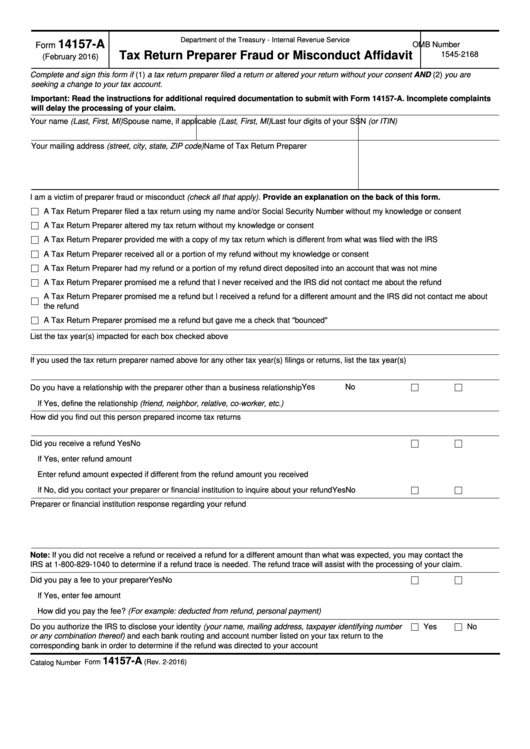

Department of the Treasury - Internal Revenue Service

14157-A

OMB Number

Form

Tax Return Preparer Fraud or Misconduct Affidavit

1545-2168

(February 2016)

Complete and sign this form if (1) a tax return preparer filed a return or altered your return without your consent AND (2) you are

seeking a change to your tax account.

Important: Read the instructions for additional required documentation to submit with Form 14157-A. Incomplete complaints

will delay the processing of your claim.

Your name (Last, First, MI)

Spouse name, if applicable (Last, First, MI)

Last four digits of your SSN (or ITIN)

Your mailing address (street, city, state, ZIP code)

Name of Tax Return Preparer

I am a victim of preparer fraud or misconduct (check all that apply). Provide an explanation on the back of this form.

A Tax Return Preparer filed a tax return using my name and/or Social Security Number without my knowledge or consent

A Tax Return Preparer altered my tax return without my knowledge or consent

A Tax Return Preparer provided me with a copy of my tax return which is different from what was filed with the IRS

A Tax Return Preparer received all or a portion of my refund without my knowledge or consent

A Tax Return Preparer had my refund or a portion of my refund direct deposited into an account that was not mine

A Tax Return Preparer promised me a refund that I never received and the IRS did not contact me about the refund

A Tax Return Preparer promised me a refund but I received a refund for a different amount and the IRS did not contact me about

the refund

A Tax Return Preparer promised me a refund but gave me a check that "bounced"

List the tax year(s) impacted for each box checked above

If you used the tax return preparer named above for any other tax year(s) filings or returns, list the tax year(s)

Yes

No

Do you have a relationship with the preparer other than a business relationship

If Yes, define the relationship (friend, neighbor, relative, co-worker, etc.)

How did you find out this person prepared income tax returns

Did you receive a refund

Yes

No

If Yes, enter refund amount

Enter refund amount expected if different from the refund amount you received

If No, did you contact your preparer or financial institution to inquire about your refund

Yes

No

Preparer or financial institution response regarding your refund

Note: If you did not receive a refund or received a refund for a different amount than what was expected, you may contact the

IRS at 1-800-829-1040 to determine if a refund trace is needed. The refund trace will assist with the processing of your claim.

Did you pay a fee to your preparer

Yes

No

If Yes, enter fee amount

How did you pay the fee? (For example: deducted from refund, personal payment)

Do you authorize the IRS to disclose your identity (your name, mailing address, taxpayer identifying number

Yes

No

or any combination thereof) and each bank routing and account number listed on your tax return to the

corresponding bank in order to determine if the refund was directed to your account

14157-A

Form

(Rev. 2-2016)

Catalog Number 59567Y

1

1 2

2 3

3