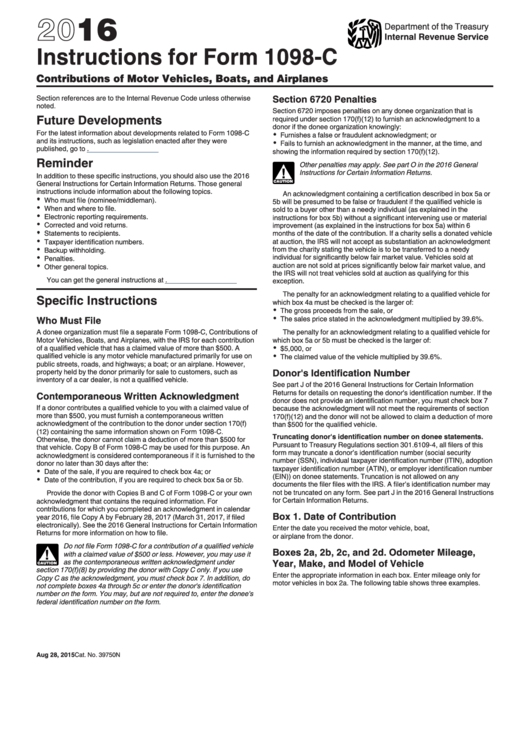

Instructions For Form 1098-C - Contributions Of Motor Vehicles, Boats, And Airplanes - 2016

ADVERTISEMENT

2016

Department of the Treasury

Internal Revenue Service

Instructions for Form 1098-C

Contributions of Motor Vehicles, Boats, and Airplanes

Section 6720 Penalties

Section references are to the Internal Revenue Code unless otherwise

noted.

Section 6720 imposes penalties on any donee organization that is

Future Developments

required under section 170(f)(12) to furnish an acknowledgment to a

donor if the donee organization knowingly:

For the latest information about developments related to Form 1098-C

Furnishes a false or fraudulent acknowledgment; or

and its instructions, such as legislation enacted after they were

Fails to furnish an acknowledgment in the manner, at the time, and

published, go to

showing the information required by section 170(f)(12).

Reminder

Other penalties may apply. See part O in the 2016 General

Instructions for Certain Information Returns.

!

In addition to these specific instructions, you should also use the 2016

General Instructions for Certain Information Returns. Those general

CAUTION

instructions include information about the following topics.

An acknowledgment containing a certification described in box 5a or

Who must file (nominee/middleman).

5b will be presumed to be false or fraudulent if the qualified vehicle is

When and where to file.

sold to a buyer other than a needy individual (as explained in the

Electronic reporting requirements.

instructions for box 5b) without a significant intervening use or material

Corrected and void returns.

improvement (as explained in the instructions for box 5a) within 6

Statements to recipients.

months of the date of the contribution. If a charity sells a donated vehicle

at auction, the IRS will not accept as substantiation an acknowledgment

Taxpayer identification numbers.

from the charity stating the vehicle is to be transferred to a needy

Backup withholding.

individual for significantly below fair market value. Vehicles sold at

Penalties.

auction are not sold at prices significantly below fair market value, and

Other general topics.

the IRS will not treat vehicles sold at auction as qualifying for this

You can get the general instructions at

exception.

The penalty for an acknowledgment relating to a qualified vehicle for

Specific Instructions

which box 4a must be checked is the larger of:

The gross proceeds from the sale, or

Who Must File

The sales price stated in the acknowledgment multiplied by 39.6%.

A donee organization must file a separate Form 1098-C, Contributions of

The penalty for an acknowledgment relating to a qualified vehicle for

Motor Vehicles, Boats, and Airplanes, with the IRS for each contribution

which box 5a or 5b must be checked is the larger of:

of a qualified vehicle that has a claimed value of more than $500. A

$5,000, or

qualified vehicle is any motor vehicle manufactured primarily for use on

The claimed value of the vehicle multiplied by 39.6%.

public streets, roads, and highways; a boat; or an airplane. However,

Donor's Identification Number

property held by the donor primarily for sale to customers, such as

inventory of a car dealer, is not a qualified vehicle.

See part J of the 2016 General Instructions for Certain Information

Returns for details on requesting the donor's identification number. If the

Contemporaneous Written Acknowledgment

donor does not provide an identification number, you must check box 7

If a donor contributes a qualified vehicle to you with a claimed value of

because the acknowledgment will not meet the requirements of section

more than $500, you must furnish a contemporaneous written

170(f)(12) and the donor will not be allowed to claim a deduction of more

acknowledgment of the contribution to the donor under section 170(f)

than $500 for the qualified vehicle.

(12) containing the same information shown on Form 1098-C.

Truncating donor's identification number on donee statements.

Otherwise, the donor cannot claim a deduction of more than $500 for

Pursuant to Treasury Regulations section 301.6109-4, all filers of this

that vehicle. Copy B of Form 1098-C may be used for this purpose. An

form may truncate a donor’s identification number (social security

acknowledgment is considered contemporaneous if it is furnished to the

number (SSN), individual taxpayer identification number (ITIN), adoption

donor no later than 30 days after the:

taxpayer identification number (ATIN), or employer identification number

Date of the sale, if you are required to check box 4a; or

(EIN)) on donee statements. Truncation is not allowed on any

Date of the contribution, if you are required to check box 5a or 5b.

documents the filer files with the IRS. A filer’s identification number may

not be truncated on any form. See part J in the 2016 General Instructions

Provide the donor with Copies B and C of Form 1098-C or your own

for Certain Information Returns.

acknowledgment that contains the required information. For

contributions for which you completed an acknowledgment in calendar

Box 1. Date of Contribution

year 2016, file Copy A by February 28, 2017 (March 31, 2017, if filed

electronically). See the 2016 General Instructions for Certain Information

Enter the date you received the motor vehicle, boat,

Returns for more information on how to file.

or airplane from the donor.

Do not file Form 1098-C for a contribution of a qualified vehicle

Boxes 2a, 2b, 2c, and 2d. Odometer Mileage,

with a claimed value of $500 or less. However, you may use it

!

Year, Make, and Model of Vehicle

as the contemporaneous written acknowledgment under

CAUTION

section 170(f)(8) by providing the donor with Copy C only. If you use

Enter the appropriate information in each box. Enter mileage only for

Copy C as the acknowledgment, you must check box 7. In addition, do

motor vehicles in box 2a. The following table shows three examples.

not complete boxes 4a through 5c or enter the donor's identification

number on the form. You may, but are not required to, enter the donee's

federal identification number on the form.

Aug 28, 2015

Cat. No. 39750N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2