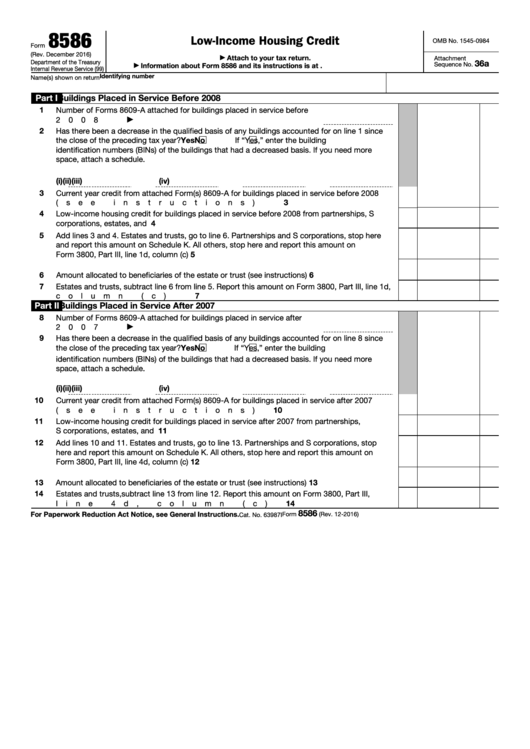

8586

Low-Income Housing Credit

OMB No. 1545-0984

Form

(Rev. December 2016)

Attach to your tax return.

▶

Attachment

Department of the Treasury

36a

Sequence No.

Information about Form 8586 and its instructions is at

▶

Internal Revenue Service (99)

Identifying number

Name(s) shown on return

Part I

Buildings Placed in Service Before 2008

1

Number of Forms 8609-A attached for buildings placed in service before

2008

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

2

Has there been a decrease in the qualified basis of any buildings accounted for on line 1 since

the close of the preceding tax year?

Yes

No

If “Yes,” enter the building

identification numbers (BINs) of the buildings that had a decreased basis. If you need more

space, attach a schedule.

(i)

(ii)

(iii)

(iv)

3

Current year credit from attached Form(s) 8609-A for buildings placed in service before 2008

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

3

4

Low-income housing credit for buildings placed in service before 2008 from partnerships, S

4

corporations, estates, and trusts .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5

Add lines 3 and 4. Estates and trusts, go to line 6. Partnerships and S corporations, stop here

and report this amount on Schedule K. All others, stop here and report this amount on

5

Form 3800, Part III, line 1d, column (c)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

6

Amount allocated to beneficiaries of the estate or trust (see instructions) .

.

.

.

.

.

.

.

6

7

Estates and trusts, subtract line 6 from line 5. Report this amount on Form 3800, Part III, line 1d,

7

column (c)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

Part II

Buildings Placed in Service After 2007

8

Number of Forms 8609-A attached for buildings placed in service after

2007

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

9

Has there been a decrease in the qualified basis of any buildings accounted for on line 8 since

the close of the preceding tax year?

Yes

No

If “Yes,” enter the building

identification numbers (BINs) of the buildings that had a decreased basis. If you need more

space, attach a schedule.

(i)

(ii)

(iii)

(iv)

10

Current year credit from attached Form(s) 8609-A for buildings placed in service after 2007

(see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Low-income housing credit for buildings placed in service after 2007 from partnerships,

11

S corporations, estates, and trusts.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

Add lines 10 and 11. Estates and trusts, go to line 13. Partnerships and S corporations, stop

here and report this amount on Schedule K. All others, stop here and report this amount on

12

Form 3800, Part III, line 4d, column (c)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

Amount allocated to beneficiaries of the estate or trust (see instructions) .

.

.

.

.

.

.

.

13

14

Estates and trusts, subtract line 13 from line 12. Report this amount on Form 3800, Part III,

line 4d, column (c) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

14

8586

For Paperwork Reduction Act Notice, see General Instructions.

Form

(Rev. 12-2016)

Cat. No. 63987I

1

1 2

2