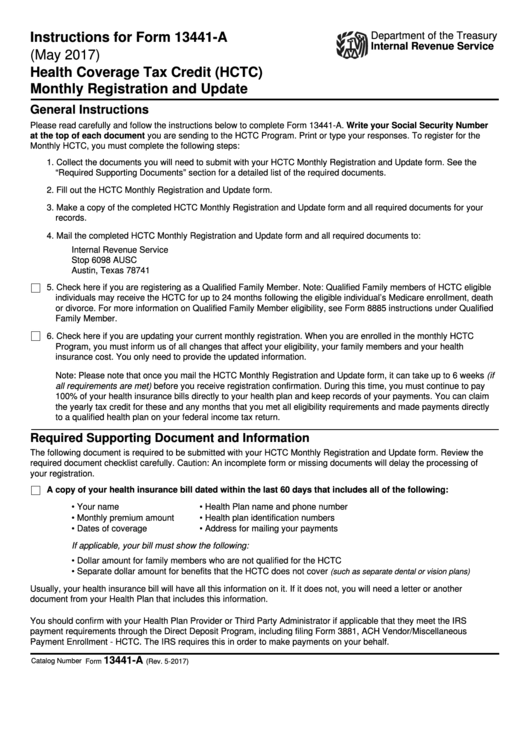

Department of the Treasury

Instructions for Form 13441-A

Internal Revenue Service

(May 2017)

Health Coverage Tax Credit (HCTC)

Monthly Registration and Update

General Instructions

Please read carefully and follow the instructions below to complete Form 13441-A. Write your Social Security Number

at the top of each document you are sending to the HCTC Program. Print or type your responses. To register for the

Monthly HCTC, you must complete the following steps:

1. Collect the documents you will need to submit with your HCTC Monthly Registration and Update form. See the

“Required Supporting Documents” section for a detailed list of the required documents.

2. Fill out the HCTC Monthly Registration and Update form.

3. Make a copy of the completed HCTC Monthly Registration and Update form and all required documents for your

records.

4. Mail the completed HCTC Monthly Registration and Update form and all required documents to:

Internal Revenue Service

Stop 6098 AUSC

Austin, Texas 78741

5. Check here if you are registering as a Qualified Family Member. Note: Qualified Family members of HCTC eligible

individuals may receive the HCTC for up to 24 months following the eligible individual’s Medicare enrollment, death

or divorce. For more information on Qualified Family Member eligibility, see Form 8885 instructions under Qualified

Family Member.

6. Check here if you are updating your current monthly registration. When you are enrolled in the monthly HCTC

Program, you must inform us of all changes that affect your eligibility, your family members and your health

insurance cost. You only need to provide the updated information.

Note: Please note that once you mail the HCTC Monthly Registration and Update form, it can take up to 6 weeks (if

all requirements are met) before you receive registration confirmation. During this time, you must continue to pay

100% of your health insurance bills directly to your health plan and keep records of your payments. You can claim

the yearly tax credit for these and any months that you met all eligibility requirements and made payments directly

to a qualified health plan on your federal income tax return.

Required Supporting Document and Information

The following document is required to be submitted with your HCTC Monthly Registration and Update form. Review the

required document checklist carefully. Caution: An incomplete form or missing documents will delay the processing of

your registration.

A copy of your health insurance bill dated within the last 60 days that includes all of the following:

• Your name

• Health Plan name and phone number

• Monthly premium amount

• Health plan identification numbers

• Dates of coverage

• Address for mailing your payments

If applicable, your bill must show the following:

• Dollar amount for family members who are not qualified for the HCTC

• Separate dollar amount for benefits that the HCTC does not cover

(such as separate dental or vision plans)

Usually, your health insurance bill will have all this information on it. If it does not, you will need a letter or another

document from your Health Plan that includes this information.

You should confirm with your Health Plan Provider or Third Party Administrator if applicable that they meet the IRS

payment requirements through the Direct Deposit Program, including filing Form 3881, ACH Vendor/Miscellaneous

Payment Enrollment - HCTC. The IRS requires this in order to make payments on your behalf.

13441-A

Catalog Number 57559E

Form

(Rev. 5-2017)

1

1 2

2 3

3 4

4