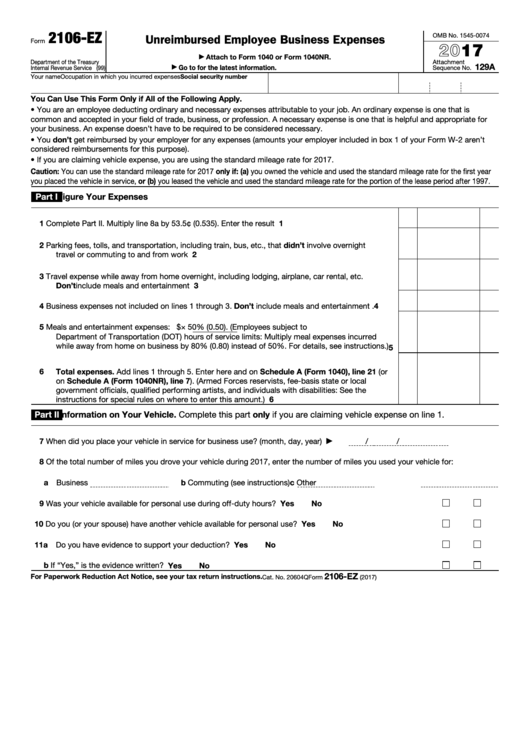

2106-EZ

OMB No. 1545-0074

Unreimbursed Employee Business Expenses

Form

2017

Attach to Form 1040 or Form 1040NR.

▶

Department of the Treasury

Attachment

129A

Go to for the latest information.

Internal Revenue Service (99)

Sequence No.

▶

Your name

Occupation in which you incurred expenses

Social security number

You Can Use This Form Only if All of the Following Apply.

• You are an employee deducting ordinary and necessary expenses attributable to your job. An ordinary expense is one that is

common and accepted in your field of trade, business, or profession. A necessary expense is one that is helpful and appropriate for

your business. An expense doesn’t have to be required to be considered necessary.

• You don’t get reimbursed by your employer for any expenses (amounts your employer included in box 1 of your Form W-2 aren’t

considered reimbursements for this purpose).

• If you are claiming vehicle expense, you are using the standard mileage rate for 2017.

Caution: You can use the standard mileage rate for 2017 only if: (a) you owned the vehicle and used the standard mileage rate for the first year

you placed the vehicle in service, or (b) you leased the vehicle and used the standard mileage rate for the portion of the lease period after 1997.

Part I

Figure Your Expenses

1

1

Complete Part II. Multiply line 8a by 53.5¢ (0.535). Enter the result here

.

.

.

.

.

.

.

.

2

Parking fees, tolls, and transportation, including train, bus, etc., that didn’t involve overnight

2

travel or commuting to and from work

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

Travel expense while away from home overnight, including lodging, airplane, car rental, etc.

Don’t include meals and entertainment .

3

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Business expenses not included on lines 1 through 3. Don’t include meals and entertainment .

4

5

Meals and entertainment expenses: $

× 50% (0.50). (Employees subject to

Department of Transportation (DOT) hours of service limits: Multiply meal expenses incurred

while away from home on business by 80% (0.80) instead of 50%. For details, see instructions.)

5

6

Total expenses. Add lines 1 through 5. Enter here and on Schedule A (Form 1040), line 21 (or

on Schedule A (Form 1040NR), line 7). (Armed Forces reservists, fee-basis state or local

government officials, qualified performing artists, and individuals with disabilities: See the

6

instructions for special rules on where to enter this amount.) .

.

.

.

.

.

.

.

.

.

.

.

Part II

Information on Your Vehicle. Complete this part only if you are claiming vehicle expense on line 1.

7

When did you place your vehicle in service for business use? (month, day, year)

/

/

▶

8

Of the total number of miles you drove your vehicle during 2017, enter the number of miles you used your vehicle for:

a Business

b Commuting (see instructions)

c Other

9

Was your vehicle available for personal use during off-duty hours? .

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

10

Do you (or your spouse) have another vehicle available for personal use? .

.

.

.

.

.

.

.

.

.

.

.

Yes

No

11a Do you have evidence to support your deduction?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

b If “Yes,” is the evidence written? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Yes

No

2106-EZ

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 20604Q

Form

(2017)

1

1 2

2 3

3 4

4