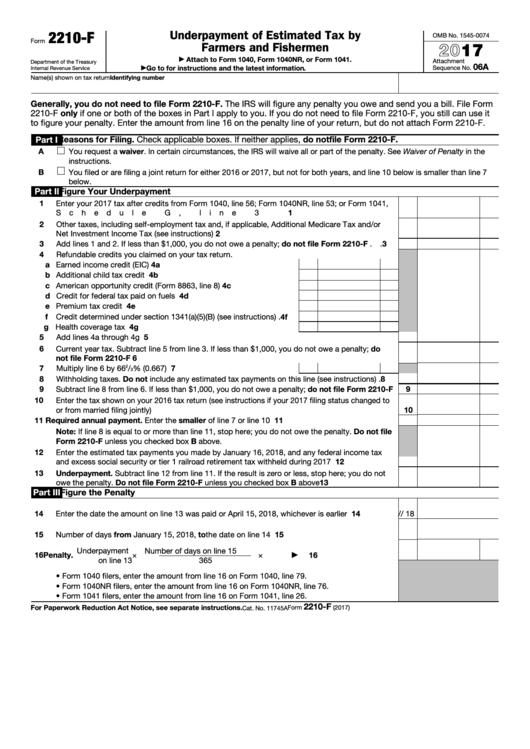

2210-F

Underpayment of Estimated Tax by

OMB No. 1545-0074

Form

2017

Farmers and Fishermen

Attach to Form 1040, Form 1040NR, or Form 1041.

▶

Attachment

Department of the Treasury

06A

Go to for instructions and the latest information.

Sequence No.

Internal Revenue Service

▶

Identifying number

Name(s) shown on tax return

Generally, you do not need to file Form 2210-F. The IRS will figure any penalty you owe and send you a bill. File Form

2210-F only if one or both of the boxes in Part I apply to you. If you do not need to file Form 2210-F, you still can use it

to figure your penalty. Enter the amount from line 16 on the penalty line of your return, but do not attach Form 2210-F.

Reasons for Filing. Check applicable boxes. If neither applies, do not file Form 2210-F.

Part I

A

You request a waiver. In certain circumstances, the IRS will waive all or part of the penalty. See Waiver of Penalty in the

instructions.

B

You filed or are filing a joint return for either 2016 or 2017, but not for both years, and line 10 below is smaller than line 7

below.

Part II

Figure Your Underpayment

1

Enter your 2017 tax after credits from Form 1040, line 56; Form 1040NR, line 53; or Form 1041,

Schedule G, line 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1

2

Other taxes, including self-employment tax and, if applicable, Additional Medicare Tax and/or

Net Investment Income Tax (see instructions) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

2

3

Add lines 1 and 2. If less than $1,000, you do not owe a penalty; do not file Form 2210-F .

.

3

4

Refundable credits you claimed on your tax return.

a Earned income credit (EIC) .

.

.

.

.

.

.

.

.

.

.

.

.

4a

b Additional child tax credit

.

.

.

.

.

.

.

.

.

.

.

.

.

4b

c American opportunity credit (Form 8863, line 8)

4c

.

.

.

.

.

.

d Credit for federal tax paid on fuels .

4d

.

.

.

.

.

.

.

.

.

.

e Premium tax credit .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4e

f Credit determined under section 1341(a)(5)(B) (see instructions) .

4f

g Health coverage tax credit .

4g

.

.

.

.

.

.

.

.

.

.

.

.

5

Add lines 4a through 4g .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

6

Current year tax. Subtract line 5 from line 3. If less than $1,000, you do not owe a penalty; do

not file Form 2210-F .

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Multiply line 6 by 66

/

% (0.667)

.

.

.

.

.

.

.

.

.

.

.

7

2

3

8

Withholding taxes. Do not include any estimated tax payments on this line (see instructions)

.

8

9

Subtract line 8 from line 6. If less than $1,000, you do not owe a penalty; do not file Form 2210-F

9

10

Enter the tax shown on your 2016 tax return (see instructions if your 2017 filing status changed to

or from married filing jointly) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Required annual payment. Enter the smaller of line 7 or line 10

.

.

.

.

.

.

.

.

.

.

11

Note: If line 8 is equal to or more than line 11, stop here; you do not owe the penalty. Do not file

Form 2210-F unless you checked box B above.

12

Enter the estimated tax payments you made by January 16, 2018, and any federal income tax

12

and excess social security or tier 1 railroad retirement tax withheld during 2017 .

.

.

.

.

.

13

Underpayment. Subtract line 12 from line 11. If the result is zero or less, stop here; you do not

owe the penalty. Do not file Form 2210-F unless you checked box B above

.

.

.

.

.

.

13

Part III

Figure the Penalty

14

Enter the date the amount on line 13 was paid or April 15, 2018, whichever is earlier .

.

.

.

14

/

/ 18

15

Number of days from January 15, 2018, to the date on line 14

15

.

.

.

.

.

.

.

.

.

.

.

Underpayment

Number of days on line 15

16

Penalty.

×

× 0.04.

.

.

.

.

.

.

.

.

.

16

▶

on line 13

365

• Form 1040 filers, enter the amount from line 16 on Form 1040, line 79.

• Form 1040NR filers, enter the amount from line 16 on Form 1040NR, line 76.

• Form 1041 filers, enter the amount from line 16 on Form 1041, line 26.

2210-F

For Paperwork Reduction Act Notice, see separate instructions.

Form

(2017)

Cat. No. 11745A

1

1