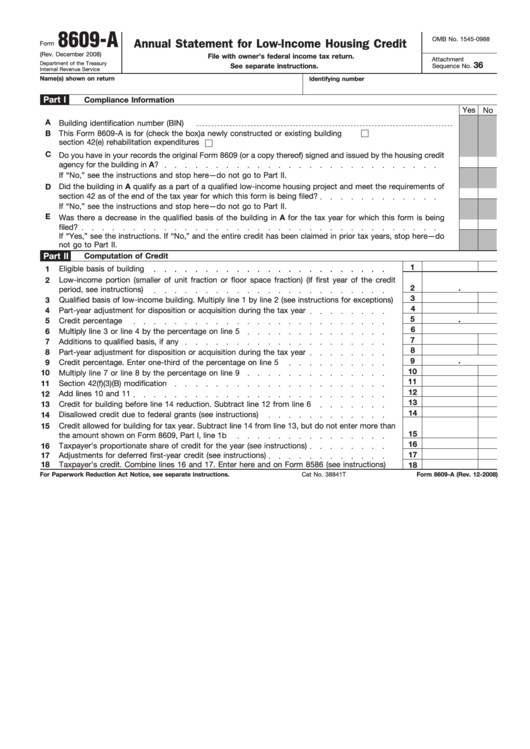

8609-A

OMB No. 1545-0988

Annual Statement for Low-Income Housing Credit

Form

(Rev. December 2008)

File with owner’s federal income tax return.

Attachment

Department of the Treasury

36

See separate instructions.

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

Part I

Compliance Information

Yes No

A

Building identification number (BIN)

B

This Form 8609-A is for (check the box)

a newly constructed or existing building

section 42(e) rehabilitation expenditures

C

Do you have in your records the original Form 8609 (or a copy thereof) signed and issued by the housing credit

agency for the building in A?

If “No,” see the instructions and stop here—do not go to Part II.

Did the building in A qualify as a part of a qualified low-income housing project and meet the requirements of

D

section 42 as of the end of the tax year for which this form is being filed?

If “No,” see the instructions and stop here—do not go to Part II.

E

Was there a decrease in the qualified basis of the building in A for the tax year for which this form is being

filed?

If “Yes,” see the instructions. If “No,” and the entire credit has been claimed in prior tax years, stop here—do

not go to Part II.

Part II

Computation of Credit

1

1

Eligible basis of building

2

Low-income portion (smaller of unit fraction or floor space fraction) (if first year of the credit

2

.

period, see instructions)

3

3

Qualified basis of low-income building. Multiply line 1 by line 2 (see instructions for exceptions)

4

Part-year adjustment for disposition or acquisition during the tax year

4

5

.

5

Credit percentage

6

6

Multiply line 3 or line 4 by the percentage on line 5

7

7

Additions to qualified basis, if any

8

8

Part-year adjustment for disposition or acquisition during the tax year

9

.

9

Credit percentage. Enter one-third of the percentage on line 5

10

10

Multiply line 7 or line 8 by the percentage on line 9

11

11

Section 42(f)(3)(B) modification

12

12

Add lines 10 and 11

13

Credit for building before line 14 reduction. Subtract line 12 from line 6

13

14

14

Disallowed credit due to federal grants (see instructions)

15

Credit allowed for building for tax year. Subtract line 14 from line 13, but do not enter more than

15

the amount shown on Form 8609, Part I, line 1b

16

16

Taxpayer’s proportionate share of credit for the year (see instructions)

17

17

Adjustments for deferred first-year credit (see instructions)

18

Taxpayer’s credit. Combine lines 16 and 17. Enter here and on Form 8586 (see instructions)

18

For Paperwork Reduction Act Notice, see separate instructions.

Cat No. 38841T

Form 8609-A (Rev. 12-2008)

1

1