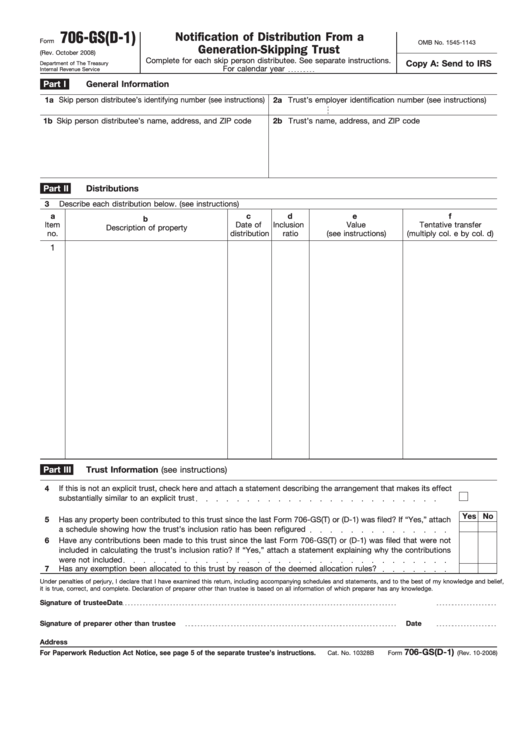

706-GS(D-1)

Notification of Distribution From a

Form

OMB No. 1545-1143

Generation-Skipping Trust

(Rev. October 2008)

Complete for each skip person distributee. See separate instructions.

Copy A: Send to IRS

Department of The Treasury

For calendar year

Internal Revenue Service

Part I

General Information

1a Skip person distributee’s identifying number (see instructions)

2a Trust’s employer identification number (see instructions)

1b Skip person distributee’s name, address, and ZIP code

2b Trust’s name, address, and ZIP code

Part II

Distributions

3

Describe each distribution below. (see instructions)

a

c

d

e

f

b

Item

Date of

Inclusion

Value

Tentative transfer

Description of property

no.

distribution

ratio

(see instructions)

(multiply col. e by col. d)

1

Part III

Trust Information (see instructions)

4

If this is not an explicit trust, check here and attach a statement describing the arrangement that makes its effect

substantially similar to an explicit trust

Yes

No

5

Has any property been contributed to this trust since the last Form 706-GS(T) or (D-1) was filed? If “Yes,” attach

a schedule showing how the trust’s inclusion ratio has been refigured

6

Have any contributions been made to this trust since the last Form 706-GS(T) or (D-1) was filed that were not

included in calculating the trust’s inclusion ratio? If “Yes,” attach a statement explaining why the contributions

were not included

7

Has any exemption been allocated to this trust by reason of the deemed allocation rules?

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief,

it is true, correct, and complete. Declaration of preparer other than trustee is based on all information of which preparer has any knowledge.

Signature of trustee

Date

Signature of preparer other than trustee

Date

Address

706-GS(D-1)

For Paperwork Reduction Act Notice, see page 5 of the separate trustee’s instructions.

Cat. No. 10328B

Form

(Rev. 10-2008)

1

1 2

2 3

3