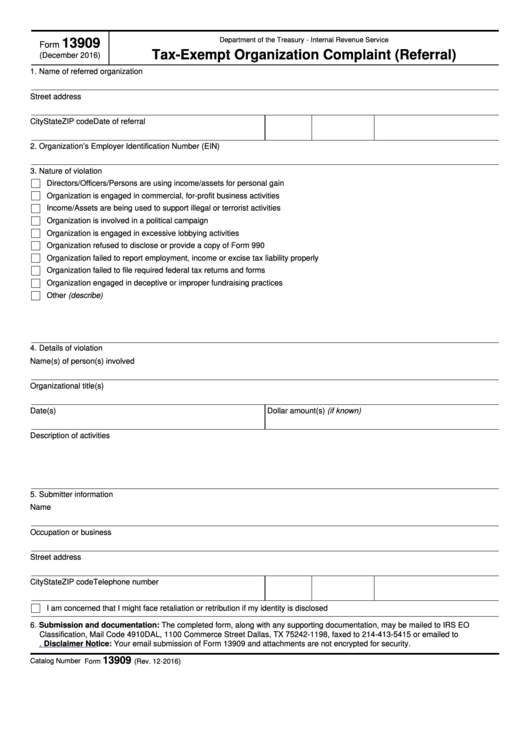

Department of the Treasury - Internal Revenue Service

13909

Form

Tax-Exempt Organization Complaint (Referral)

(December 2016)

1. Name of referred organization

Street address

City

State

ZIP code

Date of referral

2. Organization’s Employer Identification Number (EIN)

3. Nature of violation

Directors/Officers/Persons are using income/assets for personal gain

Organization is engaged in commercial, for-profit business activities

Income/Assets are being used to support illegal or terrorist activities

Organization is involved in a political campaign

Organization is engaged in excessive lobbying activities

Organization refused to disclose or provide a copy of Form 990

Organization failed to report employment, income or excise tax liability properly

Organization failed to file required federal tax returns and forms

Organization engaged in deceptive or improper fundraising practices

Other (describe)

4. Details of violation

Name(s) of person(s) involved

Organizational title(s)

Date(s)

Dollar amount(s) (if known)

Description of activities

5. Submitter information

Name

Occupation or business

Street address

City

State

ZIP code

Telephone number

I am concerned that I might face retaliation or retribution if my identity is disclosed

6. Submission and documentation: The completed form, along with any supporting documentation, may be mailed to IRS EO

Classification, Mail Code 4910DAL, 1100 Commerce Street Dallas, TX 75242-1198, faxed to 214-413-5415 or emailed to

eoclass@irs.gov. Disclaimer Notice: Your email submission of Form 13909 and attachments are not encrypted for security.

13909

Catalog Number 50614A

Form

(Rev. 12-2016)

1

1 2

2