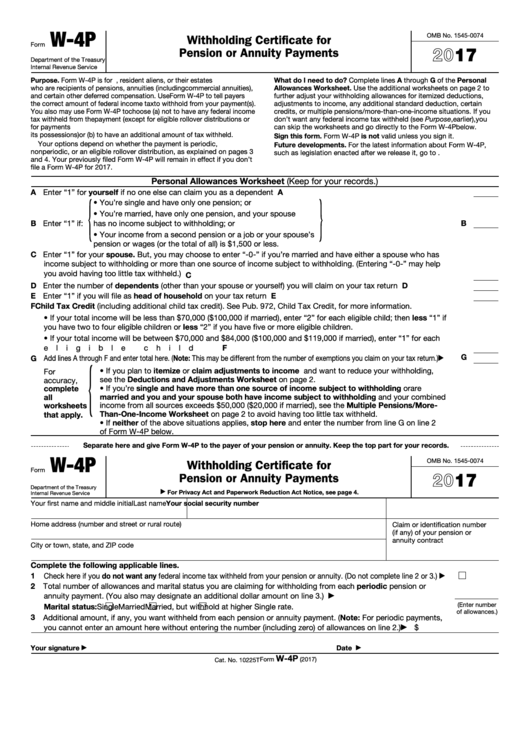

W-4P

OMB No. 1545-0074

Withholding Certificate for

Form

2017

Pension or Annuity Payments

Department of the Treasury

Internal Revenue Service

Purpose. Form W-4P is for U.S. citizens, resident aliens, or their estates

What do I need to do? Complete lines A through G of the Personal

who are recipients of pensions, annuities (including commercial annuities),

Allowances Worksheet. Use the additional worksheets on page 2 to

and certain other deferred compensation. Use Form W-4P to tell payers

further adjust your withholding allowances for itemized deductions,

the correct amount of federal income tax to withhold from your payment(s).

adjustments to income, any additional standard deduction, certain

You also may use Form W-4P to choose (a) not to have any federal income

credits, or multiple pensions/more-than-one-income situations. If you

tax withheld from the payment (except for eligible rollover distributions or

don’t want any federal income tax withheld (see Purpose, earlier), you

for payments to U.S. citizens to be delivered outside the United States or

can skip the worksheets and go directly to the Form W-4P below.

its possessions) or (b) to have an additional amount of tax withheld.

Sign this form. Form W-4P is not valid unless you sign it.

Your options depend on whether the payment is periodic,

Future developments. For the latest information about Form W-4P,

nonperiodic, or an eligible rollover distribution, as explained on pages 3

such as legislation enacted after we release it, go to

and 4. Your previously filed Form W-4P will remain in effect if you don’t

file a Form W-4P for 2017.

Personal Allowances Worksheet (Keep for your records.)

A Enter “1” for yourself if no one else can claim you as a dependent .

A

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

{

}

• You’re single and have only one pension; or

• You’re married, have only one pension, and your spouse

B Enter “1” if:

has no income subject to withholding; or

.

.

.

.

.

.

.

.

.

.

.

B

• Your income from a second pension or a job or your spouse’s

pension or wages (or the total of all) is $1,500 or less.

C Enter “1” for your spouse. But, you may choose to enter “-0-” if you’re married and have either a spouse who has

income subject to withholding or more than one source of income subject to withholding. (Entering “-0-” may help

you avoid having too little tax withheld.) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

C

D Enter the number of dependents (other than your spouse or yourself) you will claim on your tax return .

.

.

.

D

E Enter “1” if you will file as head of household on your tax return .

E

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

F Child Tax Credit (including additional child tax credit). See Pub. 972, Child Tax Credit, for more information.

• If your total income will be less than $70,000 ($100,000 if married), enter “2” for each eligible child; then less “1” if

you have two to four eligible children or less “2” if you have five or more eligible children.

• If your total income will be between $70,000 and $84,000 ($100,000 and $119,000 if married), enter “1” for each

eligible child .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

F

{

G

G Add lines A through F and enter total here. (Note: This may be different from the number of exemptions you claim on your tax return.)

▶

• If you plan to itemize or claim adjustments to income and want to reduce your withholding,

For

see the Deductions and Adjustments Worksheet on page 2.

accuracy,

• If you’re single and have more than one source of income subject to withholding or are

complete

married and you and your spouse both have income subject to withholding and your combined

all

income from all sources exceeds $50,000 ($20,000 if married), see the Multiple Pensions/More-

worksheets

Than-One-Income Worksheet on page 2 to avoid having too little tax withheld.

that apply.

• If neither of the above situations applies, stop here and enter the number from line G on line 2

of Form W-4P below.

Separate here and give Form W-4P to the payer of your pension or annuity. Keep the top part for your records.

W-4P

OMB No. 1545-0074

Withholding Certificate for

Form

2017

Pension or Annuity Payments

Department of the Treasury

For Privacy Act and Paperwork Reduction Act Notice, see page 4.

▶

Internal Revenue Service

Your first name and middle initial

Last name

Your social security number

Home address (number and street or rural route)

Claim or identification number

(if any) of your pension or

annuity contract

City or town, state, and ZIP code

Complete the following applicable lines.

1 Check here if you do not want any federal income tax withheld from your pension or annuity. (Do not complete line 2 or 3.)

▶

2 Total number of allowances and marital status you are claiming for withholding from each periodic pension or

annuity payment. (You also may designate an additional dollar amount on line 3.)

.

.

.

.

.

.

.

.

.

.

.

▶

(Enter number

Marital status:

Single

Married

Married, but withhold at higher Single rate.

of allowances.)

3 Additional amount, if any, you want withheld from each pension or annuity payment. (Note: For periodic payments,

you cannot enter an amount here without entering the number (including zero) of allowances on line 2.)

$

.

.

.

. ▶

Your signature

Date

▶

▶

W-4P

Form

(2017)

Cat. No. 10225T

1

1 2

2 3

3 4

4