apply to your organization, answer “N/A” (not applicable).

Part I - Information About Your Organization

Name of organization

Employer Identification Number (EIN)

Organization’s website address (URL)

Group exemption number

Full name and title of person completing this form

Contact phone number

1. Indicate under which section of the Internal Revenue Code you are tax exempt

Section 501(c)(3)

Section 501(c)(4)

Section 501(c)(5)

Section 501(c)(6)

Section 501(c)(7)

Section 501(c)(8)

Section 501(c)(9)

Section 501(c)(10)

Section 501(c)(14)

Section 501(c)(19)

Don’t know

Other (describe)

2. If you selected section 501(c)(3) in question 1, indicate your private foundation or public charity classification from the list below.

Skip to question 5 if you did not select section 501(c)(3) in question 1

Section 509(a)(1)

Section 509(a)(2)

Section 509(a)(3)

Section 509(a)(4)

Private foundation

Don’t know

Other (describe)

3. If you selected section 509(a)(1) in question 2, indicate the subsection under which you qualify below. Skip to question 4 if you did

not select section 509(a)(1) in question 2

Section 170(b)(1)(A)(i)

Section 170(b)(1)(A)(ii)

Section 170(b)(1)(A)(iii)

Section 170(b)(1)(A)(iv)

Section 170(b)(1)(A)(v)

Section 170(b)(1)(A)(vi)

Don’t know

4. If you selected section 509(a)(3) in question 2, indicate the type of status that applies to your organization below. Skip to question 5

if you did not select section 509(a)(3) in question 2

Type I

Type II

Type III

(Functionally Integrated)

Type III

Don’t know

(Non-Functionally Integrated)

5. Has your tax-exempt status ever been revoked based on an examination

Yes

No

Don’t know

a. If "yes" to question 5, provide the date your tax-exempt status was revoked in the format MM/DD/YYYY, for example 06/01/2009

(for June 1, 2009). If you don’t know the exact date your organization was revoked, write “Don’t know”

Date

(MM/DD/YYYY)

6. Has your tax-exempt status ever been automatically revoked for not filing a required return (Form 990-series) or notice (Form 990-N)

for three consecutive years

Yes

No

a. If "yes" to question 6, provide the date that your tax-exempt status was revoked in the format MM/DD/YYYY, for example

11/15/2010 (for November 15, 2010). The date should be no earlier than 05/15/2010

Date

(MM/DD/YYYY)

14414

Catalog Number 59845N

Form

(Rev. 10-2012)

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12