Form Approved

Social Security Administration

OMB No. 0960-0561

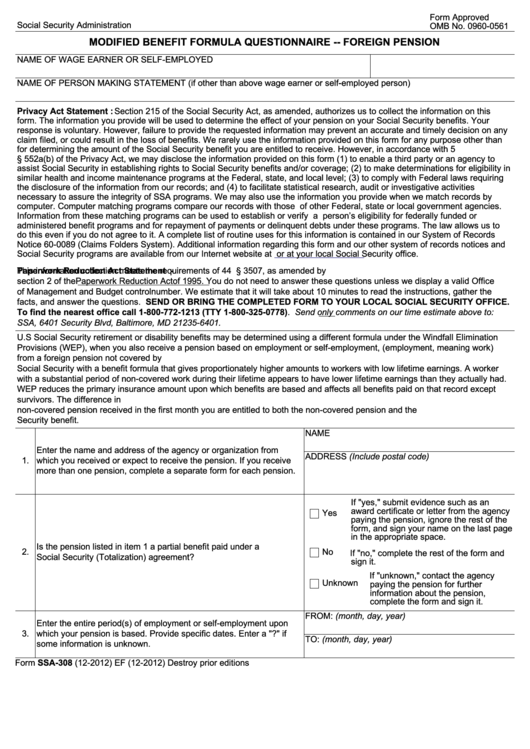

MODIFIED BENEFIT FORMULA QUESTIONNAIRE -- FOREIGN PENSION

NAME OF WAGE EARNER OR SELF-EMPLOYED PERSON

U.S. SOCIAL SECURITY NUMBER

NAME OF PERSON MAKING STATEMENT (if other than above wage earner or self-employed person)

Privacy Act Statement :

Section 215 of the Social Security Act, as amended, authorizes us to collect the information on this

form. The information you provide will be used to determine the effect of your pension on your Social Security benefits. Your

response is voluntary. However, failure to provide the requested information may prevent an accurate and timely decision on any

claim filed, or could result in the loss of benefits. We rarely use the information provided on this form for any purpose other than

for determining the amount of the Social Security benefit you are entitled to receive. However, in accordance with 5 U.S.C.

§ 552a(b) of the Privacy Act, we may disclose the information provided on this form (1) to enable a third party or an agency to

assist Social Security in establishing rights to Social Security benefits and/or coverage; (2) to make determinations for eligibility in

similar health and income maintenance programs at the Federal, state, and local level; (3) to comply with Federal laws requiring

the disclosure of the information from our records; and (4) to facilitate statistical research, audit or investigative activities

necessary to assure the integrity of SSA programs. We may also use the information you provide when we match records by

computer. Computer matching programs compare our records with those of other Federal, state or local government agencies.

Information from these matching programs can be used to establish or verify a person’s eligibility for federally funded or

administered benefit programs and for repayment of payments or delinquent debts under these programs. The law allows us to

do this even if you do not agree to it. A complete list of routine uses for this information is contained in our System of Records

Notice 60-0089 (Claims Folders System). Additional information regarding this form and our other system of records notices and

Social Security programs are available from our Internet website at

or at your local Social Security office.

Paperwork Reduction Act Statement -

This information collection meets the requirements of 44 U.S.C. § 3507, as amended by

section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office

of Management and Budget control number. We estimate that it will take about 10 minutes to read the instructions, gather the

facts, and answer the questions. SEND OR BRING THE COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE.

To find the nearest office call 1-800-772-1213 (TTY 1-800-325-0778). Send only comments on our time estimate above to:

SSA, 6401 Security Blvd, Baltimore, MD 21235-6401.

U.S Social Security retirement or disability benefits may be determined using a different formula under the Windfall Elimination

Provisions (WEP), when you also receive a pension based on employment or self-employment, (employment, meaning work)

from a foreign pension not covered by U.S. Social Security. Social Security benefit amounts use only earnings covered under

Social Security with a benefit formula that gives proportionately higher amounts to workers with low lifetime earnings. A worker

with a substantial period of non-covered work during their lifetime appears to have lower lifetime earnings than they actually had.

WEP reduces the primary insurance amount upon which benefits are based and affects all benefits paid on that record except

survivors. The difference in U.S. Social Security benefits computed under WEP cannot be greater than one-half the amount of the

non-covered pension received in the first month you are entitled to both the non-covered pension and the U.S. Social

Security benefit.

NAME

Enter the name and address of the agency or organization from

ADDRESS (Include postal code)

1.

which you received or expect to receive the pension. If you receive

more than one pension, complete a separate form for each pension.

If "yes," submit evidence such as an

award certificate or letter from the agency

Yes

paying the pension, ignore the rest of the

form, and sign your name on the last page

in the appropriate space.

Is the pension listed in item 1 a partial benefit paid under a U.S.

2.

No

If "no," complete the rest of the form and

Social Security (Totalization) agreement?

sign it.

If "unknown," contact the agency

Unknown

paying the pension for further

information about the pension,

complete the form and sign it.

FROM: (month, day, year)

Enter the entire period(s) of employment or self-employment upon

3.

which your pension is based. Provide specific dates. Enter a "?" if

TO: (month, day, year)

some information is unknown.

Form SSA-308 (12-2012) EF (12-2012) Destroy prior editions

1

1 2

2