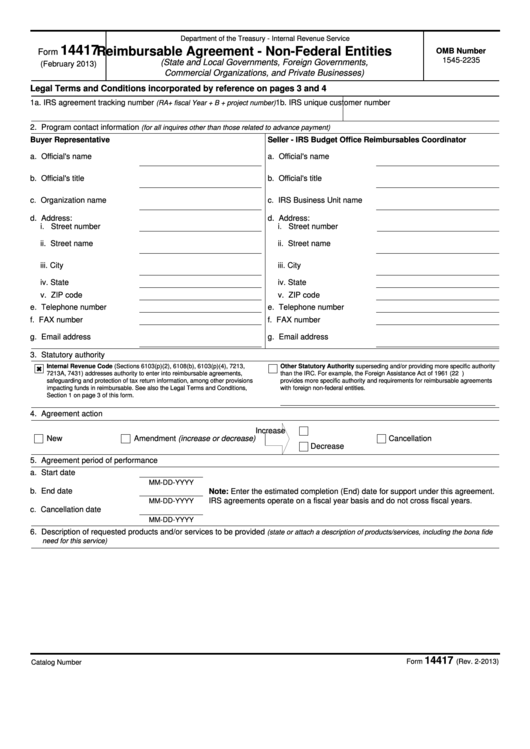

Department of the Treasury - Internal Revenue Service

14417

Reimbursable Agreement - Non-Federal Entities

OMB Number

Form

1545-2235

(State and Local Governments, Foreign Governments,

(February 2013)

Commercial Organizations, and Private Businesses)

Legal Terms and Conditions incorporated by reference on pages 3 and 4

1a. IRS agreement tracking number

1b. IRS unique customer number

(RA+ fiscal Year + B + project number)

2. Program contact information

(for all inquires other than those related to advance payment)

Buyer Representative

Seller - IRS Budget Office Reimbursables Coordinator

a. Official's name

a. Official's name

b. Official's title

b. Official's title

c. Organization name

c. IRS Business Unit name

d. Address:

d. Address:

i. Street number

i. Street number

ii. Street name

ii. Street name

iii. City

iii. City

iv. State

iv. State

v. ZIP code

v. ZIP code

e. Telephone number

e. Telephone number

f. FAX number

f. FAX number

g. Email address

g. Email address

3. Statutory authority

Internal Revenue Code (Sections 6103(p)(2), 6108(b), 6103(p)(4), 7213,

Other Statutory Authority superseding and/or providing more specific authority

7213A, 7431) addresses authority to enter into reimbursable agreements,

than the IRC. For example, the Foreign Assistance Act of 1961 (22 U.S.C. 2357)

safeguarding and protection of tax return information, among other provisions

provides more specific authority and requirements for reimbursable agreements

impacting funds in reimbursable. See also the Legal Terms and Conditions,

with foreign non-federal entities.

Section 1 on page 3 of this form.

4. Agreement action

Increase

New

Amendment (increase or decrease)

Cancellation

Decrease

5. Agreement period of performance

a. Start date

MM-DD-YYYY

b. End date

Note: Enter the estimated completion (End) date for support under this agreement.

IRS agreements operate on a fiscal year basis and do not cross fiscal years.

MM-DD-YYYY

c. Cancellation date

MM-DD-YYYY

6. Description of requested products and/or services to be provided

(state or attach a description of products/services, including the bona fide

need for this service)

14417

Form

(Rev. 2-2013)

Catalog Number 59893X

1

1 2

2 3

3 4

4 5

5 6

6