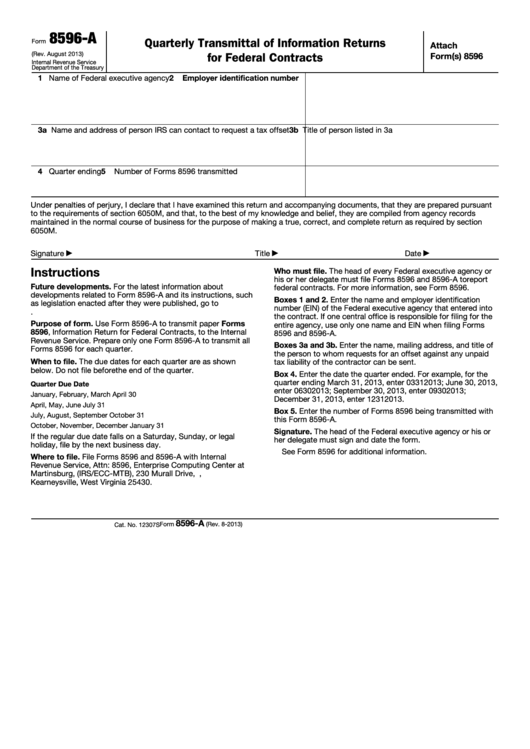

8596-A

Quarterly Transmittal of Information Returns

Attach

Form

(Rev. August 2013)

for Federal Contracts

Form(s) 8596

Internal Revenue Service

Department of the Treasury

1 Name of Federal executive agency

2

Employer identification number

3a Name and address of person IRS can contact to request a tax offset

3b Title of person listed in 3a

4 Quarter ending

5

Number of Forms 8596 transmitted

Under penalties of perjury, I declare that I have examined this return and accompanying documents, that they are prepared pursuant

to the requirements of section 6050M, and that, to the best of my knowledge and belief, they are compiled from agency records

maintained in the normal course of business for the purpose of making a true, correct, and complete return as required by section

6050M.

Signature

Title

Date

▶

▶

▶

Instructions

Who must file. The head of every Federal executive agency or

his or her delegate must file Forms 8596 and 8596-A to report

Future developments. For the latest information about

federal contracts. For more information, see Form 8596.

developments related to Form 8596-A and its instructions, such

Boxes 1 and 2. Enter the name and employer identification

as legislation enacted after they were published, go to

number (EIN) of the Federal executive agency that entered into

the contract. If one central office is responsible for filing for the

Purpose of form. Use Form 8596-A to transmit paper Forms

entire agency, use only one name and EIN when filing Forms

8596, Information Return for Federal Contracts, to the Internal

8596 and 8596-A.

Revenue Service. Prepare only one Form 8596-A to transmit all

Boxes 3a and 3b. Enter the name, mailing address, and title of

Forms 8596 for each quarter.

the person to whom requests for an offset against any unpaid

When to file. The due dates for each quarter are as shown

tax liability of the contractor can be sent.

below. Do not file before the end of the quarter.

Box 4. Enter the date the quarter ended. For example, for the

quarter ending March 31, 2013, enter 03312013; June 30, 2013,

Quarter

Due Date

enter 06302013; September 30, 2013, enter 09302013;

January, February, March

April 30

December 31, 2013, enter 12312013.

April, May, June

July 31

Box 5. Enter the number of Forms 8596 being transmitted with

July, August, September

October 31

this Form 8596-A.

October, November, December

January 31

Signature. The head of the Federal executive agency or his or

If the regular due date falls on a Saturday, Sunday, or legal

her delegate must sign and date the form.

holiday, file by the next business day.

See Form 8596 for additional information.

Where to file. File Forms 8596 and 8596-A with Internal

Revenue Service, Attn: 8596, Enterprise Computing Center at

Martinsburg, (IRS/ECC-MTB), 230 Murall Drive, P.O. Box 1359,

Kearneysville, West Virginia 25430.

8596-A

Form

(Rev. 8-2013)

Cat. No. 12307S

1

1