2

Form 5305-E (Rev. 10-2016)

Page

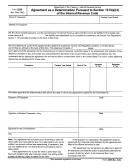

Article VI

The responsible individual

may or

may not change the beneficiary designated under this agreement to another member of the

designated beneficiary’s family described in section 529(e)(2) in accordance with the trustee’s procedures.

Article VII

1. The grantor agrees to provide the trustee with all information necessary to prepare any reports required by section 530(h).

2. The trustee agrees to submit to the Internal Revenue Service (IRS) and responsible individual the reports prescribed by the IRS.

Article VIII

Notwithstanding any other articles which may be added or incorporated, the provisions of Articles I through III will be controlling. Any

additional articles inconsistent with section 530 and the related regulations will be invalid.

Article IX

This agreement will be amended as necessary to comply with the provisions of the Code and the related regulations. Other amendments

may be made with the consent of the grantor and trustee whose signatures appear below.

Article X

Article X may be used for any additional provisions. If no other provisions will be added, draw a line through this space. If provisions are

added, they must comply with applicable requirements of state law and the Internal Revenue Code.

Grantor’s signature

Date

Trustee’s signature

Date

Witness’ signature

Date

(Use only if signature of the grantor or the trustee is required to be witnessed.)

General Instructions

section 408(n), or any person who has the

beneficiary is a nonresident alien, the

approval of the IRS to act as trustee. Any

designated beneficiary’s individual taxpayer

Section references are to the Internal

person who may serve as a trustee of a

identification number is the identification

Revenue Code unless otherwise noted.

traditional IRA may serve as the trustee of a

number of his or her Coverdell ESA. An

Coverdell ESA.

employer identification number (EIN) is

What's New

required only for a Coverdell ESA for which a

Grantor. The grantor is the person who

Military death gratuity. Families of soldiers

return is filed to report unrelated business

establishes the trust account.

who receive military death benefits may

income. An EIN is required for a common fund

contribute, subject to certain limitations, up to

Designated beneficiary. The designated

created for Coverdell ESAs.

100 percent of such benefits into an

beneficiary is the individual on whose behalf

educational savings account. Publication 970,

the trust account has been established.

Specific Instructions

Tax Benefits for Education, explains the rules

Family member. Family members of the

Note: The age limitation restricting

for rolling over the military death gratuity and

designated beneficiary include his or her

contributions, distributions, rollover

lists eligible family members.

spouse, child, grandchild, sibling, parent,

contributions, and change of beneficiary are

niece or nephew, son-in-law, daughter-in-law,

Purpose of Form

waived for a designated beneficiary with

father-in-law, mother-in-law, brother-in-law,

special needs.

Form 5305-E is a model trust account

or sister-in-law, and the spouse of any such

agreement that meets the requirements of

Article X. Article X and any that follow may

individual. A first cousin, but not his or her

section 530(b)(1) and has been pre-approved

incorporate additional provisions that are

spouse, is also a “family member.”

by the IRS. A Coverdell education savings

agreed to by the grantor and trustee to

Responsible individual. The responsible

account (ESA) is established after the form is

complete the agreement. They may include,

individual, generally, is a parent or guardian of

fully executed by both the grantor and the

for example, provisions relating to: definitions,

the designated beneficiary. However, under

trustee. This account must be created in the

investment powers, voting rights, exculpatory

certain circumstances, the responsible

United States for the exclusive purpose of

provisions, amendment and termination,

individual may be the designated beneficiary.

paying the qualified elementary, secondary,

removal of the trustee, trustee’s fees, state

and higher education expenses of the

Identification Numbers

law requirements, treatment of excess

designated beneficiary.

contributions, and prohibited transactions

The grantor and designated beneficiary’s

with the grantor, designated beneficiary, or

If the model account is a custodial account,

social security numbers will serve as their

responsible individual, etc. Attach additional

see Form 5305-EA, Coverdell Education

identification numbers. If the grantor is a

pages as necessary.

Savings Custodial Account.

nonresident alien and does not have an

identification number, write “Foreign” on the

Optional provisions in Article V and Article

Do not file Form 5305-E with the IRS.

return for which is filed to report the grantor's

VI. Form 5305-E may be reproduced in a

Instead, the grantor must keep the completed

information. The designated beneficiary’s

manner that provides only those optional

form in its records.

social security number is the identification

provisions offered by the trustee.

Definitions

number of his or her Coverdell ESA. If the

designated

Trustee. The trustee must be a bank or

savings and loan association, as defined in

5305-E

Form

(Rev. 10-2016)

1

1 2

2